Tokenization of real-world assets transforms physical properties like real estate, art, and commodities into digital tokens, enabling fractional ownership, enhanced liquidity, and streamlined transactions on blockchain platforms. Non-fungible tokens (NFTs) represent unique digital assets primarily used for art, collectibles, and intellectual property, providing verifiable scarcity and provenance. Explore the intricacies and benefits of both blockchain-driven asset models to understand their impact on modern finance.

Why it is important

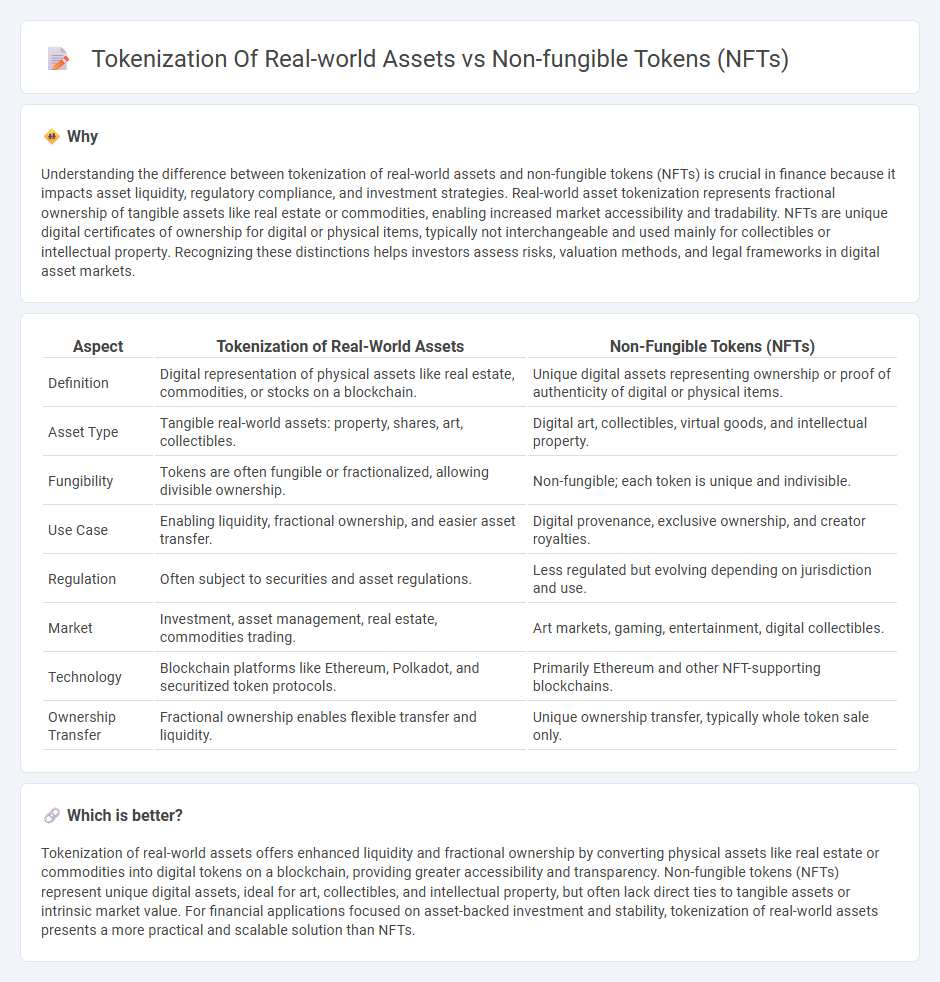

Understanding the difference between tokenization of real-world assets and non-fungible tokens (NFTs) is crucial in finance because it impacts asset liquidity, regulatory compliance, and investment strategies. Real-world asset tokenization represents fractional ownership of tangible assets like real estate or commodities, enabling increased market accessibility and tradability. NFTs are unique digital certificates of ownership for digital or physical items, typically not interchangeable and used mainly for collectibles or intellectual property. Recognizing these distinctions helps investors assess risks, valuation methods, and legal frameworks in digital asset markets.

