Decentralized exchanges operate on blockchain technology, enabling peer-to-peer trading without intermediaries and offering increased transparency and security. In contrast, fiat currency markets are centralized systems regulated by financial institutions and government authorities, ensuring stability and legal oversight. Explore the distinct advantages and challenges of these financial ecosystems to understand their impact on global finance.

Why it is important

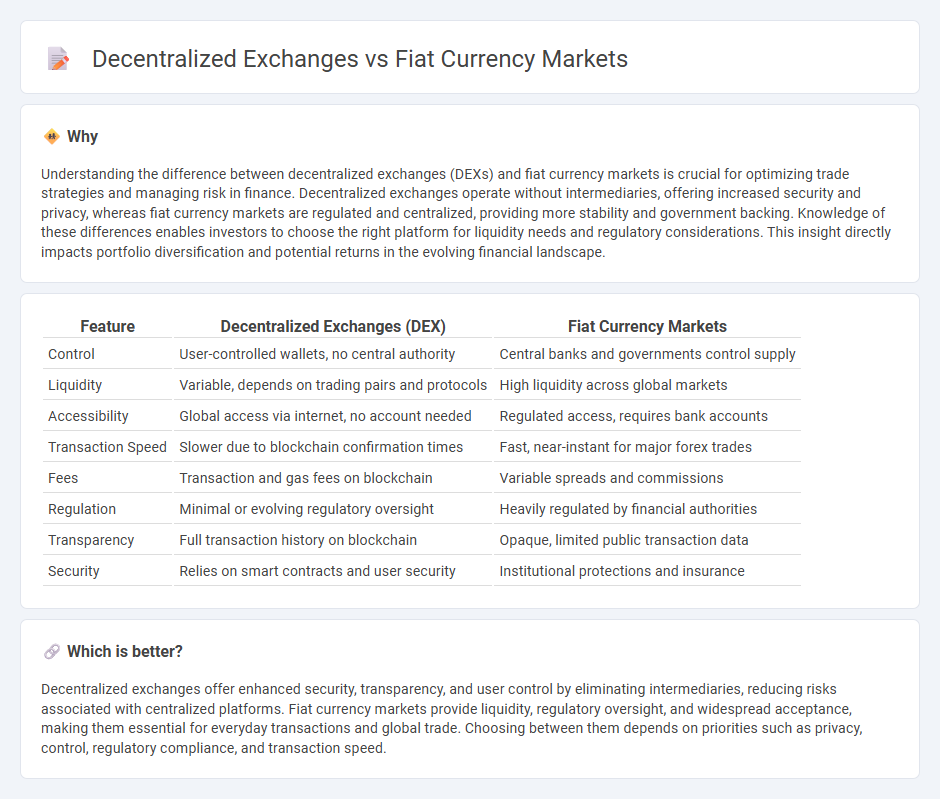

Understanding the difference between decentralized exchanges (DEXs) and fiat currency markets is crucial for optimizing trade strategies and managing risk in finance. Decentralized exchanges operate without intermediaries, offering increased security and privacy, whereas fiat currency markets are regulated and centralized, providing more stability and government backing. Knowledge of these differences enables investors to choose the right platform for liquidity needs and regulatory considerations. This insight directly impacts portfolio diversification and potential returns in the evolving financial landscape.

Comparison Table

| Feature | Decentralized Exchanges (DEX) | Fiat Currency Markets |

|---|---|---|

| Control | User-controlled wallets, no central authority | Central banks and governments control supply |

| Liquidity | Variable, depends on trading pairs and protocols | High liquidity across global markets |

| Accessibility | Global access via internet, no account needed | Regulated access, requires bank accounts |

| Transaction Speed | Slower due to blockchain confirmation times | Fast, near-instant for major forex trades |

| Fees | Transaction and gas fees on blockchain | Variable spreads and commissions |

| Regulation | Minimal or evolving regulatory oversight | Heavily regulated by financial authorities |

| Transparency | Full transaction history on blockchain | Opaque, limited public transaction data |

| Security | Relies on smart contracts and user security | Institutional protections and insurance |

Which is better?

Decentralized exchanges offer enhanced security, transparency, and user control by eliminating intermediaries, reducing risks associated with centralized platforms. Fiat currency markets provide liquidity, regulatory oversight, and widespread acceptance, making them essential for everyday transactions and global trade. Choosing between them depends on priorities such as privacy, control, regulatory compliance, and transaction speed.

Connection

Decentralized exchanges (DEXs) and fiat currency markets intertwine through liquidity gateways that enable seamless swaps between cryptocurrencies and traditional fiat currencies. Stablecoins pegged to fiat currencies act as crucial bridges, maintaining value stability and facilitating cross-market arbitrage opportunities. Market participants leverage this interconnectedness to enhance liquidity, reduce transaction costs, and expand access to global financial ecosystems.

Key Terms

Centralization

Fiat currency markets operate under centralized institutions like banks and governments, which control currency issuance and transaction verification, ensuring regulatory compliance but introducing risks of censorship and single points of failure. Decentralized exchanges (DEXs) eliminate central authorities by enabling peer-to-peer trading on blockchain networks, enhancing security, transparency, and resistance to censorship while relying on smart contracts for transaction execution. Explore how centralization impacts market efficiency and user autonomy in both trading environments.

Liquidity

Fiat currency markets boast high liquidity due to centralized control and widespread acceptance, facilitating efficient large-scale transactions and quick conversion between currencies. Decentralized exchanges rely on automated market makers and liquidity pools, which can lead to variable liquidity and potential slippage, particularly for less popular tokens. Explore how liquidity dynamics impact trading efficiency and risk in both systems to optimize your market strategies.

Counterparty Risk

Fiat currency markets involve centralized intermediaries that hold custody of funds, increasing counterparty risk due to potential insolvency or fraud. Decentralized exchanges (DEXs) operate on blockchain protocols where users retain control over their private keys, minimizing counterparty risk by eliminating intermediaries. Explore the detailed risk profiles of both platforms to understand their impact on financial security.

Source and External Links

Fiat Money: Definition, History, and How It Works - Business Insider - Fiat currency is government-issued money not backed by any commodity but by trust; central banks control supply and monetary policies to influence its value, while its risks include political instability and hyperinflation.

Fiat Money - Corporate Finance Institute - Fiat currency functions based on public confidence and government credit, offering more economic flexibility than commodity-backed money, with central banks managing supply and interest rates to stabilize markets.

Fiat currency | TRM Glossary - Fiat currency's value depends on legal recognition and trust, and while cryptocurrencies won't soon replace it, their rise is pushing central banks to develop digital versions of fiat to enhance efficiency and maintain relevance.

dowidth.com

dowidth.com