Alternative data provides unique, non-traditional insights derived from sources such as social media, satellite images, and credit card transactions, complementing traditional market data like stock prices, trading volumes, and economic indicators. This expanded data set helps financial analysts create more accurate predictive models and uncover hidden market trends. Explore how integrating alternative data with market data can enhance investment strategies and decision-making.

Why it is important

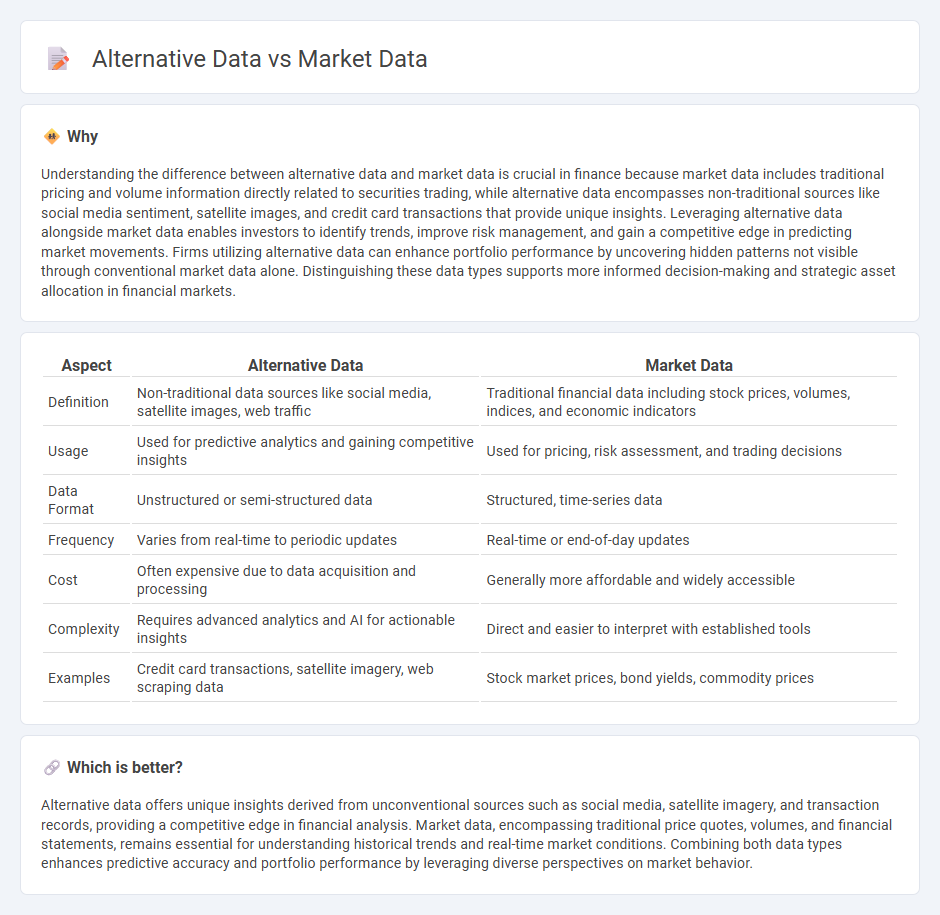

Understanding the difference between alternative data and market data is crucial in finance because market data includes traditional pricing and volume information directly related to securities trading, while alternative data encompasses non-traditional sources like social media sentiment, satellite images, and credit card transactions that provide unique insights. Leveraging alternative data alongside market data enables investors to identify trends, improve risk management, and gain a competitive edge in predicting market movements. Firms utilizing alternative data can enhance portfolio performance by uncovering hidden patterns not visible through conventional market data alone. Distinguishing these data types supports more informed decision-making and strategic asset allocation in financial markets.

Comparison Table

| Aspect | Alternative Data | Market Data |

|---|---|---|

| Definition | Non-traditional data sources like social media, satellite images, web traffic | Traditional financial data including stock prices, volumes, indices, and economic indicators |

| Usage | Used for predictive analytics and gaining competitive insights | Used for pricing, risk assessment, and trading decisions |

| Data Format | Unstructured or semi-structured data | Structured, time-series data |

| Frequency | Varies from real-time to periodic updates | Real-time or end-of-day updates |

| Cost | Often expensive due to data acquisition and processing | Generally more affordable and widely accessible |

| Complexity | Requires advanced analytics and AI for actionable insights | Direct and easier to interpret with established tools |

| Examples | Credit card transactions, satellite imagery, web scraping data | Stock market prices, bond yields, commodity prices |

Which is better?

Alternative data offers unique insights derived from unconventional sources such as social media, satellite imagery, and transaction records, providing a competitive edge in financial analysis. Market data, encompassing traditional price quotes, volumes, and financial statements, remains essential for understanding historical trends and real-time market conditions. Combining both data types enhances predictive accuracy and portfolio performance by leveraging diverse perspectives on market behavior.

Connection

Alternative data enhances traditional market data by providing additional insights from unconventional sources such as social media, satellite imagery, and transaction records. Integrating alternative data with market data enables financial analysts to improve predictive models, uncover hidden trends, and gain a competitive edge in investment decisions. This fusion of data types supports more accurate risk assessment and portfolio management in the finance sector.

Key Terms

Pricing Data

Pricing data derived from market data sources offers real-time, authoritative insights from exchanges and trading platforms, reflecting actual transaction prices for stocks, commodities, and derivatives. Alternative pricing data integrates unconventional sources such as web-scraped e-commerce prices and crowdsourced valuations, providing broader context for assessing market trends and price movements. Explore deeper into how these distinct data types revolutionize pricing strategy and investment analysis.

Sentiment Analysis

Market data primarily encompasses traditional financial metrics such as stock prices, trading volumes, and economic indicators, providing quantitative insights into market trends. Alternative data, particularly sentiment analysis, leverages natural language processing and machine learning to extract investor emotions and opinions from sources like social media, news, and forums, offering qualitative insights that can predict market movements. Explore how integrating these data types enhances investment strategies and decision-making accuracy.

Satellite Imagery

Satellite imagery offers unique alternative data by capturing real-time, high-resolution visuals of geographical areas, enabling investors to monitor supply chains, agricultural yields, and industrial activities beyond traditional market data sources like price indices and trading volumes. This alternative dataset enhances predictive analytics and decision-making in sectors such as commodities trading, insurance risk assessment, and environmental monitoring. Explore the transformative impact of satellite imagery on financial markets and industry insights.

Source and External Links

Market data - Market data in finance refers to price and related data for financial instruments from trading venues, enabling traders to see the latest prices, historical trends, and other details like volume and bid/ask sizes essential for trading and risk analysis.

Market Data - Stocks & Options API + Spreadsheet Access - Provides real-time and historical market data for U.S. stocks, options, ETFs, and mutual funds accessible via APIs, spreadsheet plugins, and CSVs, with a free 30-day trial available.

dowidth.com

dowidth.com