Perpetual futures enable traders to hold positions indefinitely without expiry dates, utilizing funding rates to maintain price stability with the underlying asset. Margin trading involves borrowing funds to increase position size, amplifying both potential gains and risks through leverage on spot markets. Explore the key differences and strategic advantages of perpetual futures versus margin trading to optimize your financial decisions.

Why it is important

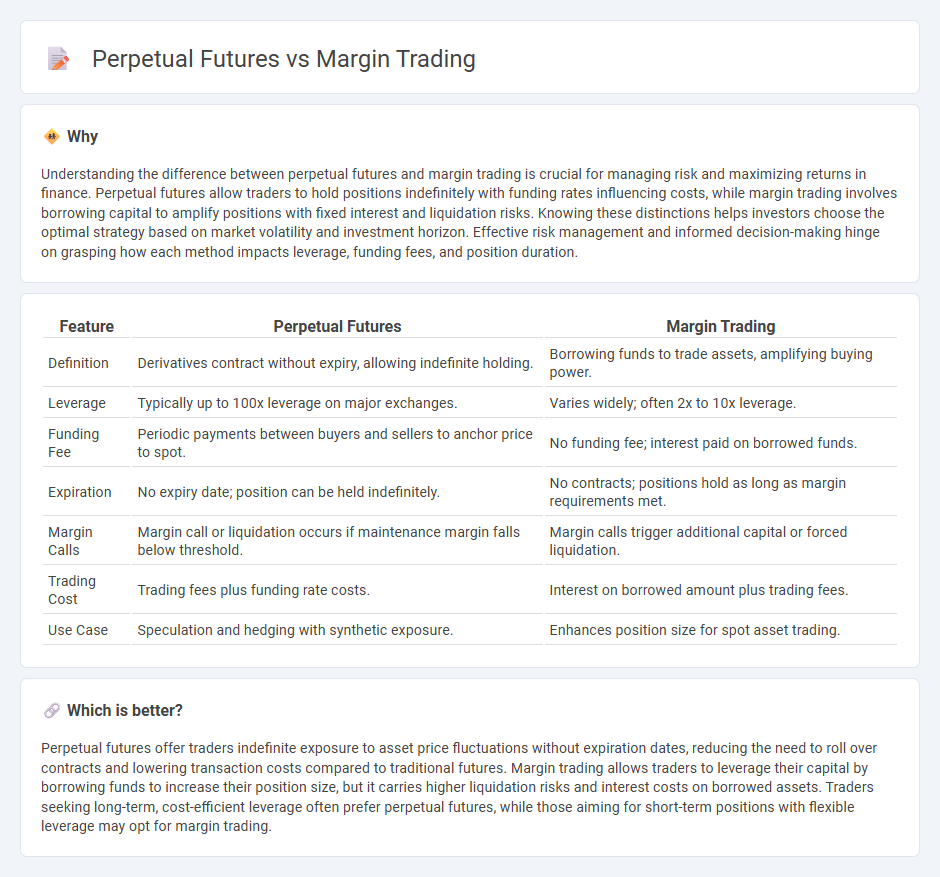

Understanding the difference between perpetual futures and margin trading is crucial for managing risk and maximizing returns in finance. Perpetual futures allow traders to hold positions indefinitely with funding rates influencing costs, while margin trading involves borrowing capital to amplify positions with fixed interest and liquidation risks. Knowing these distinctions helps investors choose the optimal strategy based on market volatility and investment horizon. Effective risk management and informed decision-making hinge on grasping how each method impacts leverage, funding fees, and position duration.

Comparison Table

| Feature | Perpetual Futures | Margin Trading |

|---|---|---|

| Definition | Derivatives contract without expiry, allowing indefinite holding. | Borrowing funds to trade assets, amplifying buying power. |

| Leverage | Typically up to 100x leverage on major exchanges. | Varies widely; often 2x to 10x leverage. |

| Funding Fee | Periodic payments between buyers and sellers to anchor price to spot. | No funding fee; interest paid on borrowed funds. |

| Expiration | No expiry date; position can be held indefinitely. | No contracts; positions hold as long as margin requirements met. |

| Margin Calls | Margin call or liquidation occurs if maintenance margin falls below threshold. | Margin calls trigger additional capital or forced liquidation. |

| Trading Cost | Trading fees plus funding rate costs. | Interest on borrowed amount plus trading fees. |

| Use Case | Speculation and hedging with synthetic exposure. | Enhances position size for spot asset trading. |

Which is better?

Perpetual futures offer traders indefinite exposure to asset price fluctuations without expiration dates, reducing the need to roll over contracts and lowering transaction costs compared to traditional futures. Margin trading allows traders to leverage their capital by borrowing funds to increase their position size, but it carries higher liquidation risks and interest costs on borrowed assets. Traders seeking long-term, cost-efficient leverage often prefer perpetual futures, while those aiming for short-term positions with flexible leverage may opt for margin trading.

Connection

Perpetual futures contracts enable traders to hold positions indefinitely without an expiry date, often using leverage through margin trading to amplify potential returns. Margin trading requires maintaining a collateral deposit, which funds the leveraged position in perpetual futures, increasing both risk and reward. This interconnectedness allows traders to capitalize on price movements in the underlying asset while managing exposure through margin requirements and liquidation thresholds.

Key Terms

Leverage

Margin trading allows traders to borrow funds to increase their position size, typically offering leverage ratios ranging from 2x to 10x depending on the platform and asset. Perpetual futures contracts provide higher leverage options, often up to 100x, enabling traders to amplify gains or losses without an expiry date on the contract. Explore more insights on how leverage impacts risk and strategy in crypto trading.

Liquidation

Margin trading involves borrowing funds to open leveraged positions, with liquidation occurring when the account's equity falls below the maintenance margin requirement, forcing automatic position closure to prevent further losses. Perpetual futures contracts feature a funding rate mechanism and no expiration, with liquidation triggered when the margin balance is insufficient to cover potential losses, often relying on a liquidation engine or insurance fund to handle defaults. Explore detailed liquidation processes in margin trading and perpetual futures to optimize risk management strategies.

Funding Rate

Margin trading involves borrowing funds to increase position size, where interest is charged on the borrowed amount without recurring payment adjustments. Perpetual futures incorporate a funding rate mechanism that regularly balances price discrepancies between the contract and underlying asset through payments exchanged between longs and shorts. Explore comprehensive guides to understand how funding rate impacts trading strategies and risk management.

Source and External Links

Margin trading - Definition, how it works and examples - Margin trading is the use of borrowed funds, called margin, to increase the potential return on a financial asset, but it also magnifies losses; for example, borrowing half the purchase price doubles both gains and losses relative to your own investment.

Basics of Buying on Margin: What's Margin Trading? - Margin trading involves opening a margin account where you borrow up to 50% of a security's purchase price regulated by rules like Reg T, with securities in the account often serving as collateral and margin interest charged on borrowed funds.

What is Margin Trading and How Do You Trade On It? - IG - Margin trading, also called leveraged trading, allows traders to open positions by putting up only a fraction of the total value (initial margin) and may require additional funds (maintenance margin) if the market moves against their position, amplifying both profits and losses.

dowidth.com

dowidth.com