Bucket investing divides assets into different segments based on time horizons and risk tolerance, aiming to manage liquidity and growth simultaneously. Income investing focuses on generating a steady cash flow through dividends, interest, or rental income, prioritizing consistent returns over capital appreciation. Explore these strategies to determine which aligns best with your financial goals and risk appetite.

Why it is important

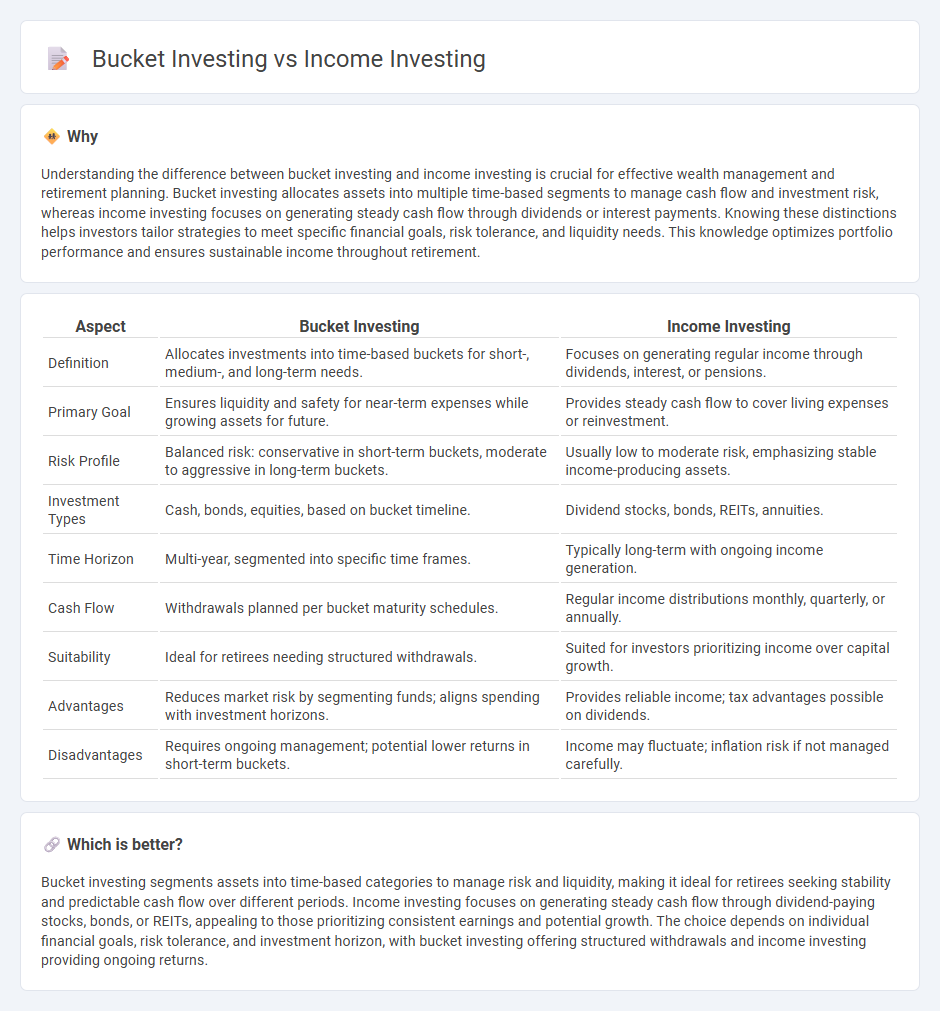

Understanding the difference between bucket investing and income investing is crucial for effective wealth management and retirement planning. Bucket investing allocates assets into multiple time-based segments to manage cash flow and investment risk, whereas income investing focuses on generating steady cash flow through dividends or interest payments. Knowing these distinctions helps investors tailor strategies to meet specific financial goals, risk tolerance, and liquidity needs. This knowledge optimizes portfolio performance and ensures sustainable income throughout retirement.

