Decentralized Autonomous Organization (DAO) treasuries utilize blockchain technology to manage and allocate assets transparently through smart contracts, enabling community-driven financial governance without centralized control. Pension funds, by contrast, rely on structured investment strategies managed by professional fund managers to ensure long-term retirement income security for contributors. Explore the operational differences and strategic benefits of DAO treasuries versus traditional pension funds to understand evolving financial management models.

Why it is important

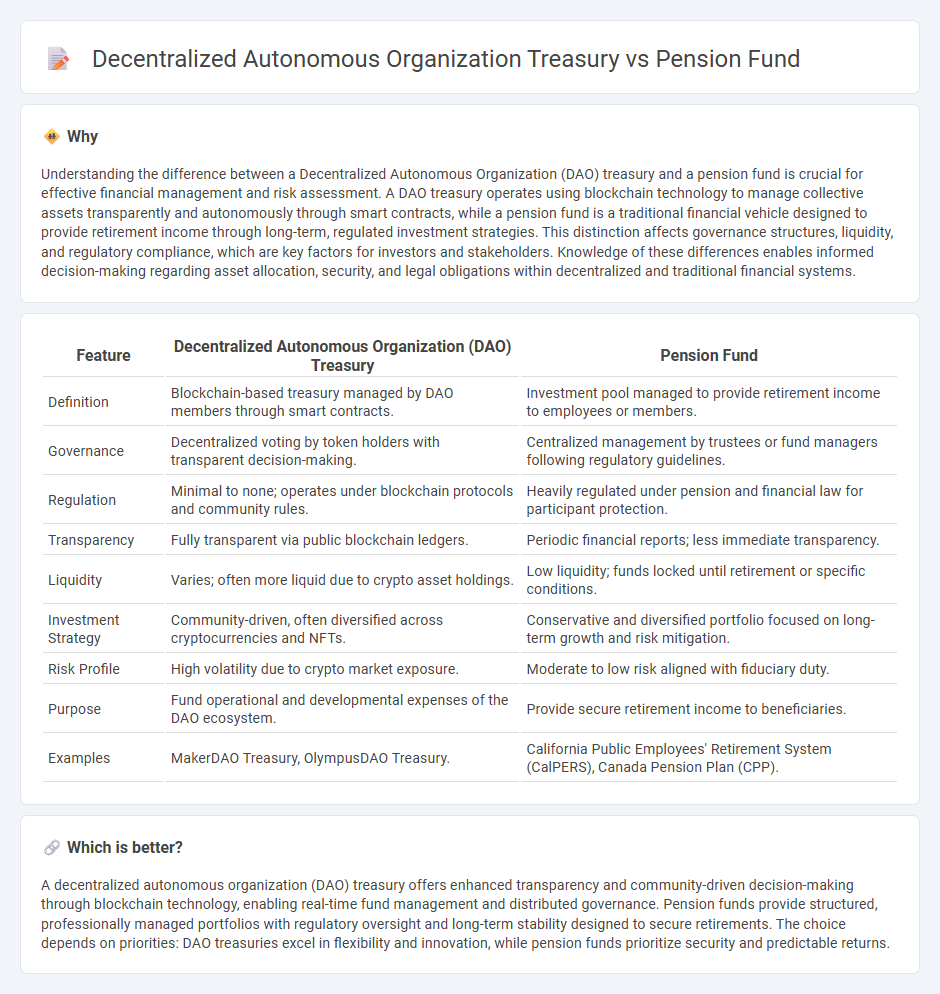

Understanding the difference between a Decentralized Autonomous Organization (DAO) treasury and a pension fund is crucial for effective financial management and risk assessment. A DAO treasury operates using blockchain technology to manage collective assets transparently and autonomously through smart contracts, while a pension fund is a traditional financial vehicle designed to provide retirement income through long-term, regulated investment strategies. This distinction affects governance structures, liquidity, and regulatory compliance, which are key factors for investors and stakeholders. Knowledge of these differences enables informed decision-making regarding asset allocation, security, and legal obligations within decentralized and traditional financial systems.

