Buy Now Pay Later (BNPL) integration offers consumers flexible installment payment options at checkout, increasing average order values and conversion rates for merchants. Mobile payment integration provides seamless, secure transactions through digital wallets and contactless methods, enhancing user convenience and accelerating the payment process. Explore how each payment solution can transform your business's financial workflow and customer experience.

Why it is important

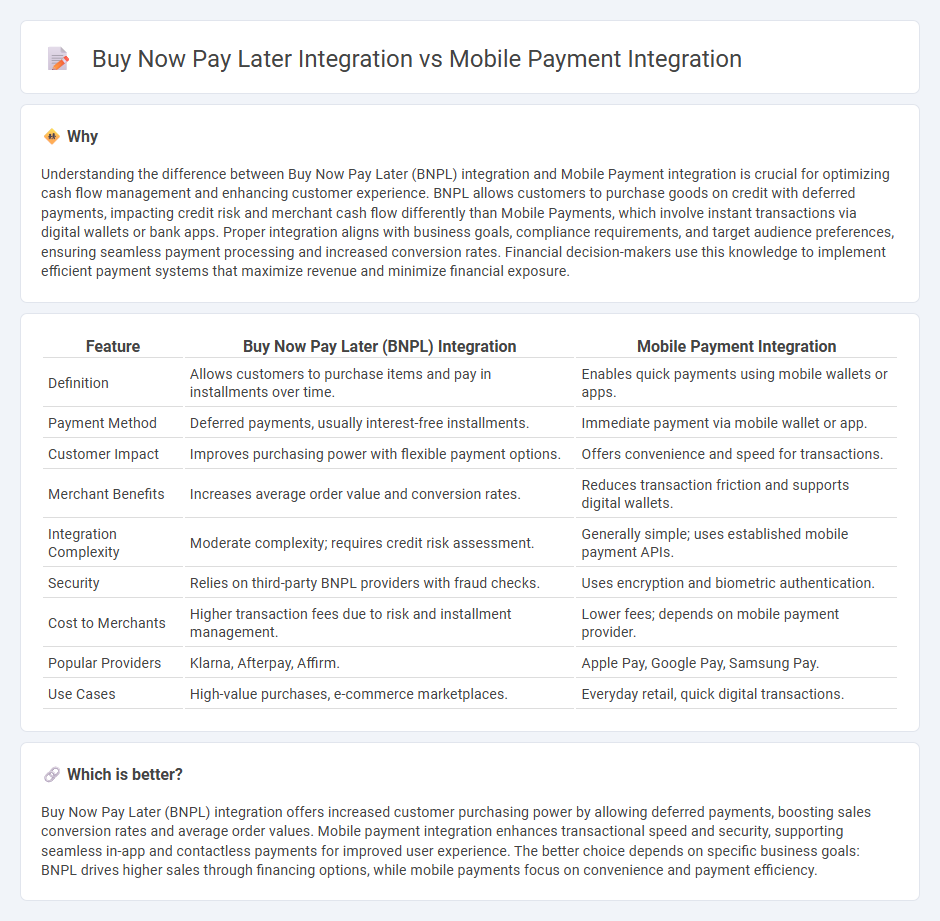

Understanding the difference between Buy Now Pay Later (BNPL) integration and Mobile Payment integration is crucial for optimizing cash flow management and enhancing customer experience. BNPL allows customers to purchase goods on credit with deferred payments, impacting credit risk and merchant cash flow differently than Mobile Payments, which involve instant transactions via digital wallets or bank apps. Proper integration aligns with business goals, compliance requirements, and target audience preferences, ensuring seamless payment processing and increased conversion rates. Financial decision-makers use this knowledge to implement efficient payment systems that maximize revenue and minimize financial exposure.

Comparison Table

| Feature | Buy Now Pay Later (BNPL) Integration | Mobile Payment Integration |

|---|---|---|

| Definition | Allows customers to purchase items and pay in installments over time. | Enables quick payments using mobile wallets or apps. |

| Payment Method | Deferred payments, usually interest-free installments. | Immediate payment via mobile wallet or app. |

| Customer Impact | Improves purchasing power with flexible payment options. | Offers convenience and speed for transactions. |

| Merchant Benefits | Increases average order value and conversion rates. | Reduces transaction friction and supports digital wallets. |

| Integration Complexity | Moderate complexity; requires credit risk assessment. | Generally simple; uses established mobile payment APIs. |

| Security | Relies on third-party BNPL providers with fraud checks. | Uses encryption and biometric authentication. |

| Cost to Merchants | Higher transaction fees due to risk and installment management. | Lower fees; depends on mobile payment provider. |

| Popular Providers | Klarna, Afterpay, Affirm. | Apple Pay, Google Pay, Samsung Pay. |

| Use Cases | High-value purchases, e-commerce marketplaces. | Everyday retail, quick digital transactions. |

Which is better?

Buy Now Pay Later (BNPL) integration offers increased customer purchasing power by allowing deferred payments, boosting sales conversion rates and average order values. Mobile payment integration enhances transactional speed and security, supporting seamless in-app and contactless payments for improved user experience. The better choice depends on specific business goals: BNPL drives higher sales through financing options, while mobile payments focus on convenience and payment efficiency.

Connection

Buy Now Pay Later (BNPL) integration enhances mobile payment systems by providing flexible financing options directly at checkout, increasing conversion rates and average order values. Mobile payment integration streamlines the user experience by allowing seamless access to BNPL services through digital wallets and payment apps. This synergy supports consumer convenience and drives growth in digital commerce by merging instant payment methods with deferred payment solutions.

Key Terms

**Mobile payment integration:**

Mobile payment integration streamlines transactions by enabling instant payments via smartphones, supporting popular platforms like Apple Pay, Google Wallet, and Samsung Pay. This integration enhances user experience, boosts conversion rates, and improves security with tokenization and biometric authentication. Discover more about how mobile payment solutions can transform your digital commerce strategy.

Digital Wallets

Digital wallets streamline mobile payment integration by enabling contactless transactions, enhancing user convenience, and improving security through tokenization and biometric authentication. Buy Now Pay Later (BNPL) integration appeals to consumers by offering flexible installment payment options directly within digital wallets, increasing average order value and reducing cart abandonment rates. Explore more about optimizing your digital wallet strategy by balancing mobile payment and BNPL features for maximum customer engagement and revenue growth.

NFC (Near Field Communication)

NFC-based mobile payment integration offers instant contactless transactions through smartphones and wearables, enhancing user convenience and security with tokenization and biometric authentication. Buy Now Pay Later (BNPL) integration, while not directly leveraging NFC technology, complements mobile payments by providing flexible financing options at checkout, boosting conversion rates and average order values. Explore further to understand how combining NFC payments with BNPL solutions can optimize your payment ecosystem and customer experience.

Source and External Links

Build an in-app payments integration - Stripe Documentation - Stripe offers a Mobile Payment Element for iOS, Android, and React Native apps, supporting both a prebuilt Payment Sheet and a customizable Embedded Element, allowing easy integration of one-time and recurring payments with extensive UI customization and global payment support.

What is mobile payment technology? What businesses need to know - Mobile payment technology uses digital wallets like Apple Pay or Google Pay, which securely store payment methods and use tokenization and biometric authentication to enable secure fund transfers via NFC, QR codes, or Bluetooth for mobile payment transactions.

Understanding Your Payment Gateway Integration For Mobile - Integrating a payment gateway into a mobile app involves setting up a merchant account, embedding a Drop-in UI with client tokens, implementing provided code snippets, thoroughly testing, and launching the app to handle real-time payment processing securely.

dowidth.com

dowidth.com