Inflation swaps and commodity swaps are financial derivatives used to manage exposure to price fluctuations. Inflation swaps provide a mechanism to hedge against inflation risk by exchanging fixed payments for payments linked to inflation indices, while commodity swaps involve exchanging cash flows based on underlying commodity prices such as oil or metals. Explore how these swaps can optimize risk management and enhance financial strategies.

Why it is important

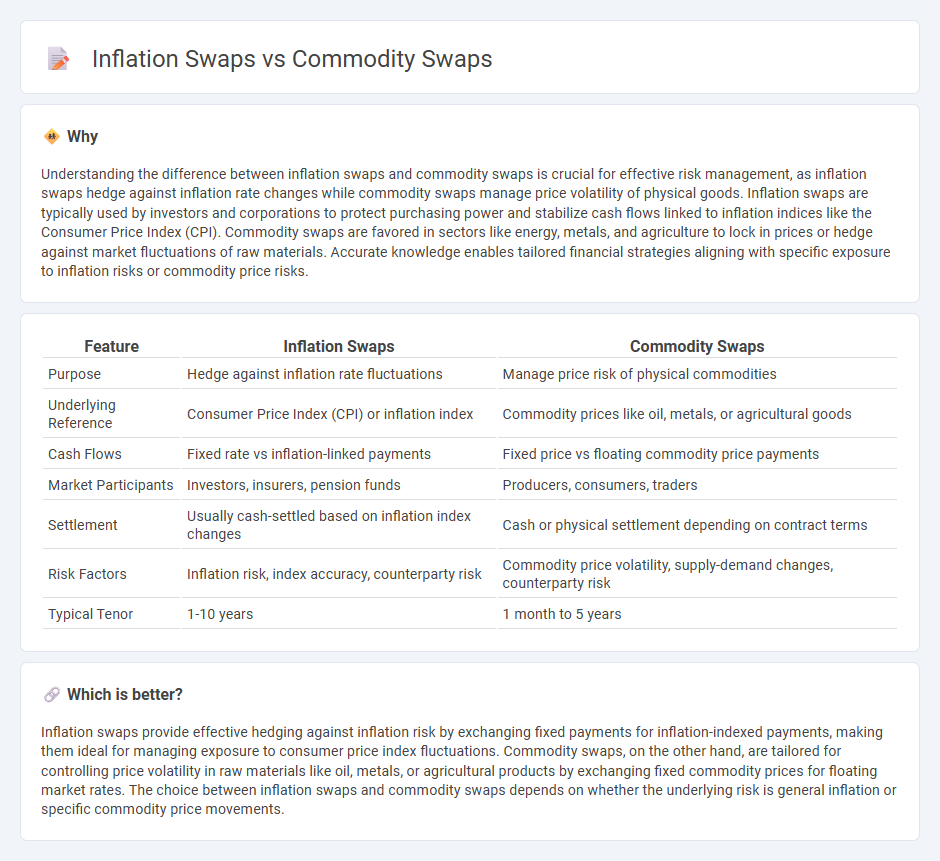

Understanding the difference between inflation swaps and commodity swaps is crucial for effective risk management, as inflation swaps hedge against inflation rate changes while commodity swaps manage price volatility of physical goods. Inflation swaps are typically used by investors and corporations to protect purchasing power and stabilize cash flows linked to inflation indices like the Consumer Price Index (CPI). Commodity swaps are favored in sectors like energy, metals, and agriculture to lock in prices or hedge against market fluctuations of raw materials. Accurate knowledge enables tailored financial strategies aligning with specific exposure to inflation risks or commodity price risks.

Comparison Table

| Feature | Inflation Swaps | Commodity Swaps |

|---|---|---|

| Purpose | Hedge against inflation rate fluctuations | Manage price risk of physical commodities |

| Underlying Reference | Consumer Price Index (CPI) or inflation index | Commodity prices like oil, metals, or agricultural goods |

| Cash Flows | Fixed rate vs inflation-linked payments | Fixed price vs floating commodity price payments |

| Market Participants | Investors, insurers, pension funds | Producers, consumers, traders |

| Settlement | Usually cash-settled based on inflation index changes | Cash or physical settlement depending on contract terms |

| Risk Factors | Inflation risk, index accuracy, counterparty risk | Commodity price volatility, supply-demand changes, counterparty risk |

| Typical Tenor | 1-10 years | 1 month to 5 years |

Which is better?

Inflation swaps provide effective hedging against inflation risk by exchanging fixed payments for inflation-indexed payments, making them ideal for managing exposure to consumer price index fluctuations. Commodity swaps, on the other hand, are tailored for controlling price volatility in raw materials like oil, metals, or agricultural products by exchanging fixed commodity prices for floating market rates. The choice between inflation swaps and commodity swaps depends on whether the underlying risk is general inflation or specific commodity price movements.

Connection

Inflation swaps and commodity swaps are interconnected as both serve to hedge against price volatility risks in financial markets, with inflation swaps protecting against changes in inflation rates and commodity swaps managing fluctuations in commodity prices such as oil, metals, and agricultural products. These derivatives allow investors and corporations to stabilize cash flows and safeguard profit margins against unpredictable economic factors affecting inflation and commodity costs. The correlation between inflation rates and commodity prices often influences the pricing and strategic use of these swaps in risk management practices.

Key Terms

Underlying Asset

Commodity swaps use physical goods such as oil, gold, or agricultural products as the underlying asset, with payments based on price fluctuations in those commodities. Inflation swaps use a consumer price index (CPI) or other inflation measures as the underlying asset, providing protection against inflation risks by exchanging fixed and floating rate payments tied to inflation rates. Explore more to understand how these swaps manage different types of market risks effectively.

Cash Flows

Commodity swaps involve exchanging fixed cash flows for floating payments based on commodity prices, providing price risk management for raw materials. Inflation swaps, on the other hand, exchange fixed payments for floating payments indexed to inflation rates, protecting against purchasing power erosion. Explore detailed cash flow structures and applications in financial risk management to deepen your understanding.

Hedging

Commodity swaps allow companies to hedge against price volatility in raw materials such as oil or metals by locking in prices for future delivery, providing budget certainty and mitigating exposure to fluctuating commodity markets. Inflation swaps help investors and businesses protect against unexpected inflation by exchanging fixed payments for floating payments linked to an inflation index, preserving purchasing power and stabilizing cash flows. Explore detailed strategies and examples to understand how these swaps can effectively manage financial risk.

Source and External Links

Commodity Swap - Definition, Example, Use, Types - A commodity swap is a derivative contract allowing two parties to exchange cash flows dependent on the price of an underlying commodity, commonly used by producers and end-users to hedge against price fluctuations, typically structured as fixed-floating swaps or commodity-for-interest swaps.

Commodity swap - Wikipedia - Commodity swaps trade a floating commodity price for a fixed price over a period; no actual commodities change hands, and are heavily used in oil markets by airlines and rail companies to stabilize fuel costs.

Commodity Swap: Explained | TIOmarkets - Commodity swaps come mainly in two forms: fixed-floating swaps, where a fixed price is exchanged for a floating market price, and commodity-for-commodity swaps, exchanging one commodity for another, each serving purposes like hedging or diversification.

dowidth.com

dowidth.com