Comparison Table

| Feature | Decentralized Autonomous Organization (DAO) Treasury | Pension Fund |

|---|---|---|

| Definition | Blockchain-based treasury managed by DAO members through smart contracts. | Investment pool managed to provide retirement income to employees or members. |

| Governance | Decentralized voting by token holders with transparent decision-making. | Centralized management by trustees or fund managers following regulatory guidelines. |

| Regulation | Minimal to none; operates under blockchain protocols and community rules. | Heavily regulated under pension and financial law for participant protection. |

| Transparency | Fully transparent via public blockchain ledgers. | Periodic financial reports; less immediate transparency. |

| Liquidity | Varies; often more liquid due to crypto asset holdings. | Low liquidity; funds locked until retirement or specific conditions. |

| Investment Strategy | Community-driven, often diversified across cryptocurrencies and NFTs. | Conservative and diversified portfolio focused on long-term growth and risk mitigation. |

| Risk Profile | High volatility due to crypto market exposure. | Moderate to low risk aligned with fiduciary duty. |

| Purpose | Fund operational and developmental expenses of the DAO ecosystem. | Provide secure retirement income to beneficiaries. |

| Examples | MakerDAO Treasury, OlympusDAO Treasury. | California Public Employees' Retirement System (CalPERS), Canada Pension Plan (CPP). |

Which is better?

A decentralized autonomous organization (DAO) treasury offers enhanced transparency and community-driven decision-making through blockchain technology, enabling real-time fund management and distributed governance. Pension funds provide structured, professionally managed portfolios with regulatory oversight and long-term stability designed to secure retirements. The choice depends on priorities: DAO treasuries excel in flexibility and innovation, while pension funds prioritize security and predictable returns.

Connection

Decentralized Autonomous Organization (DAO) treasuries manage digital assets through blockchain-based governance, ensuring transparency and security in fund allocation. Pension funds increasingly integrate DAO treasuries to diversify portfolios with decentralized finance (DeFi) assets, optimizing long-term returns while mitigating centralized risks. This synergy enhances financial resilience by leveraging smart contracts for automated, trustless fund management.

Key Terms

Asset Management

Pension fund asset management centers on long-term, conservative investments to ensure stable returns and protect retiree benefits, often utilizing diversified portfolios including bonds, equities, and real estate. Decentralized Autonomous Organization (DAO) treasuries prioritize crypto assets and liquidity pools, leveraging blockchain transparency and automated governance for dynamic allocation and risk management. Explore the evolving strategies in asset management to understand how these entities optimize their financial resources.

Governance Structure

Pension funds typically operate under a hierarchical governance structure with clearly defined roles for trustees, fund managers, and regulatory oversight to ensure fiduciary responsibility and risk management. In contrast, decentralized autonomous organization (DAO) treasuries utilize blockchain-based smart contracts and community voting mechanisms that enable transparent, decentralized decision-making without centralized intermediaries. Explore the distinct governance frameworks and operational protocols to understand how each manages stakeholder interests and funds efficiently.

Fund Disbursement

Pension funds typically follow structured, long-term schedules for disbursing retirement benefits, ensuring consistent income streams for participants based on actuarial calculations and regulatory compliance. Decentralized Autonomous Organization (DAO) treasuries utilize blockchain protocols to execute transparent, on-chain fund disbursements governed by member voting and smart contracts, enabling agile and decentralized financial management. Explore how these contrasting disbursement mechanisms impact financial security and governance efficiency.

Source and External Links

Pension fund - A pension fund is a program or scheme that provides retirement income and invests in stocks, bonds, real estate, and other assets with a focus on prudence and risk management, increasingly using passive investment methods and diversifying into alternative assets to maintain returns.

Retirement & Savings Solutions | Pension Fund - Pension Fund offers retirement and savings products, along with financial education, serving clergy and related organizations with the goal of managing and growing retirement income securely.

State of NJ - Department of the Treasury - NJDPB | TPAF - The Teachers' Pension and Annuity Fund (TPAF) provides eligibility, enrollment, and transfer information specific to pension members in New Jersey's retirement system.

dowidth.com

dowidth.com