Tokenized treasuries represent digital assets backed by government securities, offering stability and transparency in portfolio diversification. Decentralized Finance (DeFi) yield products leverage blockchain technology to provide higher returns through liquidity mining, staking, and lending without traditional intermediaries. Explore how these innovations reshape investment strategies and risk management in modern finance.

Why it is important

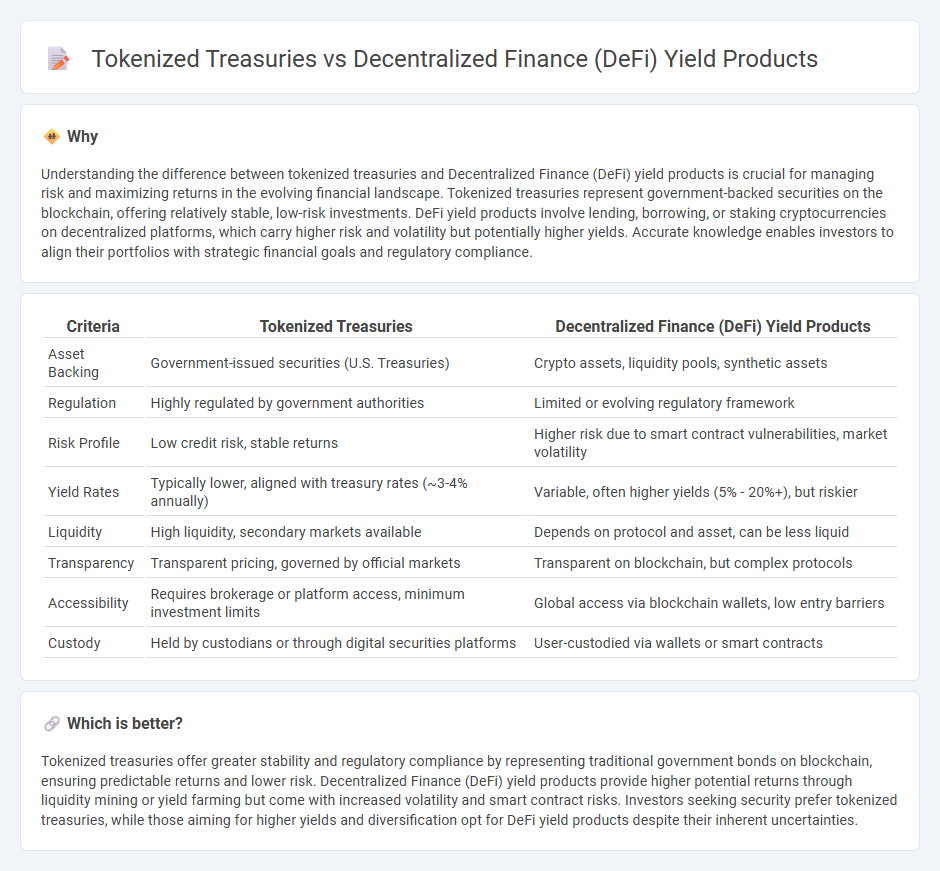

Understanding the difference between tokenized treasuries and Decentralized Finance (DeFi) yield products is crucial for managing risk and maximizing returns in the evolving financial landscape. Tokenized treasuries represent government-backed securities on the blockchain, offering relatively stable, low-risk investments. DeFi yield products involve lending, borrowing, or staking cryptocurrencies on decentralized platforms, which carry higher risk and volatility but potentially higher yields. Accurate knowledge enables investors to align their portfolios with strategic financial goals and regulatory compliance.

Comparison Table

| Criteria | Tokenized Treasuries | Decentralized Finance (DeFi) Yield Products |

|---|---|---|

| Asset Backing | Government-issued securities (U.S. Treasuries) | Crypto assets, liquidity pools, synthetic assets |

| Regulation | Highly regulated by government authorities | Limited or evolving regulatory framework |

| Risk Profile | Low credit risk, stable returns | Higher risk due to smart contract vulnerabilities, market volatility |

| Yield Rates | Typically lower, aligned with treasury rates (~3-4% annually) | Variable, often higher yields (5% - 20%+), but riskier |

| Liquidity | High liquidity, secondary markets available | Depends on protocol and asset, can be less liquid |

| Transparency | Transparent pricing, governed by official markets | Transparent on blockchain, but complex protocols |

| Accessibility | Requires brokerage or platform access, minimum investment limits | Global access via blockchain wallets, low entry barriers |

| Custody | Held by custodians or through digital securities platforms | User-custodied via wallets or smart contracts |

Which is better?

Tokenized treasuries offer greater stability and regulatory compliance by representing traditional government bonds on blockchain, ensuring predictable returns and lower risk. Decentralized Finance (DeFi) yield products provide higher potential returns through liquidity mining or yield farming but come with increased volatility and smart contract risks. Investors seeking security prefer tokenized treasuries, while those aiming for higher yields and diversification opt for DeFi yield products despite their inherent uncertainties.

Connection

Tokenized treasuries enable fractional ownership and increased liquidity of traditional government bonds by leveraging blockchain technology, making them accessible in decentralized finance (DeFi) ecosystems. DeFi yield products utilize these tokenized treasuries as low-risk collateral or stable assets to generate attractive returns through lending, staking, or liquidity provision. Integrating tokenized treasuries into DeFi enhances capital efficiency and broadens investment opportunities by combining the security of sovereign debt with the innovation of decentralized protocols.

Key Terms

Smart Contracts

DeFi yield products leverage smart contracts to automate lending, borrowing, and liquidity provision, enabling trustless and transparent financial services without intermediaries. Tokenized treasuries utilize blockchain to create digital representations of government bonds or assets, integrating smart contracts for automated interest payments and transferability, enhancing liquidity and accessibility. Explore the evolving role of smart contracts in optimizing DeFi yield strategies and tokenized treasury management to understand their impact on future finance.

APY (Annual Percentage Yield)

DeFi yield products often offer APYs ranging from 5% to over 100%, depending on the platform and risk level, leveraging smart contracts and liquidity pools for high returns. Tokenized treasuries provide more stable, lower APYs typically between 2% and 6%, reflecting government bond benchmarks with added liquidity through blockchain tokenization. Explore the detailed comparison of APY performance and risk factors in DeFi versus tokenized treasuries to make informed investment decisions.

Tokenization

Decentralized Finance (DeFi) yield products leverage blockchain technology to offer high-yield opportunities through smart contracts without intermediaries, enabling transparent and automated interest generation. Tokenized treasuries represent traditional assets transformed into digital tokens, providing increased liquidity and accessibility while preserving underlying asset value and reducing settlement times. Explore how tokenization is revolutionizing asset management and unlocking new potential in financial markets.

Source and External Links

What is yield farming in decentralized finance (DeFi)? - Yield farming or liquidity mining lets cryptocurrency holders lend or stake assets in DeFi platforms to earn rewards like interest, transaction fees, or governance tokens by providing liquidity to decentralized pools and protocols.

What is yield farming and how does it work? - Yield farming is a DeFi method where users allocate digital assets into protocols to provide liquidity, earning rewards mostly in governance tokens, with yields often expressed as annual percentage yield (APY).

Top 10 DeFi Yield Farming Platforms - Leading DeFi platforms like Uniswap, SushiSwap, and Curve offer competitive yield farming opportunities by allowing users to provide liquidity and earn passive income through token rewards and fees while supporting decentralized exchanges and derivatives.

dowidth.com

dowidth.com