Risk parity portfolios allocate risk equally across asset classes to achieve diversified exposure and stable returns, emphasizing risk management over capital allocation. Smart beta portfolios select and weight securities based on alternative factors such as value, momentum, or volatility to enhance performance and manage risk dynamically. Explore how these strategies compare in driving optimal portfolio outcomes and risk-adjusted returns.

Why it is important

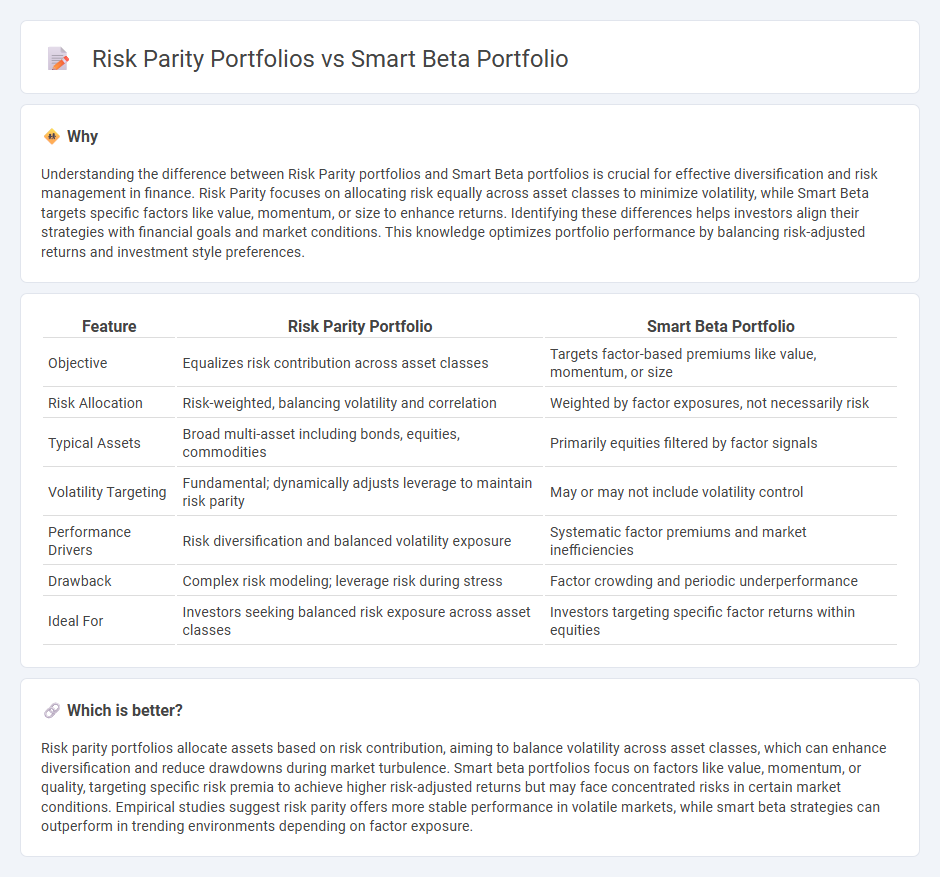

Understanding the difference between Risk Parity portfolios and Smart Beta portfolios is crucial for effective diversification and risk management in finance. Risk Parity focuses on allocating risk equally across asset classes to minimize volatility, while Smart Beta targets specific factors like value, momentum, or size to enhance returns. Identifying these differences helps investors align their strategies with financial goals and market conditions. This knowledge optimizes portfolio performance by balancing risk-adjusted returns and investment style preferences.

Comparison Table

| Feature | Risk Parity Portfolio | Smart Beta Portfolio |

|---|---|---|

| Objective | Equalizes risk contribution across asset classes | Targets factor-based premiums like value, momentum, or size |

| Risk Allocation | Risk-weighted, balancing volatility and correlation | Weighted by factor exposures, not necessarily risk |

| Typical Assets | Broad multi-asset including bonds, equities, commodities | Primarily equities filtered by factor signals |

| Volatility Targeting | Fundamental; dynamically adjusts leverage to maintain risk parity | May or may not include volatility control |

| Performance Drivers | Risk diversification and balanced volatility exposure | Systematic factor premiums and market inefficiencies |

| Drawback | Complex risk modeling; leverage risk during stress | Factor crowding and periodic underperformance |

| Ideal For | Investors seeking balanced risk exposure across asset classes | Investors targeting specific factor returns within equities |

Which is better?

Risk parity portfolios allocate assets based on risk contribution, aiming to balance volatility across asset classes, which can enhance diversification and reduce drawdowns during market turbulence. Smart beta portfolios focus on factors like value, momentum, or quality, targeting specific risk premia to achieve higher risk-adjusted returns but may face concentrated risks in certain market conditions. Empirical studies suggest risk parity offers more stable performance in volatile markets, while smart beta strategies can outperform in trending environments depending on factor exposure.

Connection

Risk parity portfolios and smart beta portfolios both optimize asset allocation to enhance risk-adjusted returns by diversifying sources of risk across multiple asset classes. Risk parity focuses on balancing risk contributions proportionally, often using leverage to equalize risk exposure, while smart beta strategies systematically tilt towards specific factors like value, momentum, or low volatility to outperform traditional market-cap-weighted indices. Integrating risk parity principles within smart beta frameworks can improve portfolio diversification and resilience by combining factor-driven benefits with balanced risk distribution.

Key Terms

Factor Exposure

Smart beta portfolios emphasize targeted factor exposures such as value, momentum, size, and low volatility to enhance risk-adjusted returns through systematic rules-based strategies. Risk parity portfolios aim to balance risk contributions across asset classes by allocating capital so that each asset's risk, often measured by volatility or beta, is equalized, reducing concentration in traditional equity or bond risks. Explore deeper insights into how these approaches differ in managing factor exposures and optimizing portfolio risk.

Leverage

Smart beta portfolios leverage factor-based strategies such as value, momentum, and low volatility to enhance risk-adjusted returns without necessarily increasing overall leverage. Risk parity portfolios systematically allocate capital to equalize risk contributions across assets, often employing leverage to maintain balanced risk exposure in low-volatility assets like bonds. Explore in-depth comparisons to understand how leverage impacts performance and risk in these portfolio approaches.

Asset Allocation

Smart beta portfolios utilize factor-based strategies emphasizing value, momentum, size, and quality to enhance returns and manage risk through systematic asset allocation. Risk parity portfolios allocate capital based on risk contribution rather than capital weights, aiming to balance risk evenly across asset classes such as equities, bonds, and commodities. Explore the benefits and methodologies behind asset allocation in both strategies to optimize portfolio performance.

Source and External Links

Smart Beta - Overview, How It Works, Trading Strategies - A smart beta portfolio combines passive and active investing by tracking an underlying index but optimizing it using active management techniques, focusing on diversification and market factor considerations such as value, liquidity, quality, and momentum to lower risk and improve returns.

What are smart beta strategies? A guide to ... - Saxo Bank - Smart beta strategies use a rules-based, factor-driven system that selects and weights securities based on factors like value, momentum, low volatility, quality, and size, aiming to customize portfolio risk and return compared to traditional market-cap-weighted indices.

Smart Beta ETFs - Smart beta ETFs use alternative weighting methods such as equal weighting, fundamental weighting, and factor-based weighting, which can focus on risk-oriented factors (low volatility) or return-oriented factors (momentum, quality), offering a low-cost way to implement these strategies.

dowidth.com

dowidth.com