Risk parity portfolios allocate risk equally across asset classes to achieve balanced volatility and improved diversification. Maximum diversification portfolios focus on maximizing the diversification ratio by combining assets with low correlations and higher return contributions. Explore the distinctions and benefits of these strategies to enhance portfolio risk management.

Why it is important

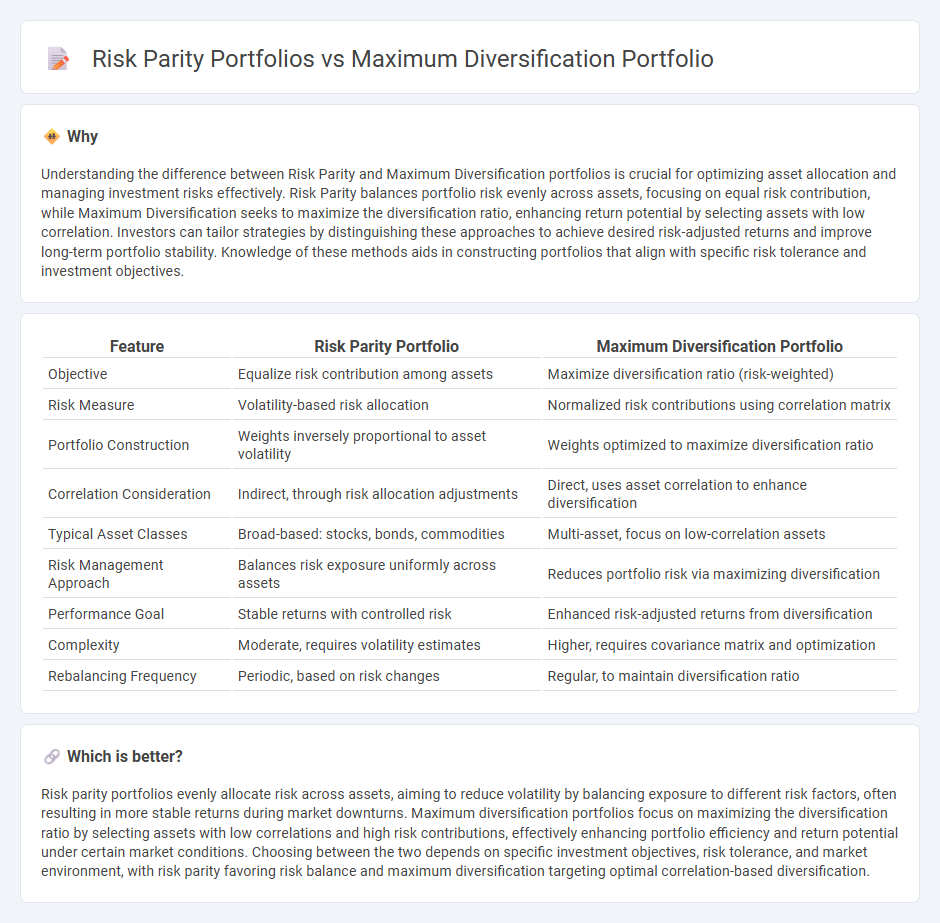

Understanding the difference between Risk Parity and Maximum Diversification portfolios is crucial for optimizing asset allocation and managing investment risks effectively. Risk Parity balances portfolio risk evenly across assets, focusing on equal risk contribution, while Maximum Diversification seeks to maximize the diversification ratio, enhancing return potential by selecting assets with low correlation. Investors can tailor strategies by distinguishing these approaches to achieve desired risk-adjusted returns and improve long-term portfolio stability. Knowledge of these methods aids in constructing portfolios that align with specific risk tolerance and investment objectives.

