Catastrophe bonds transfer disaster risk from insurers to investors by offering high-yield securities triggered by predefined catastrophic events, providing immediate capital relief. Contingent capital is a pre-arranged financial agreement allowing companies to raise funds quickly after a crisis, often through convertible debt or equity instruments. Explore the key differences and applications of these financial tools to optimize risk management strategies.

Why it is important

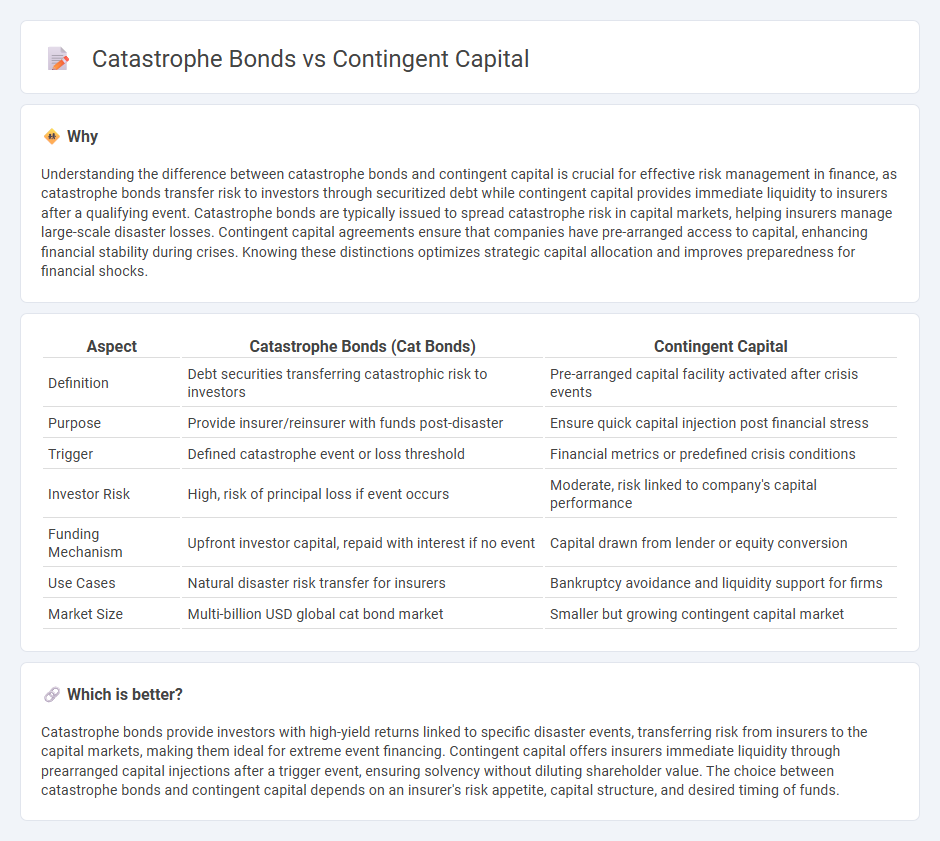

Understanding the difference between catastrophe bonds and contingent capital is crucial for effective risk management in finance, as catastrophe bonds transfer risk to investors through securitized debt while contingent capital provides immediate liquidity to insurers after a qualifying event. Catastrophe bonds are typically issued to spread catastrophe risk in capital markets, helping insurers manage large-scale disaster losses. Contingent capital agreements ensure that companies have pre-arranged access to capital, enhancing financial stability during crises. Knowing these distinctions optimizes strategic capital allocation and improves preparedness for financial shocks.

Comparison Table

| Aspect | Catastrophe Bonds (Cat Bonds) | Contingent Capital |

|---|---|---|

| Definition | Debt securities transferring catastrophic risk to investors | Pre-arranged capital facility activated after crisis events |

| Purpose | Provide insurer/reinsurer with funds post-disaster | Ensure quick capital injection post financial stress |

| Trigger | Defined catastrophe event or loss threshold | Financial metrics or predefined crisis conditions |

| Investor Risk | High, risk of principal loss if event occurs | Moderate, risk linked to company's capital performance |

| Funding Mechanism | Upfront investor capital, repaid with interest if no event | Capital drawn from lender or equity conversion |

| Use Cases | Natural disaster risk transfer for insurers | Bankruptcy avoidance and liquidity support for firms |

| Market Size | Multi-billion USD global cat bond market | Smaller but growing contingent capital market |

Which is better?

Catastrophe bonds provide investors with high-yield returns linked to specific disaster events, transferring risk from insurers to the capital markets, making them ideal for extreme event financing. Contingent capital offers insurers immediate liquidity through prearranged capital injections after a trigger event, ensuring solvency without diluting shareholder value. The choice between catastrophe bonds and contingent capital depends on an insurer's risk appetite, capital structure, and desired timing of funds.

Connection

Catastrophe bonds and contingent capital are both innovative financial instruments designed to provide liquidity to insurers and governments following catastrophic events, such as natural disasters. Catastrophe bonds transfer risk to capital markets by paying investors high yields in exchange for the risk of losing principal if a predefined catastrophe occurs, while contingent capital agreements allow insurers to access predetermined capital injections contingent upon specified trigger events. These instruments enhance risk management and capital optimization by ensuring rapid access to funds when traditional insurance claims payments could strain balance sheets.

Key Terms

Conversion Trigger

Contingent capital triggers conversion based on predefined financial stress events such as a drop in a bank's capital ratio, while catastrophe bonds convert when a specified natural disaster occurrence, like an earthquake or hurricane, meets predefined parameters. Conversion triggers for contingent capital focus on regulatory or accounting criteria reflecting a firm's solvency, whereas catastrophe bonds rely on measurable catastrophe losses reported by independent agencies. Explore the detailed mechanisms behind these triggers to understand how risk is transferred and managed in each instrument.

Loss Absorption

Contingent capital provides immediate loss absorption by converting debt into equity during financial distress, enhancing insurer solvency without cash outflows. Catastrophe bonds transfer risk to investors, triggering principal loss absorption only upon predefined catastrophic events, thus offering insurers liquidity without increasing liabilities. Explore the mechanisms and benefits of both instruments for effective risk management.

Risk Transfer

Contingent capital and catastrophe bonds represent key instruments in risk transfer, each offering distinct mechanisms for insurers to manage financial exposure to catastrophic events. Contingent capital provides pre-arranged access to funds via equity or debt triggers following a loss event, enabling rapid liquidity without immediate debt issuance. Examine detailed risk transfer strategies and performance metrics in contingent capital and catastrophe bonds to optimize your risk management approach.

Source and External Links

Contingent Capital: Definition, Mechanism, Triggers & Risks - POEMS - Contingent capital is a hybrid long-term debt instrument that converts into equity when predefined triggers occur, such as a drop in the issuer's capital ratio or regulatory intervention, helping absorb losses and strengthen the issuer's balance sheet automatically without external decision-making.

Contingent Risk Capital - IRMI - Contingent capital is securitized capital accessed via an options contract that allows an issuer to obtain risk capital only if a specified financial trigger event happens, providing immediate funding but without transferring risk like insurance.

Understanding Contingent Capital - Casualty Actuarial Society - Contingent capital instruments are favored over traditional hybrids for loss absorption, often converting debt to equity or writing down face value when capital ratios fall below thresholds, and are used by banks, insurers, and other financial institutions to improve capital positions and risk exposure.

dowidth.com

dowidth.com