Loss harvesting involves strategically selling investments at a loss to offset capital gains and reduce tax liability, maximizing after-tax returns. Tax-efficient fund placement optimizes the allocation of assets across taxable and tax-advantaged accounts to minimize tax impact on investment income and growth. Explore these strategies in depth to enhance portfolio tax management and investment efficiency.

Why it is important

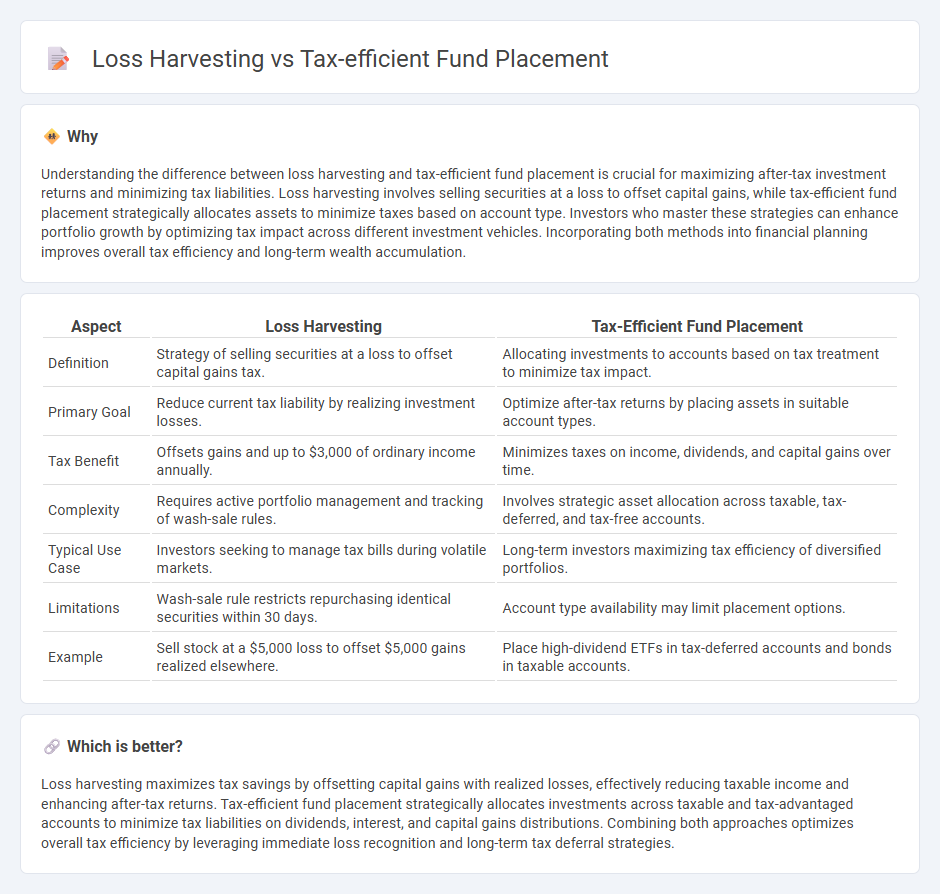

Understanding the difference between loss harvesting and tax-efficient fund placement is crucial for maximizing after-tax investment returns and minimizing tax liabilities. Loss harvesting involves selling securities at a loss to offset capital gains, while tax-efficient fund placement strategically allocates assets to minimize taxes based on account type. Investors who master these strategies can enhance portfolio growth by optimizing tax impact across different investment vehicles. Incorporating both methods into financial planning improves overall tax efficiency and long-term wealth accumulation.