Comparison Table

| Aspect | Tokenization of Real-World Assets | Non-Fungible Tokens (NFTs) |

|---|---|---|

| Definition | Digital representation of physical assets like real estate, commodities, or stocks on a blockchain. | Unique digital assets representing ownership or proof of authenticity of digital or physical items. |

| Asset Type | Tangible real-world assets: property, shares, art, collectibles. | Digital art, collectibles, virtual goods, and intellectual property. |

| Fungibility | Tokens are often fungible or fractionalized, allowing divisible ownership. | Non-fungible; each token is unique and indivisible. |

| Use Case | Enabling liquidity, fractional ownership, and easier asset transfer. | Digital provenance, exclusive ownership, and creator royalties. |

| Regulation | Often subject to securities and asset regulations. | Less regulated but evolving depending on jurisdiction and use. |

| Market | Investment, asset management, real estate, commodities trading. | Art markets, gaming, entertainment, digital collectibles. |

| Technology | Blockchain platforms like Ethereum, Polkadot, and securitized token protocols. | Primarily Ethereum and other NFT-supporting blockchains. |

| Ownership Transfer | Fractional ownership enables flexible transfer and liquidity. | Unique ownership transfer, typically whole token sale only. |

Which is better?

Tokenization of real-world assets offers enhanced liquidity and fractional ownership by converting physical assets like real estate or commodities into digital tokens on a blockchain, providing greater accessibility and transparency. Non-fungible tokens (NFTs) represent unique digital assets, ideal for art, collectibles, and intellectual property, but often lack direct ties to tangible assets or intrinsic market value. For financial applications focused on asset-backed investment and stability, tokenization of real-world assets presents a more practical and scalable solution than NFTs.

Connection

Tokenization of real-world assets involves converting physical assets like real estate, art, or commodities into digital tokens on a blockchain, enabling fractional ownership and increased liquidity. Non-fungible tokens (NFTs) represent unique digital certificates of ownership, crucial for authenticating and trading individual or rare asset tokens. The connection lies in NFTs providing a secure, transparent framework for representing and transferring ownership of tokenized assets, bridging traditional finance and blockchain technology.

Key Terms

Uniqueness

Non-fungible tokens (NFTs) represent unique digital assets with distinct metadata and provenance, making each token one-of-a-kind and irreplaceable. Tokenization of real-world assets converts physical items like real estate or art into divisible digital tokens, which may lack the inherent uniqueness found in NFTs. Discover how these innovations impact ownership and authenticity in digital and physical markets.

Ownership

Non-fungible tokens (NFTs) provide unique digital ownership proof through blockchain, ensuring indivisibility and verifiable provenance of digital art, collectibles, and media. Tokenization of real-world assets transforms physical properties into divisible digital shares, enabling fractional ownership and increased liquidity of assets like real estate, commodities, and equities. Explore how these technologies redefine asset ownership and investment models in the digital economy.

Liquidity

Non-fungible tokens (NFTs) represent unique digital assets with limited liquidity due to their distinctiveness and indivisibility, often complicating secondary market transactions. In contrast, tokenization of real-world assets, such as real estate or commodities, enhances liquidity by dividing assets into fungible tokens that can be easily bought, sold, or traded on blockchain platforms. Explore the benefits and challenges of both digital strategies to understand their impact on asset liquidity.

Source and External Links

Non-fungible token - An NFT is a unique digital identifier recorded on a blockchain used to certify ownership and authenticity of digital items, differing from fungible cryptocurrencies in that NFTs are unique and cannot be exchanged on a one-to-one basis; they are often linked to digital media such as art or videos, and their ownership is transferable but may not convey legal rights over the underlying asset.

What is a non-fungible token (NFT)? - NFTs are unique cryptoassets that authenticate ownership of digital assets like artwork or virtual items, notable for their ability to sell digital art through a blockchain-based certificate of authenticity, as exemplified by high-profile sales like Beeple's digital artworks selling for millions.

What is a non-fungible token (NFT)? - NFTs are cryptographic tokens representing unique digital or physical items such as art, tickets, or real estate, enabling proof of ownership and authenticity through unique IDs recorded on blockchains to ensure trusted transactions and genuine items in marketplaces.

dowidth.com

dowidth.com