Revenue-based financing provides capital in exchange for a fixed percentage of future revenues until a predetermined repayment cap is reached. Profit-sharing financing involves sharing a portion of net profits with investors, aligning returns with business performance but varying with profit fluctuations. Explore the distinct benefits and applications of revenue-based versus profit-sharing financing to determine the best fit for your business growth strategy.

Why it is important

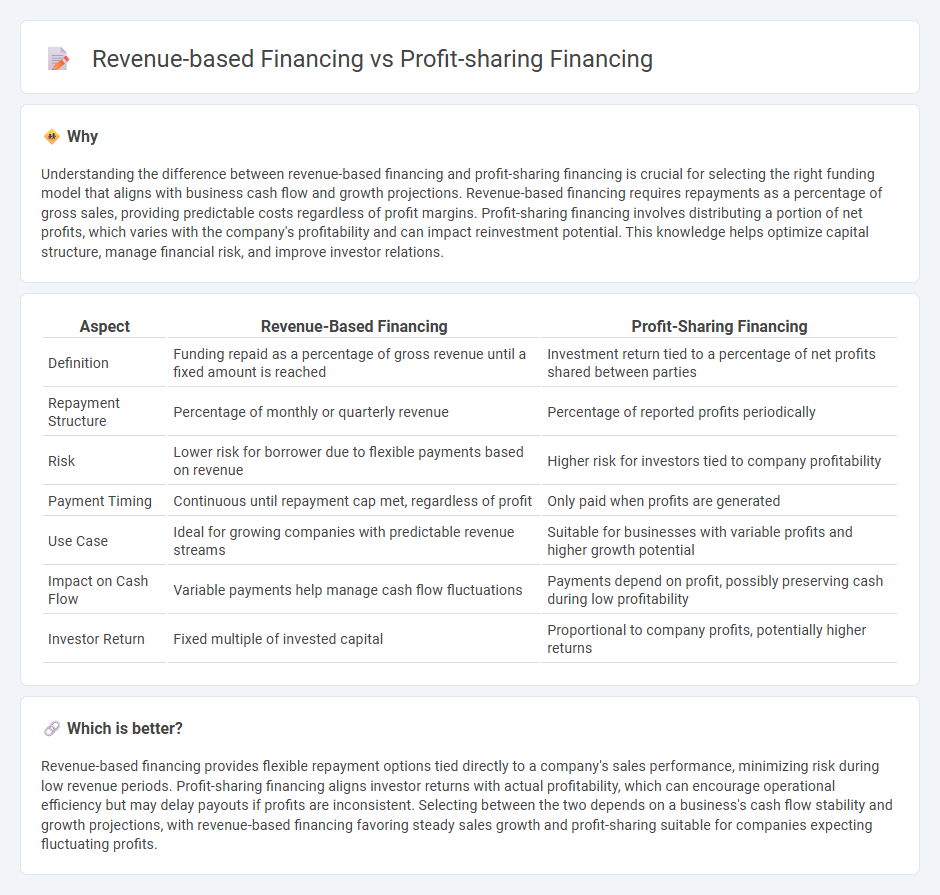

Understanding the difference between revenue-based financing and profit-sharing financing is crucial for selecting the right funding model that aligns with business cash flow and growth projections. Revenue-based financing requires repayments as a percentage of gross sales, providing predictable costs regardless of profit margins. Profit-sharing financing involves distributing a portion of net profits, which varies with the company's profitability and can impact reinvestment potential. This knowledge helps optimize capital structure, manage financial risk, and improve investor relations.

Comparison Table

| Aspect | Revenue-Based Financing | Profit-Sharing Financing |

|---|---|---|

| Definition | Funding repaid as a percentage of gross revenue until a fixed amount is reached | Investment return tied to a percentage of net profits shared between parties |

| Repayment Structure | Percentage of monthly or quarterly revenue | Percentage of reported profits periodically |

| Risk | Lower risk for borrower due to flexible payments based on revenue | Higher risk for investors tied to company profitability |

| Payment Timing | Continuous until repayment cap met, regardless of profit | Only paid when profits are generated |

| Use Case | Ideal for growing companies with predictable revenue streams | Suitable for businesses with variable profits and higher growth potential |

| Impact on Cash Flow | Variable payments help manage cash flow fluctuations | Payments depend on profit, possibly preserving cash during low profitability |

| Investor Return | Fixed multiple of invested capital | Proportional to company profits, potentially higher returns |

Which is better?

Revenue-based financing provides flexible repayment options tied directly to a company's sales performance, minimizing risk during low revenue periods. Profit-sharing financing aligns investor returns with actual profitability, which can encourage operational efficiency but may delay payouts if profits are inconsistent. Selecting between the two depends on a business's cash flow stability and growth projections, with revenue-based financing favoring steady sales growth and profit-sharing suitable for companies expecting fluctuating profits.

Connection

Revenue-based financing and profit-sharing financing are connected through their structure of linking repayments to a company's financial performance instead of fixed interest rates. Both methods provide flexible funding by allowing investors to receive returns based on a percentage of revenue or profits, aligning the interests of lenders and borrowers. These models offer alternative capital solutions for startups and growing businesses seeking to preserve equity while managing cash flow.

Key Terms

Net Profit

Profit-sharing financing allows investors to receive a percentage of the company's net profit, aligning returns with the business's actual profitability rather than gross revenue. Revenue-based financing provides repayments as a fixed percentage of gross revenue, which may not accurately reflect the company's net profit margins or operational costs. Explore the nuanced impacts of these financing models on your company's net profit and long-term financial health.

Gross Revenue

Profit-sharing financing allocates a portion of net profits to investors, meaning payouts depend on the company's profitability after deducting expenses, whereas revenue-based financing ties repayments directly to gross revenue, resulting in payments based on total sales without expense deductions. Revenue-based financing offers more predictable cash flow obligations since payments fluctuate with top-line income rather than bottom-line earnings. Explore detailed comparisons to determine which structure aligns better with your business's financial strategy and growth stage.

Distribution Ratio

Profit-sharing financing allocates a fixed percentage of net profits to investors, influencing the distribution ratio based on business profitability fluctuations. Revenue-based financing retrieves a predetermined portion of gross revenues until a set repayment cap is achieved, offering more consistent cash flow impacts on the distribution ratio. Explore detailed comparisons of distribution ratios in profit-sharing versus revenue-based financing for optimized capital strategy decisions.

Source and External Links

Profit Share - Profit-sharing financing is a flexible funding model where payments to investors are tied to a percentage of the company's profits rather than fixed interest, typically structured as convertible notes or debt with payments starting after a grace period and continuing until a capped return is reached, offering non-dilutive capital and potentially cheaper long-term costs than traditional equity or revenue-based financing.

Profit Share Loans - Profit-share loans provide funding in exchange for a negotiated percentage of profits generated by the financed assets, with returns often concentrated towards the loan's end, balancing higher return potentials with increased time risk compared to fixed-interest loans, commonly used in renewable energy projects.

Choosing a retirement plan: Profit sharing plan - In the context of employee compensation, profit-sharing is a discretionary employer contribution plan that allocates a share of company profits to employees' retirement accounts based on a set formula, offering flexibility and tax advantages but distinct from profit-sharing financing for capital investment.

dowidth.com

dowidth.com