Comparison Table

| Feature | Risk Parity Portfolio | Maximum Diversification Portfolio |

|---|---|---|

| Objective | Equalize risk contribution among assets | Maximize diversification ratio (risk-weighted) |

| Risk Measure | Volatility-based risk allocation | Normalized risk contributions using correlation matrix |

| Portfolio Construction | Weights inversely proportional to asset volatility | Weights optimized to maximize diversification ratio |

| Correlation Consideration | Indirect, through risk allocation adjustments | Direct, uses asset correlation to enhance diversification |

| Typical Asset Classes | Broad-based: stocks, bonds, commodities | Multi-asset, focus on low-correlation assets |

| Risk Management Approach | Balances risk exposure uniformly across assets | Reduces portfolio risk via maximizing diversification |

| Performance Goal | Stable returns with controlled risk | Enhanced risk-adjusted returns from diversification |

| Complexity | Moderate, requires volatility estimates | Higher, requires covariance matrix and optimization |

| Rebalancing Frequency | Periodic, based on risk changes | Regular, to maintain diversification ratio |

Which is better?

Risk parity portfolios evenly allocate risk across assets, aiming to reduce volatility by balancing exposure to different risk factors, often resulting in more stable returns during market downturns. Maximum diversification portfolios focus on maximizing the diversification ratio by selecting assets with low correlations and high risk contributions, effectively enhancing portfolio efficiency and return potential under certain market conditions. Choosing between the two depends on specific investment objectives, risk tolerance, and market environment, with risk parity favoring risk balance and maximum diversification targeting optimal correlation-based diversification.

Connection

Risk parity portfolios and maximum diversification portfolios both aim to achieve balanced exposure across assets by optimizing risk allocation rather than capital allocation. Risk parity focuses on equalizing the risk contribution of each asset, while maximum diversification maximizes the portfolio's diversification ratio by selecting assets with low correlations and high individual volatilities. Both strategies leverage diversification principles to minimize portfolio volatility and improve risk-adjusted returns in multi-asset investing.

Key Terms

Correlation

Maximum diversification portfolios optimize asset allocations by minimizing portfolio variance relative to individual asset volatilities, primarily exploiting low correlations between assets to enhance diversification. Risk parity portfolios allocate capital based on equalizing risk contributions from each asset, effectively balancing exposures while also leveraging correlation structures to achieve stable risk distribution. Explore more insights on how correlation impacts portfolio construction strategies for optimal risk-adjusted returns.

Risk contribution

Maximum diversification portfolios aim to optimize the allocation by maximizing the diversification ratio, resulting in unequal risk contributions across assets, whereas risk parity portfolios target equal risk contributions from each asset to enhance portfolio balance and stability. Risk parity approaches typically reduce concentration risk and improve risk-adjusted returns by allocating capital based on volatility and correlation metrics rather than market capitalization. Explore more on how these methodologies influence asset allocation and portfolio performance dynamics.

Asset allocation

Maximum diversification portfolios focus on optimizing the risk-adjusted returns by allocating assets to achieve the highest diversification, often emphasizing low correlations among assets to reduce overall portfolio volatility. Risk parity portfolios allocate capital based on risk contributions, ensuring each asset class equally contributes to the portfolio's total risk, commonly balancing equities, bonds, and alternative investments to manage exposure. Explore more about these asset allocation strategies to understand their impact on portfolio stability and performance.

Source and External Links

Risk Parity, Maximum Diversification, and Minimum Variance - The maximum diversification portfolio maximizes the ratio of weighted-average asset volatilities to portfolio volatility, aligning with the tangent portfolio on the efficient frontier assuming expected asset returns increase proportionally with risk, and it equalizes each asset's marginal contribution to risk.

The Diversification Ratio: Measuring Portfolio Diversification - The most diversified portfolio improves the diversification ratio of a benchmark (such as S&P 500) by adjusting asset weights under constraints, boosting diversification and capturing more available diversification without drastically changing the original portfolio weights.

Regularized maximum diversification investment strategy - EconStor - The maximum diversification portfolio is constructed by maximizing the diversification ratio with constraints on portfolio weights, and regularization techniques help stabilize the solution and improve Sharpe ratios, potentially outperforming minimum variance but still challenged by practical estimation issues and constraints on short selling.

dowidth.com

dowidth.com