Liability Driven Investing (LDI) focuses on aligning assets with future liabilities to minimize risk and ensure financial obligations are met, making it essential for pension funds and insurance companies. Income investing prioritizes generating consistent cash flows through dividends, interest, or rent, appealing to investors seeking steady income streams. Explore the key differences and strategies between these approaches to optimize your financial planning.

Why it is important

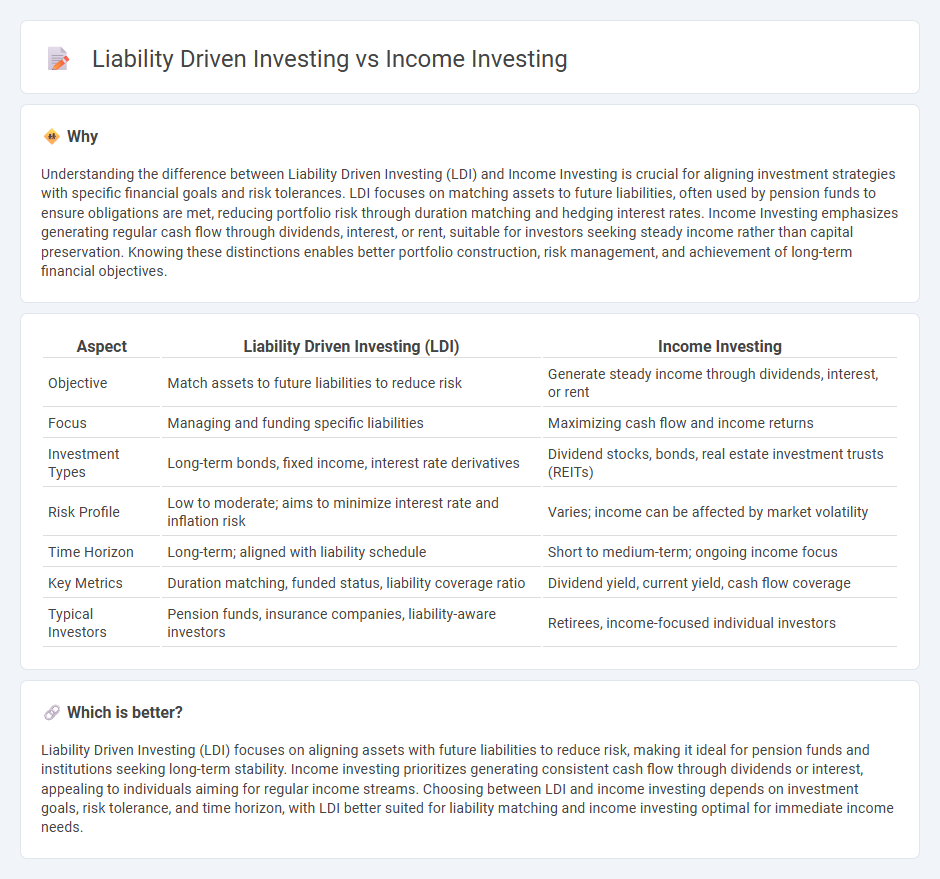

Understanding the difference between Liability Driven Investing (LDI) and Income Investing is crucial for aligning investment strategies with specific financial goals and risk tolerances. LDI focuses on matching assets to future liabilities, often used by pension funds to ensure obligations are met, reducing portfolio risk through duration matching and hedging interest rates. Income Investing emphasizes generating regular cash flow through dividends, interest, or rent, suitable for investors seeking steady income rather than capital preservation. Knowing these distinctions enables better portfolio construction, risk management, and achievement of long-term financial objectives.

Comparison Table

| Aspect | Liability Driven Investing (LDI) | Income Investing |

|---|---|---|

| Objective | Match assets to future liabilities to reduce risk | Generate steady income through dividends, interest, or rent |

| Focus | Managing and funding specific liabilities | Maximizing cash flow and income returns |

| Investment Types | Long-term bonds, fixed income, interest rate derivatives | Dividend stocks, bonds, real estate investment trusts (REITs) |

| Risk Profile | Low to moderate; aims to minimize interest rate and inflation risk | Varies; income can be affected by market volatility |

| Time Horizon | Long-term; aligned with liability schedule | Short to medium-term; ongoing income focus |

| Key Metrics | Duration matching, funded status, liability coverage ratio | Dividend yield, current yield, cash flow coverage |

| Typical Investors | Pension funds, insurance companies, liability-aware investors | Retirees, income-focused individual investors |

Which is better?

Liability Driven Investing (LDI) focuses on aligning assets with future liabilities to reduce risk, making it ideal for pension funds and institutions seeking long-term stability. Income investing prioritizes generating consistent cash flow through dividends or interest, appealing to individuals aiming for regular income streams. Choosing between LDI and income investing depends on investment goals, risk tolerance, and time horizon, with LDI better suited for liability matching and income investing optimal for immediate income needs.

Connection

Liability-driven investing (LDI) and income investing are interconnected through their shared objective of matching assets with future liabilities to ensure stable cash flow. LDI strategies focus on managing financial obligations by aligning investment returns with anticipated payout dates, while income investing prioritizes generating regular income streams from fixed-income securities and dividend-paying assets. Both approaches emphasize risk management and predictable income, making them integral to pension fund management and retirement planning.

Key Terms

**Income Investing:**

Income investing emphasizes generating consistent cash flow through dividends, interest payments, and rental income from diversified assets such as stocks, bonds, and real estate investment trusts (REITs). This strategy prioritizes stable and predictable returns to meet ongoing financial needs while preserving capital. Discover how income investing can provide reliable revenue streams tailored to your financial goals.

Dividend Yield

Dividend yield plays a crucial role in income investing, where investors prioritize stocks with a strong, stable yield to generate consistent cash flow. Liability-driven investing, however, centers on aligning asset returns with future liabilities, often favoring fixed-income securities over high-dividend stocks to mitigate risks. Explore how optimizing dividend yield can impact your financial strategy and risk management approach.

Interest Income

Income investing prioritizes generating steady interest income by investing in bonds, dividend-paying stocks, and fixed-income securities, aiming for predictable cash flows. Liability-driven investing (LDI) centers on matching asset cash flows with future liabilities, primarily using interest rate swaps, bonds, and other fixed-income instruments to manage interest rate risk and funding status. Explore key strategies and performance metrics to understand how interest income plays a crucial role in both approaches.

Source and External Links

Income Investing - Overview, Features, Advantages - Income investing is a strategy focused on building a portfolio specifically designed to generate regular income, mainly through dividends, bond yields, and interest payments from government bonds, corporate bonds, and dividend-paying stocks.

Investing for growth, income or both - An income investing strategy aims to create a portfolio that generates scheduled income, balancing risk, income amount, liquidity, and fees across investments such as bonds, preferred shares, GICs, and dividend-paying stocks.

Income Investing Playbook 2025: Ideas for a New Rate Cycle - Income investing includes assets like bonds, dividend-paying stocks, and REITs, providing a reliable cash flow that can diversify portfolios, especially as interest rates begin to normalize following recent cycles.

dowidth.com

dowidth.com