Comparison Table

| Aspect | Bucket Investing | Income Investing |

|---|---|---|

| Definition | Allocates investments into time-based buckets for short-, medium-, and long-term needs. | Focuses on generating regular income through dividends, interest, or pensions. |

| Primary Goal | Ensures liquidity and safety for near-term expenses while growing assets for future. | Provides steady cash flow to cover living expenses or reinvestment. |

| Risk Profile | Balanced risk: conservative in short-term buckets, moderate to aggressive in long-term buckets. | Usually low to moderate risk, emphasizing stable income-producing assets. |

| Investment Types | Cash, bonds, equities, based on bucket timeline. | Dividend stocks, bonds, REITs, annuities. |

| Time Horizon | Multi-year, segmented into specific time frames. | Typically long-term with ongoing income generation. |

| Cash Flow | Withdrawals planned per bucket maturity schedules. | Regular income distributions monthly, quarterly, or annually. |

| Suitability | Ideal for retirees needing structured withdrawals. | Suited for investors prioritizing income over capital growth. |

| Advantages | Reduces market risk by segmenting funds; aligns spending with investment horizons. | Provides reliable income; tax advantages possible on dividends. |

| Disadvantages | Requires ongoing management; potential lower returns in short-term buckets. | Income may fluctuate; inflation risk if not managed carefully. |

Which is better?

Bucket investing segments assets into time-based categories to manage risk and liquidity, making it ideal for retirees seeking stability and predictable cash flow over different periods. Income investing focuses on generating steady cash flow through dividend-paying stocks, bonds, or REITs, appealing to those prioritizing consistent earnings and potential growth. The choice depends on individual financial goals, risk tolerance, and investment horizon, with bucket investing offering structured withdrawals and income investing providing ongoing returns.

Connection

Bucket investing and income investing are connected through their shared focus on generating steady cash flow to meet an investor's financial needs. Bucket investing segments assets into different time frames to provide both liquidity and growth, aligning well with income investing's goal of producing regular income streams from dividends, interest, or rental payments. This strategic allocation helps balance risk and return while ensuring reliable income for short-term expenses and long-term financial growth.

Key Terms

Dividend Yield

Dividend yield is a crucial metric in income investing, emphasizing stocks that generate regular cash flow through dividends, ideal for investors seeking steady income. Bucket investing segments assets into different categories based on time horizons, balancing dividend-paying stocks with bonds and cash to manage risk and liquidity during varying market conditions. Explore how integrating dividend yield strategies with bucket investing can optimize portfolio stability and income consistency.

Asset Allocation

Income investing emphasizes generating steady cash flow primarily through dividend-paying stocks and bonds, while bucket investing structures asset allocation by dividing investments into time-specific segments to meet short-, medium-, and long-term needs. Efficient asset allocation in income investing balances high-yield securities with stable bonds to maximize income and manage risk, whereas bucket investing allocates assets according to withdrawal timelines, typically placing liquid, low-risk assets in short-term buckets and growth-oriented investments in long-term ones. Discover more about optimizing asset allocation strategies to enhance financial security and income generation.

Withdrawal Strategy

Income investing emphasizes generating steady cash flow through dividends or interest payments, providing consistent income for withdrawals over time. Bucket investing segments assets into different time-based buckets, aligning withdrawal strategies with market conditions to minimize sequence of returns risk. Explore how each withdrawal strategy can enhance portfolio sustainability under varying economic scenarios.

Source and External Links

Income Investing - Overview, Features, Advantages - Income investing is a strategy focused on building a portfolio to generate regular income through dividends, bond yields, and interest payments, typically involving government bonds, dividend-paying stocks, and corporate bonds with varying risk and yield profiles.

Income Investing Playbook 2025: Ideas for a New Rate Cycle - Income investing aims to produce steady cash flow via bonds, dividend-paying stocks, and REITs, with current opportunities due to the normalization of interest rates offering a favorable environment for income-focused portfolios.

Investing for growth, income or both - Income investing involves selecting assets that provide regular payouts such as dividends or interest, with considerations of risk level, income amount, liquidity, and fees critical to designing an income-generating portfolio tailored to investor needs.

dowidth.com

dowidth.com