Digital asset custody offers secure storage solutions for cryptocurrencies through third-party providers, enhancing protection against theft and loss compared to traditional methods. Direct registration systems record securities ownership directly on a company's books, eliminating the need for physical certificates and intermediaries. Explore the benefits and differences between these systems to determine the best fit for your financial strategy.

Why it is important

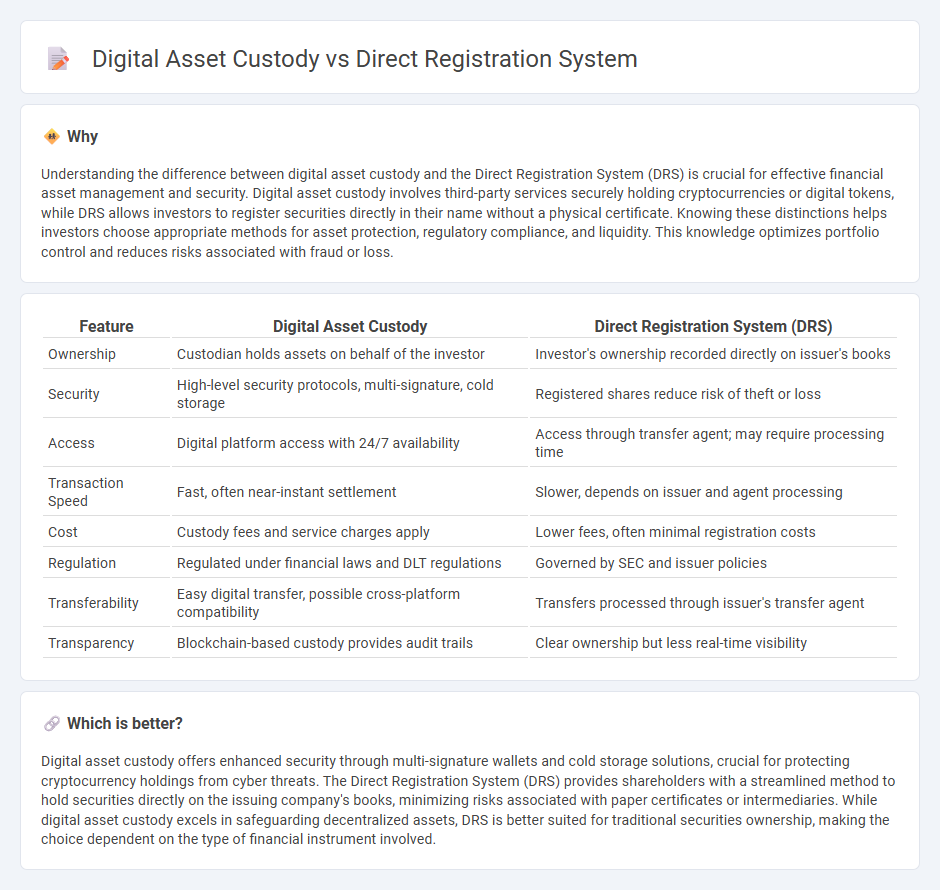

Understanding the difference between digital asset custody and the Direct Registration System (DRS) is crucial for effective financial asset management and security. Digital asset custody involves third-party services securely holding cryptocurrencies or digital tokens, while DRS allows investors to register securities directly in their name without a physical certificate. Knowing these distinctions helps investors choose appropriate methods for asset protection, regulatory compliance, and liquidity. This knowledge optimizes portfolio control and reduces risks associated with fraud or loss.

Comparison Table

| Feature | Digital Asset Custody | Direct Registration System (DRS) |

|---|---|---|

| Ownership | Custodian holds assets on behalf of the investor | Investor's ownership recorded directly on issuer's books |

| Security | High-level security protocols, multi-signature, cold storage | Registered shares reduce risk of theft or loss |

| Access | Digital platform access with 24/7 availability | Access through transfer agent; may require processing time |

| Transaction Speed | Fast, often near-instant settlement | Slower, depends on issuer and agent processing |

| Cost | Custody fees and service charges apply | Lower fees, often minimal registration costs |

| Regulation | Regulated under financial laws and DLT regulations | Governed by SEC and issuer policies |

| Transferability | Easy digital transfer, possible cross-platform compatibility | Transfers processed through issuer's transfer agent |

| Transparency | Blockchain-based custody provides audit trails | Clear ownership but less real-time visibility |

Which is better?

Digital asset custody offers enhanced security through multi-signature wallets and cold storage solutions, crucial for protecting cryptocurrency holdings from cyber threats. The Direct Registration System (DRS) provides shareholders with a streamlined method to hold securities directly on the issuing company's books, minimizing risks associated with paper certificates or intermediaries. While digital asset custody excels in safeguarding decentralized assets, DRS is better suited for traditional securities ownership, making the choice dependent on the type of financial instrument involved.

Connection

Digital asset custody involves the secure storage and management of cryptocurrencies and blockchain-based tokens, while the Direct Registration System (DRS) records ownership of securities directly on a company's books without physical certificates. Both systems enhance transparency and reduce risks by eliminating intermediaries--digital custodians safeguard assets against cyber threats, and DRS minimizes risks of fraud or loss of physical stock certificates. The integration of digital custody with DRS supports seamless, secure asset management by combining blockchain technology's immutability with direct shareholder registration benefits.

Key Terms

Ownership Record

Direct registration systems maintain ownership records on a centralized ledger managed by issuers or transfer agents, ensuring shareholders hold securities in their name without physical certificates. Digital asset custody involves securing digital securities and tokens through blockchain technology, providing transparent, immutable ownership records on distributed ledgers. Explore the differences and benefits of each approach to determine the best fit for your asset management needs.

Third-Party Custodian

Direct registration systems enable investors to hold securities in their name on the issuer's books, eliminating the need for physical certificates and facilitating faster transfers. Digital asset custody, often managed by third-party custodians, provides secure storage and management of blockchain-based assets, ensuring compliance with regulatory standards and safeguarding against cyber threats. Explore how third-party custodians bridge traditional and digital asset management for enhanced security and efficiency.

Blockchain Settlement

Direct registration systems enable investors to hold securities directly on the blockchain, enhancing transparency and reducing settlement times compared to traditional intermediaries. Digital asset custody solutions provide secure storage and management of blockchain-based assets, addressing risks such as private key loss and regulatory compliance. Explore how these innovations transform the landscape of blockchain settlement processes and asset ownership.

Source and External Links

Direct Registration System (DRS) | DTCC Securities Processing - The Direct Registration System (DRS) allows investors to hold securities in book-entry form directly with the issuer, eliminating physical certificates while still providing statements and direct communications such as dividends and proxies from the issuer or transfer agent, enabled by electronic transfers through DTC's FAST program.

Direct holding system - Wikipedia - A direct registration system registers securities ownership directly with the issuer or a single entity, offering a record of ownership without physical certificates, and modern electronic DRS eliminates historic risks and delays related to paper certificate transfers.

Direct Registration System - Securities Transfer Corporation - DRS provides a safe and convenient alternative to physical certificates by electronically recording shares on the company's books, allowing shareholders to receive direct communications and request physical certificates anytime, while making transfers between brokers and DRS electronic and easy.

dowidth.com

dowidth.com