Liability Driven Investing (LDI) focuses on aligning investment strategies with future financial obligations, primarily used by pension funds and institutions to manage risks related to liabilities. Goals-Based Investing (GBI) centers on individual investor objectives, tailoring asset allocation to meet specific financial goals such as retirement, education, or wealth accumulation. Explore the key differences and benefits of LDI and GBI to optimize your investment approach.

Why it is important

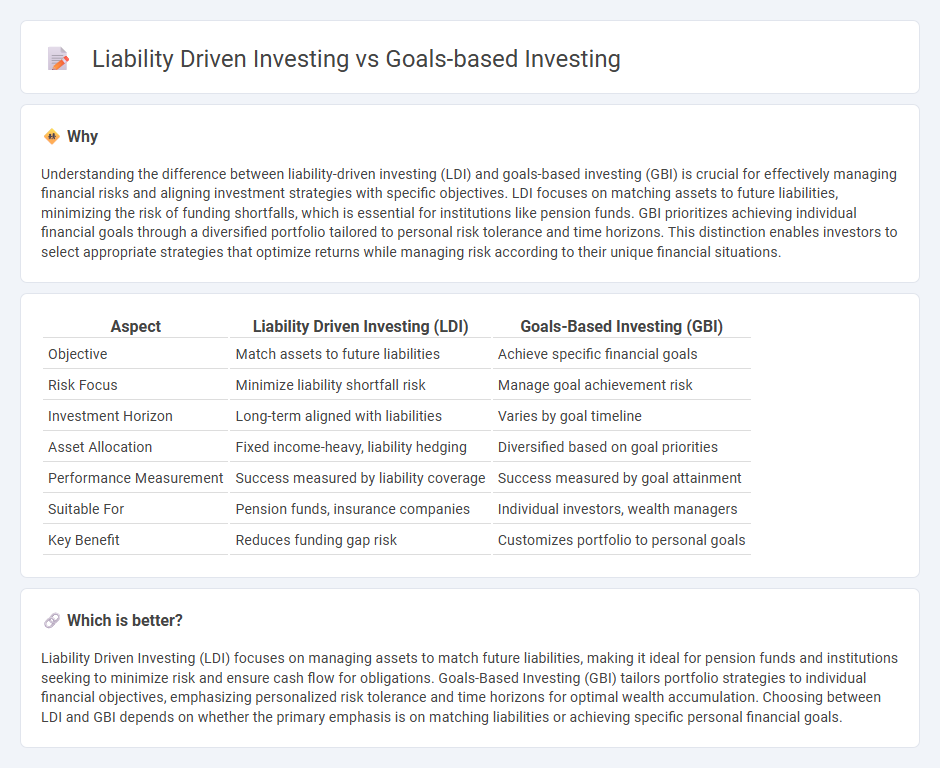

Understanding the difference between liability-driven investing (LDI) and goals-based investing (GBI) is crucial for effectively managing financial risks and aligning investment strategies with specific objectives. LDI focuses on matching assets to future liabilities, minimizing the risk of funding shortfalls, which is essential for institutions like pension funds. GBI prioritizes achieving individual financial goals through a diversified portfolio tailored to personal risk tolerance and time horizons. This distinction enables investors to select appropriate strategies that optimize returns while managing risk according to their unique financial situations.

Comparison Table

| Aspect | Liability Driven Investing (LDI) | Goals-Based Investing (GBI) |

|---|---|---|

| Objective | Match assets to future liabilities | Achieve specific financial goals |

| Risk Focus | Minimize liability shortfall risk | Manage goal achievement risk |

| Investment Horizon | Long-term aligned with liabilities | Varies by goal timeline |

| Asset Allocation | Fixed income-heavy, liability hedging | Diversified based on goal priorities |

| Performance Measurement | Success measured by liability coverage | Success measured by goal attainment |

| Suitable For | Pension funds, insurance companies | Individual investors, wealth managers |

| Key Benefit | Reduces funding gap risk | Customizes portfolio to personal goals |

Which is better?

Liability Driven Investing (LDI) focuses on managing assets to match future liabilities, making it ideal for pension funds and institutions seeking to minimize risk and ensure cash flow for obligations. Goals-Based Investing (GBI) tailors portfolio strategies to individual financial objectives, emphasizing personalized risk tolerance and time horizons for optimal wealth accumulation. Choosing between LDI and GBI depends on whether the primary emphasis is on matching liabilities or achieving specific personal financial goals.

Connection

Liability-driven investing (LDI) and goals-based investing both focus on aligning investment strategies with specific financial obligations and objectives, optimizing asset allocation to meet future liabilities or personal goals. LDI is commonly used by pension funds to ensure assets cover projected liabilities, while goals-based investing tailors portfolios to individual investor milestones such as retirement or education funding. Both approaches prioritize risk management and cash flow matching to achieve financial security and targeted outcomes.

Key Terms

**Goals-Based Investing:**

Goals-based investing centers on aligning investment strategies with specific financial objectives, such as retirement, education, or purchasing a home, ensuring portfolio customization to meet personalized timelines and risk tolerances. This approach emphasizes measurable outcomes tied directly to individual goals, promoting disciplined savings and adaptive asset allocation. Explore detailed comparisons and strategic insights to optimize your investment approach further.

Personal Objectives

Goals-based investing prioritizes aligning portfolios with individual financial milestones such as retirement and education funding, using personalized risk tolerance and time horizons. Liability-driven investing concentrates on matching assets to future liabilities, often employed by pension funds to ensure obligations are met through immunization strategies. Explore detailed strategies to determine which approach best supports your unique financial objectives.

Asset Allocation

Goals-based investing emphasizes aligning asset allocation with individual financial objectives and timelines, targeting personalized outcomes through diversified portfolios. Liability-driven investing prioritizes securing assets to meet predefined liabilities, often using fixed income instruments to match the timing and amount of future obligations. Explore deeper insights into asset allocation strategies that balance growth potential and risk management in both approaches.

Source and External Links

Goal-based investing - Wikipedia - Goals-based investing (GBI) is an investment approach that allocates capital based on prioritizing multiple financial goals to optimize the probability of achieving essential needs and aspirations within a set timeframe, integrating financial planning with investment management.

Goals-Based Investing | Wilmington Trust - The GBI process involves identifying, prioritizing, and specifying financial goals, then investing to maximize the chance of success for each goal, with research showing it can notably increase portfolio performance and client wealth.

How Goal-Based Investing Motivates Investors - Morningstar - Goals-based investing helps investors stay motivated by making financial goals personal and meaningful, improving patience and commitment, and has been shown to increase investor wealth by more than 15% compared to naive strategies.

dowidth.com

dowidth.com