Climate-linked derivatives offer financial instruments that hedge risks associated with climate variability, enabling investors to manage exposure to environmental factors more effectively. Transition bonds finance projects aimed at reducing carbon emissions and supporting the shift to a low-carbon economy, providing targeted capital for sustainable development. Explore the distinct roles and benefits of these innovative finance tools to better understand their impact on climate resilience.

Why it is important

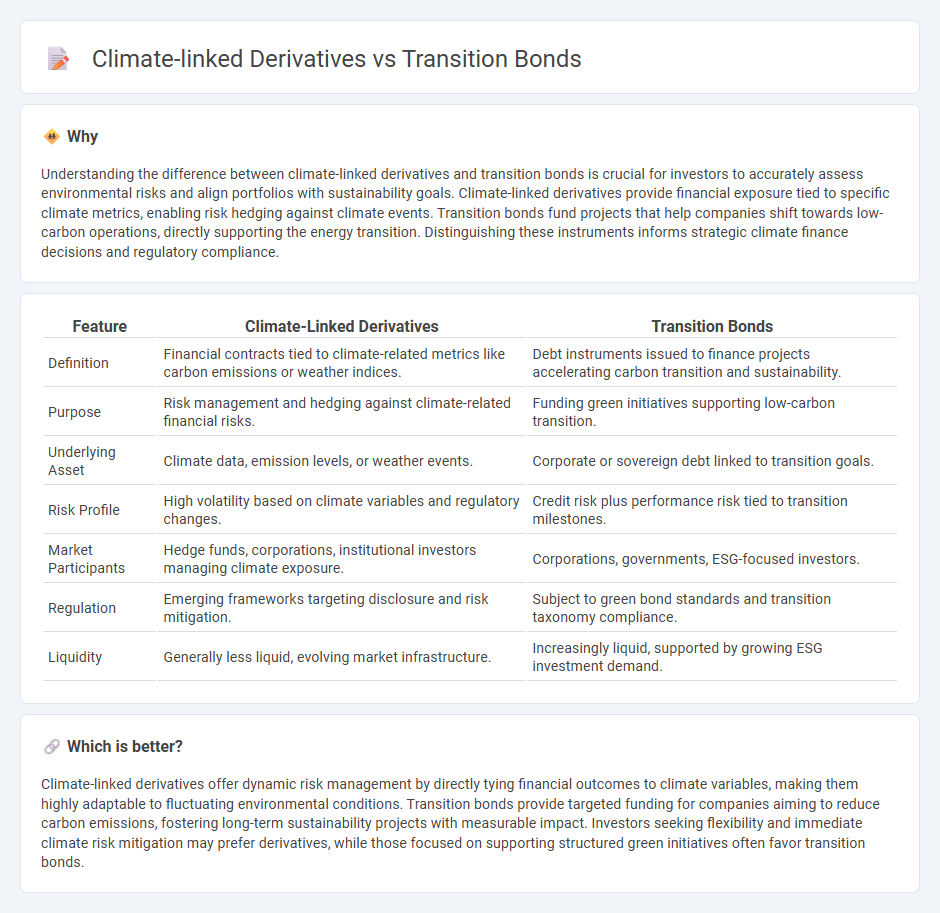

Understanding the difference between climate-linked derivatives and transition bonds is crucial for investors to accurately assess environmental risks and align portfolios with sustainability goals. Climate-linked derivatives provide financial exposure tied to specific climate metrics, enabling risk hedging against climate events. Transition bonds fund projects that help companies shift towards low-carbon operations, directly supporting the energy transition. Distinguishing these instruments informs strategic climate finance decisions and regulatory compliance.

Comparison Table

| Feature | Climate-Linked Derivatives | Transition Bonds |

|---|---|---|

| Definition | Financial contracts tied to climate-related metrics like carbon emissions or weather indices. | Debt instruments issued to finance projects accelerating carbon transition and sustainability. |

| Purpose | Risk management and hedging against climate-related financial risks. | Funding green initiatives supporting low-carbon transition. |

| Underlying Asset | Climate data, emission levels, or weather events. | Corporate or sovereign debt linked to transition goals. |

| Risk Profile | High volatility based on climate variables and regulatory changes. | Credit risk plus performance risk tied to transition milestones. |

| Market Participants | Hedge funds, corporations, institutional investors managing climate exposure. | Corporations, governments, ESG-focused investors. |

| Regulation | Emerging frameworks targeting disclosure and risk mitigation. | Subject to green bond standards and transition taxonomy compliance. |

| Liquidity | Generally less liquid, evolving market infrastructure. | Increasingly liquid, supported by growing ESG investment demand. |

Which is better?

Climate-linked derivatives offer dynamic risk management by directly tying financial outcomes to climate variables, making them highly adaptable to fluctuating environmental conditions. Transition bonds provide targeted funding for companies aiming to reduce carbon emissions, fostering long-term sustainability projects with measurable impact. Investors seeking flexibility and immediate climate risk mitigation may prefer derivatives, while those focused on supporting structured green initiatives often favor transition bonds.

Connection

Climate-linked derivatives and transition bonds are connected through their role in managing financial risks associated with environmental changes and sustainable development. Climate-linked derivatives provide instruments for hedging risks tied to weather patterns and carbon prices, while transition bonds finance projects aimed at reducing carbon emissions and supporting the shift to a low-carbon economy. Both financial tools enable investors and corporations to address climate-related risks and align capital flows with environmental objectives.

Key Terms

Sustainability Performance Targets

Transition bonds are debt instruments that finance projects aligned with reducing carbon footprints and achieving sustainability performance targets (SPTs), thereby supporting the shift to a low-carbon economy. Climate-linked derivatives are financial contracts whose payoffs depend on environmental metrics, such as carbon emissions or renewable energy generation, directly tied to a company's sustainability goals and SPTs. Explore the mechanisms and benefits of these innovative financial tools to better understand their roles in sustainable finance.

Carbon Credits

Transition bonds finance projects aimed at reducing carbon emissions in high-impact sectors, often integrating carbon credits to offset residual emissions and meet decarbonization targets. Climate-linked derivatives, such as carbon credit futures and options, allow companies and investors to hedge against regulatory risks and price volatility in carbon markets. Explore how leveraging carbon credits in these financial instruments advances sustainable investment strategies.

Coupon Step-up/Step-down

Transition bonds often feature coupon step-up or step-down mechanisms tied to a company's progress in reducing carbon emissions or meeting sustainability targets, incentivizing positive environmental performance. Climate-linked derivatives, such as options or swaps, use trigger events linked to climate metrics, impacting payout structures tied to environmental outcomes but typically without direct coupon adjustments. Explore the detailed structures and market impacts of these financial instruments to understand their role in climate finance innovation.

Source and External Links

Transition Bonds | Smith School of Business - Transition bonds are a class of bonds used to fund a company's transition to reduced environmental impact or lower carbon emissions, financing projects that help shift to sustainable practices even if not initially "green," such as carbon capture by coal firms.

Transition bonds: What are they and how do they help decarbonize - Transition bonds finance projects in carbon-intensive industries that are moving toward lower emissions, bridging the gap between green bonds and sustainability-linked bonds by supporting entities transitioning to more sustainable operations.

Transition Finance in the Debt Capital Market - Transition finance, including transition bonds, plays a key role in funding climate transition projects aligned with Paris Agreement goals, though it currently does not finance fossil fuel companies extensively and overlaps with sustainable and green bond markets.

dowidth.com

dowidth.com