Insurtech revolutionizes the insurance industry by leveraging AI and big data to enhance policy underwriting, claims processing, and customer engagement, driving efficiency and personalized experiences. Mortgage tech transforms home financing through automated loan approvals, digital documentation, and improved risk assessment, significantly reducing closing times and increasing accessibility. Explore how these fintech innovations are reshaping financial services and empowering consumers.

Why it is important

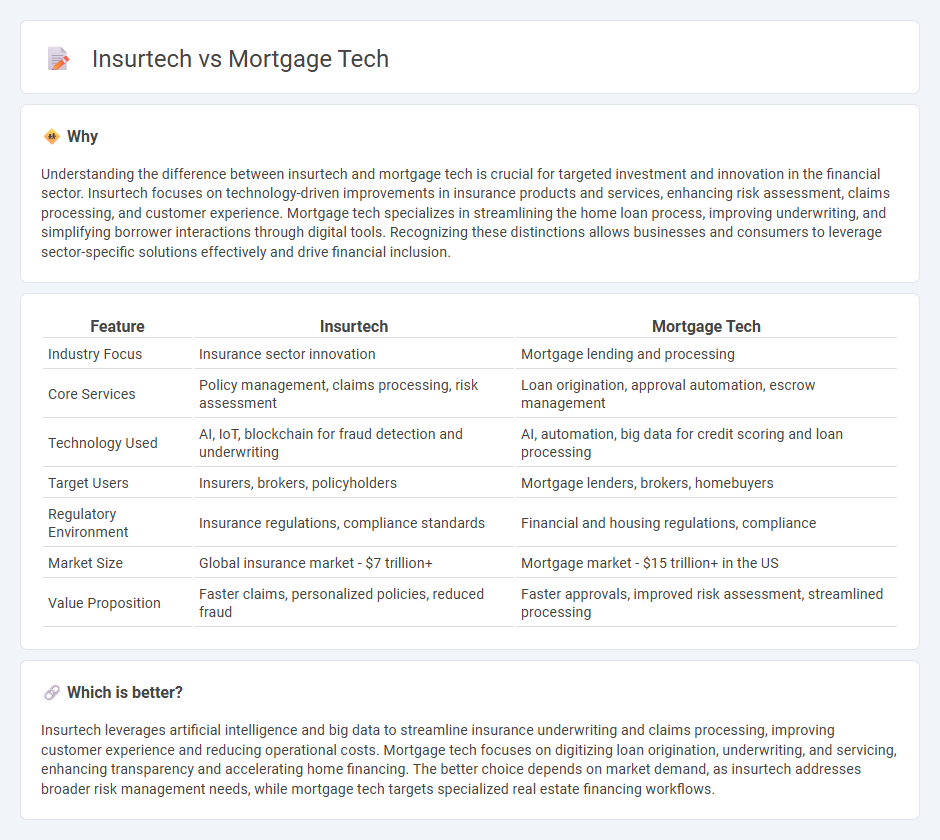

Understanding the difference between insurtech and mortgage tech is crucial for targeted investment and innovation in the financial sector. Insurtech focuses on technology-driven improvements in insurance products and services, enhancing risk assessment, claims processing, and customer experience. Mortgage tech specializes in streamlining the home loan process, improving underwriting, and simplifying borrower interactions through digital tools. Recognizing these distinctions allows businesses and consumers to leverage sector-specific solutions effectively and drive financial inclusion.

Comparison Table

| Feature | Insurtech | Mortgage Tech |

|---|---|---|

| Industry Focus | Insurance sector innovation | Mortgage lending and processing |

| Core Services | Policy management, claims processing, risk assessment | Loan origination, approval automation, escrow management |

| Technology Used | AI, IoT, blockchain for fraud detection and underwriting | AI, automation, big data for credit scoring and loan processing |

| Target Users | Insurers, brokers, policyholders | Mortgage lenders, brokers, homebuyers |

| Regulatory Environment | Insurance regulations, compliance standards | Financial and housing regulations, compliance |

| Market Size | Global insurance market - $7 trillion+ | Mortgage market - $15 trillion+ in the US |

| Value Proposition | Faster claims, personalized policies, reduced fraud | Faster approvals, improved risk assessment, streamlined processing |

Which is better?

Insurtech leverages artificial intelligence and big data to streamline insurance underwriting and claims processing, improving customer experience and reducing operational costs. Mortgage tech focuses on digitizing loan origination, underwriting, and servicing, enhancing transparency and accelerating home financing. The better choice depends on market demand, as insurtech addresses broader risk management needs, while mortgage tech targets specialized real estate financing workflows.

Connection

Insurtech and mortgage tech intersect by streamlining risk assessment and underwriting processes through advanced data analytics and artificial intelligence. Both industries leverage digital platforms to enhance customer experience, reduce processing times, and improve accuracy in pricing insurance policies and mortgage loans. Integration of these technologies fosters seamless collaboration between insurers and lenders, optimizing financial product offerings and risk management strategies.

Key Terms

Loan Origination System (Mortgage Tech)

Loan Origination Systems (LOS) in mortgage technology streamline the loan application process by automating tasks such as credit checks, document verification, and approval workflows, significantly reducing processing time and operational costs. In contrast, insurtech primarily focuses on automating underwriting, claims management, and customer engagement within the insurance sector. Explore the evolving capabilities of LOS to see how mortgage tech continues to transform home financing.

Underwriting Automation (Insurtech)

Underwriting automation in insurtech leverages AI and machine learning to analyze vast datasets, streamline risk assessment, and expedite policy issuance with higher accuracy. Mortgage tech underwriting focuses on credit scoring and property valuation automation but often relies more on traditional data sources and regulatory compliance. Explore the latest innovations driving underwriting efficiency and accuracy across both sectors.

Risk Assessment Model (Both)

Mortgage tech leverages advanced algorithms and big data analytics to enhance risk assessment models, enabling lenders to accurately evaluate borrower creditworthiness and property value. Insurtech employs AI-driven risk assessment frameworks to predict claims probability and customer risk profiles, optimizing underwriting processes and pricing strategies. Explore how integrating these innovative risk assessment models transforms financial decision-making in both industries.

Source and External Links

What Is Mortgage Technology? - BeSmartee - Mortgage technology automates and streamlines mortgage processes such as loan applications, documentation, and approvals using AI and software, reducing errors and speeding up the lending process for both borrowers and lenders.

Better Mortgage: Simple, Online, AI-Powered Mortgage - Better uses AI-powered tech to offer faster mortgage approvals and closings, lower rates, and higher chances of approval, aiming to provide a fully digital and efficient mortgage experience.

Where does mortgage tech innovation and funding go in 2025? - Mortgage technology innovation in 2025 focuses on making data actionable for lenders and servicers, improving customer acquisition and outcomes, with increasing investment as the mortgage market rebounds.

dowidth.com

dowidth.com