Comparison Table

| Aspect | Loss Harvesting | Tax-Efficient Fund Placement |

|---|---|---|

| Definition | Strategy of selling securities at a loss to offset capital gains tax. | Allocating investments to accounts based on tax treatment to minimize tax impact. |

| Primary Goal | Reduce current tax liability by realizing investment losses. | Optimize after-tax returns by placing assets in suitable account types. |

| Tax Benefit | Offsets gains and up to $3,000 of ordinary income annually. | Minimizes taxes on income, dividends, and capital gains over time. |

| Complexity | Requires active portfolio management and tracking of wash-sale rules. | Involves strategic asset allocation across taxable, tax-deferred, and tax-free accounts. |

| Typical Use Case | Investors seeking to manage tax bills during volatile markets. | Long-term investors maximizing tax efficiency of diversified portfolios. |

| Limitations | Wash-sale rule restricts repurchasing identical securities within 30 days. | Account type availability may limit placement options. |

| Example | Sell stock at a $5,000 loss to offset $5,000 gains realized elsewhere. | Place high-dividend ETFs in tax-deferred accounts and bonds in taxable accounts. |

Which is better?

Loss harvesting maximizes tax savings by offsetting capital gains with realized losses, effectively reducing taxable income and enhancing after-tax returns. Tax-efficient fund placement strategically allocates investments across taxable and tax-advantaged accounts to minimize tax liabilities on dividends, interest, and capital gains distributions. Combining both approaches optimizes overall tax efficiency by leveraging immediate loss recognition and long-term tax deferral strategies.

Connection

Loss harvesting enhances portfolio tax efficiency by strategically selling securities at a loss to offset capital gains, which complements tax-efficient fund placement by allocating assets across taxable and tax-advantaged accounts to minimize tax liabilities. Combining these strategies maximizes after-tax returns by balancing realized losses with optimal asset location, particularly for investments with different tax treatments such as equities and bonds. Implementing loss harvesting alongside tax-efficient fund placement leverages tax code provisions to protect investment gains and improve overall portfolio performance.

Key Terms

Asset Location

Tax-efficient fund placement maximizes after-tax returns by strategically allocating assets between tax-advantaged accounts like IRAs and taxable accounts to exploit differing tax treatments on dividends, interest, and capital gains. Loss harvesting involves selling securities at a loss in taxable accounts to offset capital gains, thereby reducing current tax liability but requires careful monitoring to avoid wash sale rules. Explore further to understand how optimal asset location combined with loss harvesting strategies can significantly enhance portfolio tax efficiency.

Capital Gains

Tax-efficient fund placement strategically allocates investments across taxable and tax-advantaged accounts to minimize capital gains taxes over time. Loss harvesting involves selling securities at a loss to offset realized gains and reduce immediate tax liabilities. Explore these techniques to optimize your investment returns and capitalize on tax-saving opportunities.

Tax-Loss Harvesting

Tax-loss harvesting strategically offsets capital gains by selling investments at a loss, reducing overall taxable income and maximizing after-tax returns. This method contrasts with tax-efficient fund placement, which allocates assets to minimize tax impact but does not actively realize losses for tax benefits. Explore how tax-loss harvesting can enhance your portfolio's tax efficiency and improve long-term wealth management.

Source and External Links

Tax-efficient fund placement (a.k.a. "asset location") - how and why ... - Tax-efficient fund placement, also called asset location, involves strategically placing different asset classes into taxable or tax-advantaged accounts to maximize after-tax returns, based primarily on each asset's tax-efficiency and expected return, especially valuable for high earners managing a holistic portfolio.

Tax-efficient fund placement - Bogleheads - Tax-efficient fund placement minimizes taxes by allocating tax-inefficient investments like bond funds and REITs into tax-advantaged accounts, while more tax-efficient funds such as total market stock index funds are placed in taxable accounts, maximizing tax benefits across multiple account types.

Asset Location Optimization - Tax-Efficient Fund Placement - Effective asset location strategies include holding bonds in tax-deferred accounts, municipal bonds in taxable accounts, and high-return but tax-inefficient assets in tax-protected accounts while maximizing retirement account contributions and considering Roth conversions to optimize tax outcomes.

dowidth.com

dowidth.com