Buy now pay later (BNPL) services offer short-term financing that allows consumers to purchase goods and repay in installments without interest, enhancing budget flexibility during transactions. In contrast, a line of credit provides a revolving borrowing limit that can be used repeatedly with interest charged on outstanding balances, offering more extensive financial management options. Explore the differences and benefits of BNPL versus lines of credit to optimize your personal finance strategy.

Why it is important

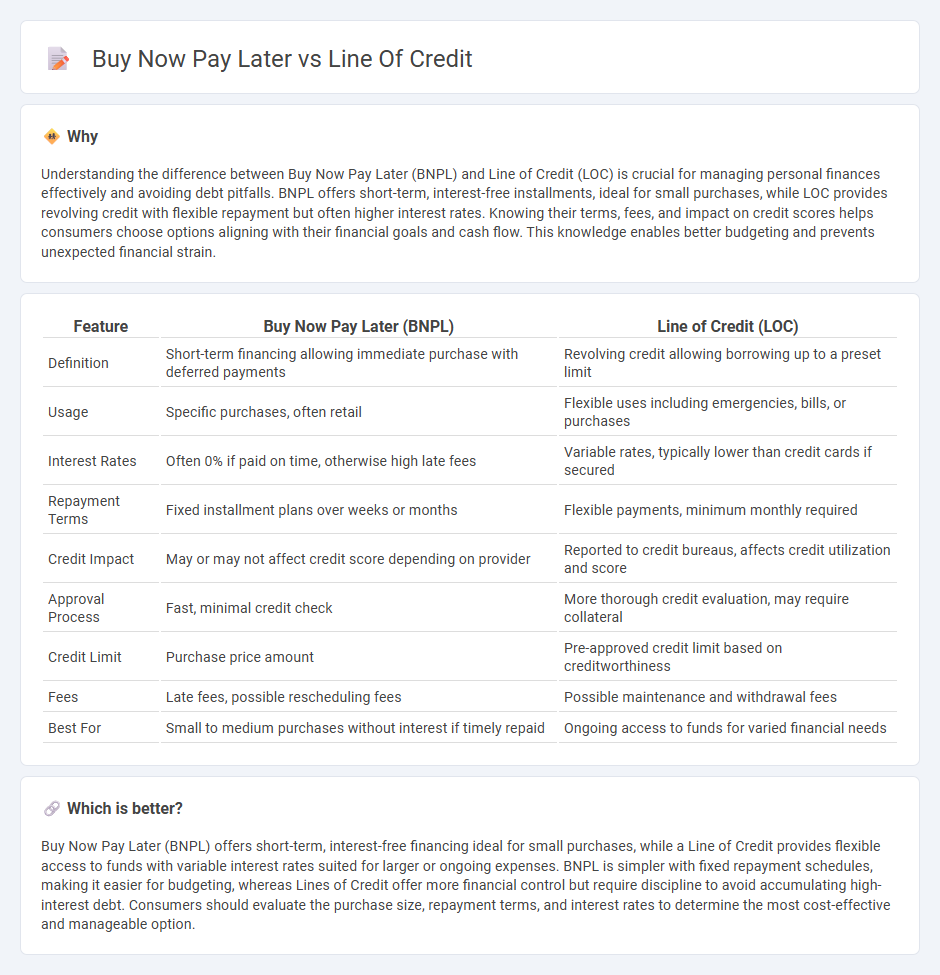

Understanding the difference between Buy Now Pay Later (BNPL) and Line of Credit (LOC) is crucial for managing personal finances effectively and avoiding debt pitfalls. BNPL offers short-term, interest-free installments, ideal for small purchases, while LOC provides revolving credit with flexible repayment but often higher interest rates. Knowing their terms, fees, and impact on credit scores helps consumers choose options aligning with their financial goals and cash flow. This knowledge enables better budgeting and prevents unexpected financial strain.

Comparison Table

| Feature | Buy Now Pay Later (BNPL) | Line of Credit (LOC) |

|---|---|---|

| Definition | Short-term financing allowing immediate purchase with deferred payments | Revolving credit allowing borrowing up to a preset limit |

| Usage | Specific purchases, often retail | Flexible uses including emergencies, bills, or purchases |

| Interest Rates | Often 0% if paid on time, otherwise high late fees | Variable rates, typically lower than credit cards if secured |

| Repayment Terms | Fixed installment plans over weeks or months | Flexible payments, minimum monthly required |

| Credit Impact | May or may not affect credit score depending on provider | Reported to credit bureaus, affects credit utilization and score |

| Approval Process | Fast, minimal credit check | More thorough credit evaluation, may require collateral |

| Credit Limit | Purchase price amount | Pre-approved credit limit based on creditworthiness |

| Fees | Late fees, possible rescheduling fees | Possible maintenance and withdrawal fees |

| Best For | Small to medium purchases without interest if timely repaid | Ongoing access to funds for varied financial needs |

Which is better?

Buy Now Pay Later (BNPL) offers short-term, interest-free financing ideal for small purchases, while a Line of Credit provides flexible access to funds with variable interest rates suited for larger or ongoing expenses. BNPL is simpler with fixed repayment schedules, making it easier for budgeting, whereas Lines of Credit offer more financial control but require discipline to avoid accumulating high-interest debt. Consumers should evaluate the purchase size, repayment terms, and interest rates to determine the most cost-effective and manageable option.

Connection

Buy Now Pay Later (BNPL) and Line of Credit both provide consumers with access to flexible financing options that enable purchases without immediate full payment. BNPL plans often function as short-term lines of credit, allowing borrowers to repay over a defined period with fixed installments, while traditional lines of credit offer revolving borrowing limits with variable repayment terms. Both financial products impact consumer credit scores and spending behaviors, influencing overall personal finance management.

Key Terms

Credit Limit

A line of credit offers a flexible credit limit that can be reused as you repay the outstanding balance, often with higher borrowing limits and variable interest rates. Buy now pay later (BNPL) typically provides smaller, fixed credit limits for short-term purchases with fixed repayment schedules and minimal or no interest if paid on time. Explore the differences in credit limits and terms to determine the best financing option for your needs.

Interest Rate

Line of credit interest rates typically range from 7% to 25% APR, varying based on creditworthiness and lender policies, offering flexible repayment terms. Buy Now Pay Later (BNPL) services often feature 0% interest promotions for short-term installments but may impose high fees or interest rates up to 30% if payments are missed or extended. Explore detailed comparisons and financial implications to choose the best option for your needs.

Repayment Terms

Repayment terms for a line of credit typically involve flexible monthly minimum payments based on outstanding balances and interest accrual, often allowing for revolving credit use. Buy Now Pay Later (BNPL) options feature fixed installment payments over a short period, commonly spanning weeks to months, with no or low interest if paid on schedule. Explore detailed comparisons to understand which repayment structure aligns best with your financial needs.

Source and External Links

Lines of credit: What they are & how they work - Capital One - A line of credit is a type of revolving loan that allows a borrower to withdraw and repay funds repeatedly up to a preset limit, available as personal, home equity, or business lines and can be secured or unsecured, based on creditworthiness.

What Is a Line of Credit? - Experian - A personal line of credit allows borrowing up to a set limit during a draw period with flexibility similar to a credit card, then transitions to a repayment phase, and it can be secured or unsecured depending on collateral availability.

Business Line of Credit | American Express Business Blueprint - A business line of credit offers flexible access to funds up to a credit limit to manage expenses, with the ability to draw, repay, and redraw funds as needed for various business purposes.

dowidth.com

dowidth.com