Inflation swaps and currency swaps are financial derivatives used to manage different types of risk: inflation swaps hedge against inflation rate fluctuations, while currency swaps mitigate foreign exchange risk between two parties. Inflation swaps involve exchanging fixed payments for inflation-linked payments, whereas currency swaps involve exchanging principal and interest in different currencies. Explore the mechanics and applications of these swaps to optimize your financial risk management strategies.

Why it is important

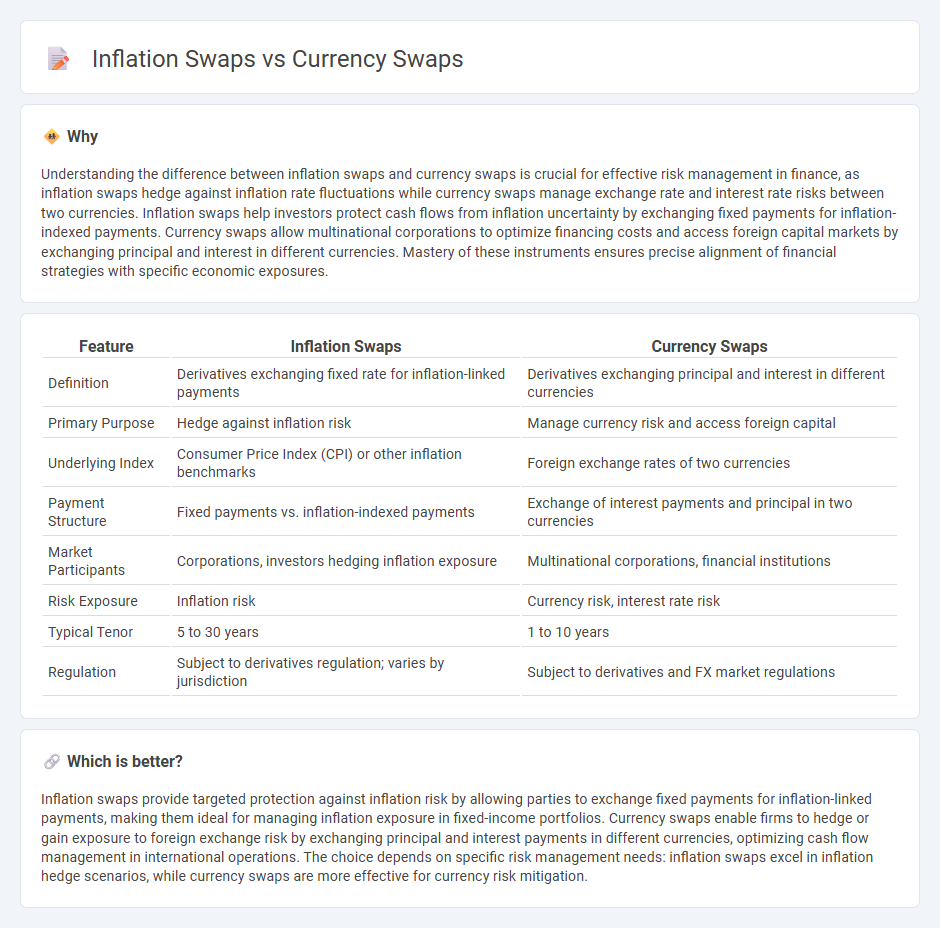

Understanding the difference between inflation swaps and currency swaps is crucial for effective risk management in finance, as inflation swaps hedge against inflation rate fluctuations while currency swaps manage exchange rate and interest rate risks between two currencies. Inflation swaps help investors protect cash flows from inflation uncertainty by exchanging fixed payments for inflation-indexed payments. Currency swaps allow multinational corporations to optimize financing costs and access foreign capital markets by exchanging principal and interest in different currencies. Mastery of these instruments ensures precise alignment of financial strategies with specific economic exposures.

Comparison Table

| Feature | Inflation Swaps | Currency Swaps |

|---|---|---|

| Definition | Derivatives exchanging fixed rate for inflation-linked payments | Derivatives exchanging principal and interest in different currencies |

| Primary Purpose | Hedge against inflation risk | Manage currency risk and access foreign capital |

| Underlying Index | Consumer Price Index (CPI) or other inflation benchmarks | Foreign exchange rates of two currencies |

| Payment Structure | Fixed payments vs. inflation-indexed payments | Exchange of interest payments and principal in two currencies |

| Market Participants | Corporations, investors hedging inflation exposure | Multinational corporations, financial institutions |

| Risk Exposure | Inflation risk | Currency risk, interest rate risk |

| Typical Tenor | 5 to 30 years | 1 to 10 years |

| Regulation | Subject to derivatives regulation; varies by jurisdiction | Subject to derivatives and FX market regulations |

Which is better?

Inflation swaps provide targeted protection against inflation risk by allowing parties to exchange fixed payments for inflation-linked payments, making them ideal for managing inflation exposure in fixed-income portfolios. Currency swaps enable firms to hedge or gain exposure to foreign exchange risk by exchanging principal and interest payments in different currencies, optimizing cash flow management in international operations. The choice depends on specific risk management needs: inflation swaps excel in inflation hedge scenarios, while currency swaps are more effective for currency risk mitigation.

Connection

Inflation swaps and currency swaps are interconnected through their shared purpose of managing financial risks related to fluctuating economic variables such as inflation rates and foreign exchange rates. Both instruments allow investors and institutions to hedge against uncertainty, with inflation swaps focusing on inflation rate exposure and currency swaps addressing exchange rate volatility. By combining these swaps, market participants can effectively mitigate risks arising from cross-border inflation differentials and currency fluctuations simultaneously.

Key Terms

Exchange Rate (Currency Swaps)

Currency swaps involve exchanging principal and interest payments in different currencies, directly impacting exchange rate risk management by locking in rates and protecting against currency fluctuations. Inflation swaps, by contrast, focus on hedging inflation risk without exchanging currencies, making exchange rates irrelevant in their structure. Explore deeper insights into how currency swaps safeguard against exchange rate volatility.

Interest Rate (Inflation Swaps)

Interest rate inflation swaps are derivative contracts exchanging fixed payments for floating payments linked to an inflation index, providing protection against inflation risk. Currency swaps involve exchanging principal and interest payments in different currencies, primarily addressing exchange rate and interest rate risks. Explore more to understand how these swaps optimize hedging strategies in diverse financial environments.

Notional Principal

Currency swaps involve exchanging principal and interest payments in different currencies, with notional principal amounts that may fluctuate based on exchange rate movements, impacting valuation and risk exposure. Inflation swaps use a fixed notional principal amount, where payments are exchanged based on the inflation rate versus a fixed rate, helping parties hedge against inflation risk without exchanging the principal itself. Explore the mechanisms and applications of these swaps to understand their strategic role in financial risk management.

Source and External Links

Currency Swap Contract - Definition, How It Works, Types - A currency swap is a derivative contract between two parties exchanging interest payments and sometimes principal amounts in different currencies to hedge currency exchange risks or obtain favorable borrowing rates.

Currency Swaps Meaning, Types and Examples - Currency swaps are OTC agreements where two parties exchange equivalent principal amounts and interest payments in different currencies, often to borrow at better rates in their home currency.

Central Bank Currency Swaps Tracker - Central bank currency swaps involve one central bank exchanging currency with another at prevailing rates to boost foreign currency reserves and lend domestically, with an agreement to reverse the swap at a future date.

dowidth.com

dowidth.com