Greenium refers to the premium investors pay for green bonds due to their environmental benefits, reflecting strong demand for sustainable finance. Blue bonds, a subset of green bonds, specifically fund marine and ocean-related projects to promote water ecosystem preservation. Explore the differences between greenium and blue bonds to understand their unique roles in sustainable investment strategies.

Why it is important

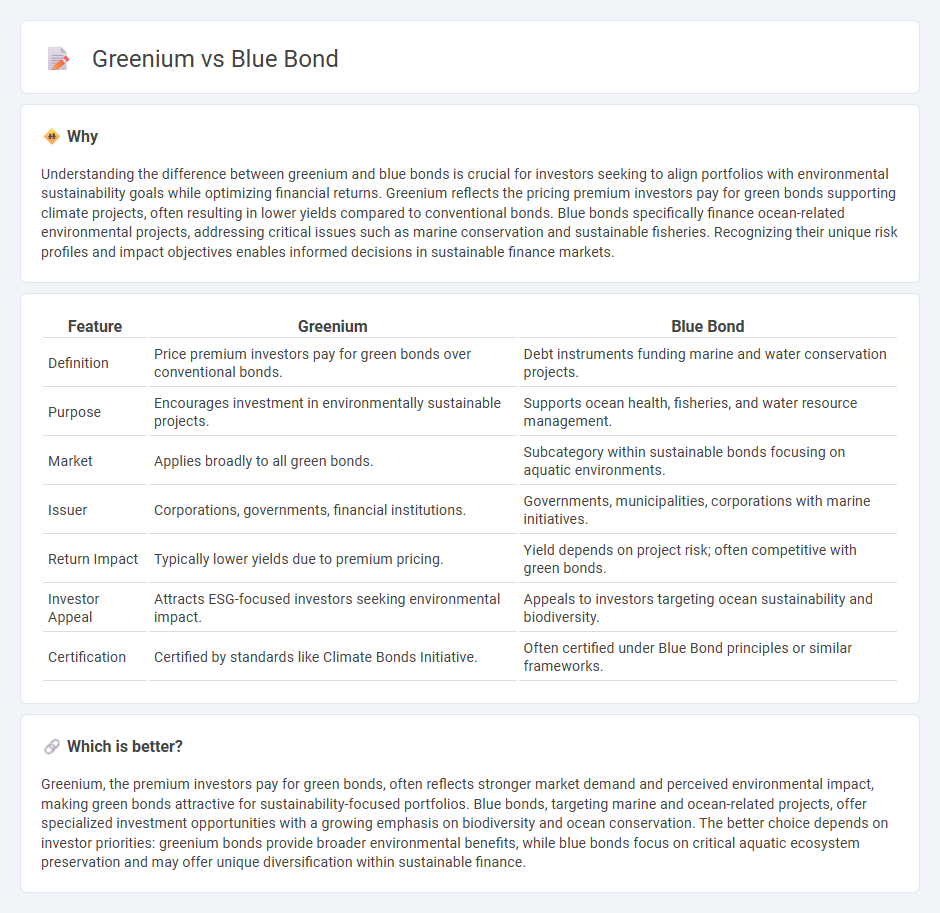

Understanding the difference between greenium and blue bonds is crucial for investors seeking to align portfolios with environmental sustainability goals while optimizing financial returns. Greenium reflects the pricing premium investors pay for green bonds supporting climate projects, often resulting in lower yields compared to conventional bonds. Blue bonds specifically finance ocean-related environmental projects, addressing critical issues such as marine conservation and sustainable fisheries. Recognizing their unique risk profiles and impact objectives enables informed decisions in sustainable finance markets.

Comparison Table

| Feature | Greenium | Blue Bond |

|---|---|---|

| Definition | Price premium investors pay for green bonds over conventional bonds. | Debt instruments funding marine and water conservation projects. |

| Purpose | Encourages investment in environmentally sustainable projects. | Supports ocean health, fisheries, and water resource management. |

| Market | Applies broadly to all green bonds. | Subcategory within sustainable bonds focusing on aquatic environments. |

| Issuer | Corporations, governments, financial institutions. | Governments, municipalities, corporations with marine initiatives. |

| Return Impact | Typically lower yields due to premium pricing. | Yield depends on project risk; often competitive with green bonds. |

| Investor Appeal | Attracts ESG-focused investors seeking environmental impact. | Appeals to investors targeting ocean sustainability and biodiversity. |

| Certification | Certified by standards like Climate Bonds Initiative. | Often certified under Blue Bond principles or similar frameworks. |

Which is better?

Greenium, the premium investors pay for green bonds, often reflects stronger market demand and perceived environmental impact, making green bonds attractive for sustainability-focused portfolios. Blue bonds, targeting marine and ocean-related projects, offer specialized investment opportunities with a growing emphasis on biodiversity and ocean conservation. The better choice depends on investor priorities: greenium bonds provide broader environmental benefits, while blue bonds focus on critical aquatic ecosystem preservation and may offer unique diversification within sustainable finance.

Connection

Greenium refers to the premium investors are willing to pay for green bonds due to their environmental benefits, while blue bonds are a specific category of green bonds aimed at financing ocean and water-related projects. The connection lies in how the greenium influences the pricing and demand for blue bonds, making them more attractive to socially responsible investors seeking sustainable investment opportunities. This dynamic supports increased capital flow into ocean conservation and sustainable marine economic development.

Key Terms

Sustainable Finance

Blue bonds specifically fund marine and ocean-related conservation projects, driving sustainable finance initiatives that protect aquatic ecosystems. Greenium refers to the premium investors are willing to pay for green bonds due to their environmental benefits and lower perceived risk, highlighting market preference for sustainability. Explore the distinctions and impacts of blue bonds and greenium to deepen your understanding of sustainable finance trends.

Marine Conservation

Blue bonds are debt instruments designed to finance marine conservation projects, promoting sustainable ocean economies and protecting marine biodiversity. Greenium refers to the premium investors are willing to pay for sustainable bonds, reflecting strong demand for environmental impact investments, including blue bonds. Explore more to understand how blue bonds and greenium drive innovation in marine conservation financing.

Yield Spread

Blue bonds typically exhibit a lower yield spread compared to conventional bonds due to their environmental and sustainability benefits, attracting investors seeking impact investments. Greenium refers to the price premium or yield discount investors accept when purchasing green bonds, reflecting strong demand for environmentally responsible assets. Explore the nuances of blue bonds and greenium to better understand their influence on yield spread dynamics.

Source and External Links

Blue Bond | Research and Innovation - European Union - A Blue Bond is a debt instrument issued by governments, development banks, or corporations to raise finance for marine and ocean-based projects with long-term sustainability and environmental benefits, functioning like a conventional bond but with proceeds dedicated to sustainable ocean activities.

Blue Bonds - NAP Global Network - Blue bonds are a type of green bond focused on financing marine resource projects that support ocean health and climate adaptation through activities like mangrove restoration, marine protected areas expansion, and sustainable marine value chains.

Blue Finance - IFC - Blue finance involves loans and bonds dedicated to blue economy projects, with IFC leading notable blue bond issuances in countries like the Philippines and Thailand to support sustainable ocean economy activities including water supply, fisheries, and renewable energy development.

dowidth.com

dowidth.com