Dark pool trading facilitates large-scale, private transactions away from public exchanges, reducing market impact and improving anonymity for institutional investors. Alternative Trading Systems (ATS) serve as regulated platforms that match buyers and sellers, offering diverse trading options beyond traditional exchanges while maintaining transparency and compliance. Explore the distinct mechanisms and benefits of dark pools and ATS to enhance your trading strategy knowledge.

Why it is important

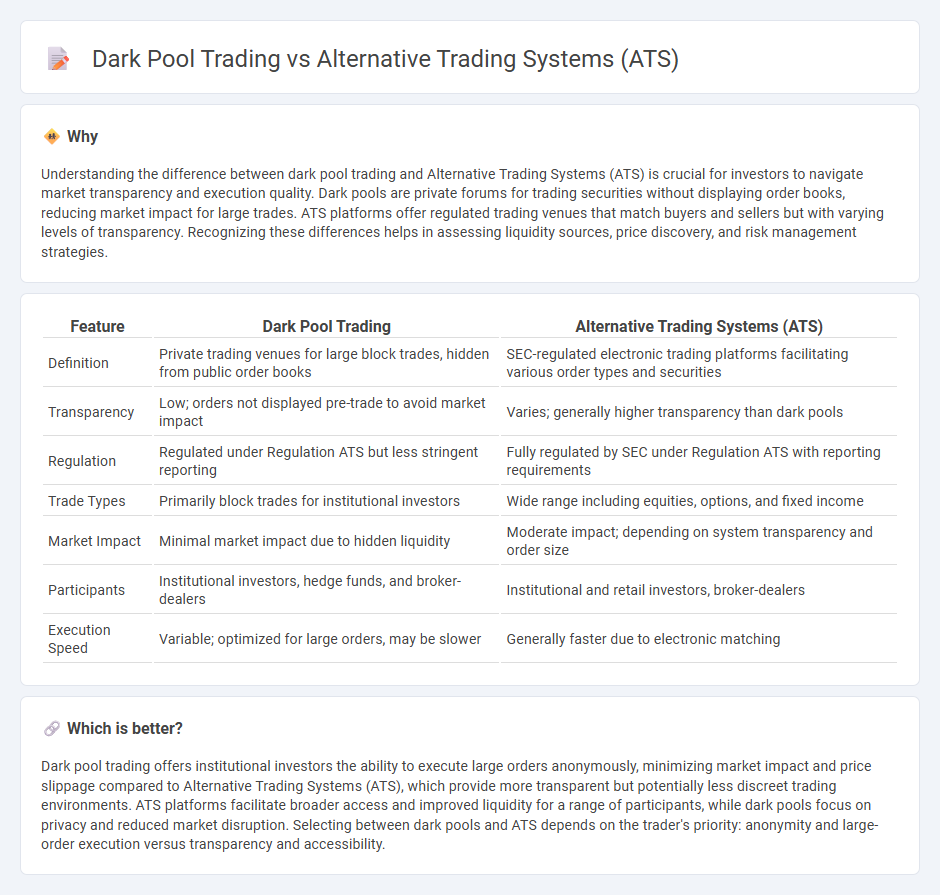

Understanding the difference between dark pool trading and Alternative Trading Systems (ATS) is crucial for investors to navigate market transparency and execution quality. Dark pools are private forums for trading securities without displaying order books, reducing market impact for large trades. ATS platforms offer regulated trading venues that match buyers and sellers but with varying levels of transparency. Recognizing these differences helps in assessing liquidity sources, price discovery, and risk management strategies.

Comparison Table

| Feature | Dark Pool Trading | Alternative Trading Systems (ATS) |

|---|---|---|

| Definition | Private trading venues for large block trades, hidden from public order books | SEC-regulated electronic trading platforms facilitating various order types and securities |

| Transparency | Low; orders not displayed pre-trade to avoid market impact | Varies; generally higher transparency than dark pools |

| Regulation | Regulated under Regulation ATS but less stringent reporting | Fully regulated by SEC under Regulation ATS with reporting requirements |

| Trade Types | Primarily block trades for institutional investors | Wide range including equities, options, and fixed income |

| Market Impact | Minimal market impact due to hidden liquidity | Moderate impact; depending on system transparency and order size |

| Participants | Institutional investors, hedge funds, and broker-dealers | Institutional and retail investors, broker-dealers |

| Execution Speed | Variable; optimized for large orders, may be slower | Generally faster due to electronic matching |

Which is better?

Dark pool trading offers institutional investors the ability to execute large orders anonymously, minimizing market impact and price slippage compared to Alternative Trading Systems (ATS), which provide more transparent but potentially less discreet trading environments. ATS platforms facilitate broader access and improved liquidity for a range of participants, while dark pools focus on privacy and reduced market disruption. Selecting between dark pools and ATS depends on the trader's priority: anonymity and large-order execution versus transparency and accessibility.

Connection

Dark pool trading operates within alternative trading systems (ATS), providing private venues where institutional investors execute large orders without exposing them to public markets. These ATS platforms facilitate increased anonymity and reduced market impact by matching buy and sell orders internally, away from traditional exchanges. The connection between dark pools and ATS is integral, as dark pools represent a subset of ATS focused on minimizing information leakage to preserve trading strategies.

Key Terms

Transparency

Alternative Trading Systems (ATS) operate with a level of transparency by providing pre-trade information such as order size and price, enhancing market visibility for participants. Dark pool trading conceals trade details until after execution, minimizing market impact but reducing pre-trade transparency. Explore how these differing transparency levels influence trading strategies and market fairness.

Liquidity

Alternative Trading Systems (ATS) provide regulated platforms where buyers and sellers execute trades with enhanced transparency and price discovery, contributing significantly to market liquidity. Dark pool trading operates within ATS but allows large block trades to occur anonymously, minimizing market impact while potentially reducing visible liquidity. Explore deeper insights into how ATS and dark pools shape liquidity dynamics in modern financial markets.

Regulation

Alternative Trading Systems (ATS) operate under SEC Regulation ATS, requiring registration and periodic reporting to ensure transparency and investor protection, whereas dark pool trading, often a subset of ATS, features limited pre-trade transparency and operates under exemptions that reduce disclosure obligations. ATS must comply with stringent rules on market access, best execution, and surveillance, while dark pools are scrutinized for potential market abuse due to their opaque nature. Explore further to understand how regulatory frameworks impact trading efficiency and market fairness within these venues.

Source and External Links

Alternative trading system - Wikipedia - An Alternative Trading System (ATS) is a US and Canadian regulatory term for a non-exchange trading venue that matches buyers and sellers for transactions, regulated as broker-dealers rather than exchanges, and serves as an important alternative to traditional stock exchanges, often used for trading large blocks of shares electronically or otherwise.

Alternative Trading System (ATS) - Definition, Examples - ATSs are trading venues that match buyers and sellers, registered as broker-dealers instead of exchanges, important for professional traders to avoid market price distortion since they operate away from public exchange order books; examples include dark pools, electronic communication networks (ECNs), crossing networks, and call markets.

Alternative Trading System (ATS) Regulation and Requirements - Various types of ATSs include dark pools (anonymous large block trading), ECNs (automated order matching), crossing networks (trades at set times/prices), broker-dealers' internal systems, and call markets, each catering to specific market needs by providing private or specialized trade execution.

dowidth.com

dowidth.com