Buy Now Pay Later (BNPL) offers consumers instant purchase with deferred payment, often interest-free over short terms, enhancing purchasing power and cash flow flexibility. In contrast, Layaway plans require full payment before receiving the product, typically without interest, appealing to budget-conscious shoppers avoiding debt. Explore the key differences and benefits of BNPL versus Layaway to make informed financial decisions.

Why it is important

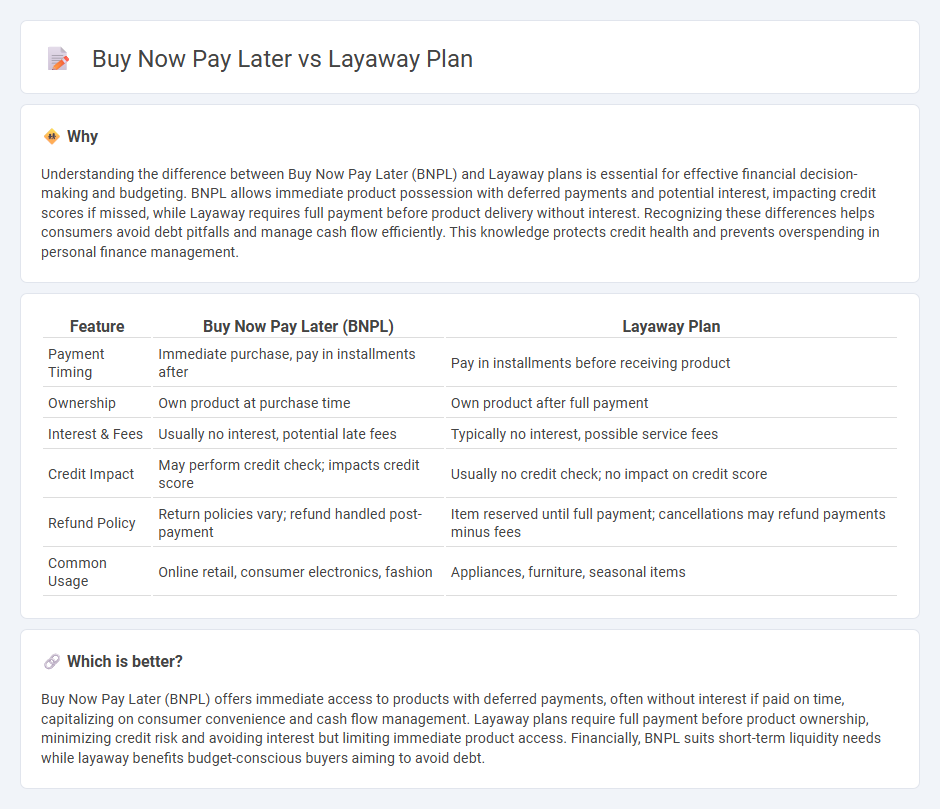

Understanding the difference between Buy Now Pay Later (BNPL) and Layaway plans is essential for effective financial decision-making and budgeting. BNPL allows immediate product possession with deferred payments and potential interest, impacting credit scores if missed, while Layaway requires full payment before product delivery without interest. Recognizing these differences helps consumers avoid debt pitfalls and manage cash flow efficiently. This knowledge protects credit health and prevents overspending in personal finance management.

Comparison Table

| Feature | Buy Now Pay Later (BNPL) | Layaway Plan |

|---|---|---|

| Payment Timing | Immediate purchase, pay in installments after | Pay in installments before receiving product |

| Ownership | Own product at purchase time | Own product after full payment |

| Interest & Fees | Usually no interest, potential late fees | Typically no interest, possible service fees |

| Credit Impact | May perform credit check; impacts credit score | Usually no credit check; no impact on credit score |

| Refund Policy | Return policies vary; refund handled post-payment | Item reserved until full payment; cancellations may refund payments minus fees |

| Common Usage | Online retail, consumer electronics, fashion | Appliances, furniture, seasonal items |

Which is better?

Buy Now Pay Later (BNPL) offers immediate access to products with deferred payments, often without interest if paid on time, capitalizing on consumer convenience and cash flow management. Layaway plans require full payment before product ownership, minimizing credit risk and avoiding interest but limiting immediate product access. Financially, BNPL suits short-term liquidity needs while layaway benefits budget-conscious buyers aiming to avoid debt.

Connection

Buy Now Pay Later (BNPL) and Layaway plans both provide consumers with flexible financing options for purchasing goods without immediate full payment. BNPL allows customers to receive products upfront and repay in installments over time, while Layaway requires payments before product release, securing the item until fully paid. Both methods enhance purchasing power by spreading costs, targeting budget-conscious shoppers and driving retail sales growth.

Key Terms

Deferred Payment

Layaway plans require customers to pay the full price of an item in installments before receiving the product, ensuring no debt is accrued. Buy now pay later (BNPL) services allow immediate possession of goods with payments deferred over time, often involving interest or fees if payments are late. Explore the benefits and risks of deferred payment options to make informed purchasing decisions.

Interest Charges

Layaway plans typically require paying the full purchase amount before receiving the product, often without interest charges, making it a budget-friendly option for those avoiding debt. Buy Now Pay Later services offer immediate access to items with scheduled payments but frequently involve interest or late fees if payments are missed. Explore detailed comparisons to understand how interest impacts your total cost in both payment methods.

Ownership Transfer

Layaway plans require full payment before ownership and possession of the item transfer to the buyer, ensuring the product is reserved but not immediately taken home. Buy Now Pay Later (BNPL) allows instant ownership and use of the item while spreading payments over time, often with minimal or no upfront cost. Explore the detailed differences in ownership transfer and financial implications to choose the best option for your purchase needs.

Source and External Links

What is layaway? Top 5 stores that offer a layaway program - Layaway is a payment plan where a customer puts down a deposit to reserve an item, pays it off in scheduled installments, and picks it up when fully paid, often with a small service fee involved.

Layaway - Wikipedia - Layaway is a purchase agreement where the seller holds an item until the consumer completes payment; no interest is charged, but the buyer only receives the item after full payment, with possible fees for holding the item.

What Is Layaway and How Does It Work? - Capital One - Layaway allows customers to reserve merchandise with a deposit, pay the remainder over time in installments, and take home the item once fully paid, serving as an alternative to credit for managing large purchases.

dowidth.com

dowidth.com