Perpetual futures allow traders to hold positions indefinitely without an expiration date, offering flexibility in managing market exposure. Leveraged tokens provide built-in leverage through tokenized assets, enabling amplified gains or losses without the need for margin maintenance. Explore detailed comparisons to understand how each instrument suits different trading strategies in the finance market.

Why it is important

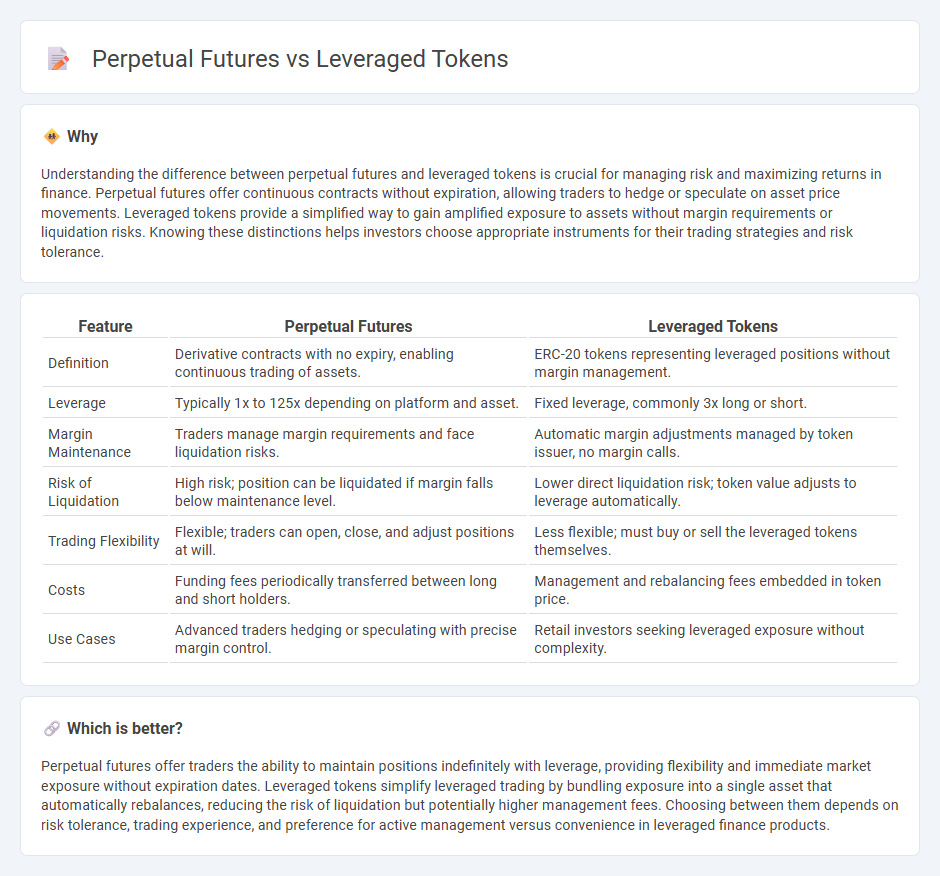

Understanding the difference between perpetual futures and leveraged tokens is crucial for managing risk and maximizing returns in finance. Perpetual futures offer continuous contracts without expiration, allowing traders to hedge or speculate on asset price movements. Leveraged tokens provide a simplified way to gain amplified exposure to assets without margin requirements or liquidation risks. Knowing these distinctions helps investors choose appropriate instruments for their trading strategies and risk tolerance.

Comparison Table

| Feature | Perpetual Futures | Leveraged Tokens |

|---|---|---|

| Definition | Derivative contracts with no expiry, enabling continuous trading of assets. | ERC-20 tokens representing leveraged positions without margin management. |

| Leverage | Typically 1x to 125x depending on platform and asset. | Fixed leverage, commonly 3x long or short. |

| Margin Maintenance | Traders manage margin requirements and face liquidation risks. | Automatic margin adjustments managed by token issuer, no margin calls. |

| Risk of Liquidation | High risk; position can be liquidated if margin falls below maintenance level. | Lower direct liquidation risk; token value adjusts to leverage automatically. |

| Trading Flexibility | Flexible; traders can open, close, and adjust positions at will. | Less flexible; must buy or sell the leveraged tokens themselves. |

| Costs | Funding fees periodically transferred between long and short holders. | Management and rebalancing fees embedded in token price. |

| Use Cases | Advanced traders hedging or speculating with precise margin control. | Retail investors seeking leveraged exposure without complexity. |

Which is better?

Perpetual futures offer traders the ability to maintain positions indefinitely with leverage, providing flexibility and immediate market exposure without expiration dates. Leveraged tokens simplify leveraged trading by bundling exposure into a single asset that automatically rebalances, reducing the risk of liquidation but potentially higher management fees. Choosing between them depends on risk tolerance, trading experience, and preference for active management versus convenience in leveraged finance products.

Connection

Perpetual futures and leveraged tokens are interconnected through their shared function of enabling traders to amplify exposure to underlying assets without owning them outright. Both instruments use leverage to magnify potential returns and risks, with perpetual futures offering continuous contracts and leveraged tokens bundling this exposure into easily tradable assets. This connection enhances market liquidity and provides diverse strategies for speculative trading and hedging within the finance ecosystem.

Key Terms

Leverage

Leveraged tokens and perpetual futures both offer traders enhanced exposure to asset price movements by using leverage, but they differ in structure and risk management. Leveraged tokens provide a fixed leverage ratio, typically ranging from 2x to 3x, and automatically rebalance daily to maintain this target, minimizing liquidation risk. Explore more to understand which leveraged instrument suits your trading strategy.

Liquidation

Leveraged tokens offer built-in leveraged exposure without the risk of margin liquidation, as they automatically rebalance to maintain target leverage levels, contrasting with perpetual futures that require margin maintenance and face liquidation when margin falls below maintenance margin. Perpetual futures users must actively manage positions to avoid liquidation, which can result in forced closing of positions and loss of collateral. Explore the differences further to understand which trading instrument aligns with your risk management strategy and investment goals.

Funding Rate

Leveraged tokens offer a fixed exposure without the need to manage margin or funding rates, while perpetual futures require continuous funding rate payments that can fluctuate based on market demand. The funding rate in perpetual futures acts as a periodic fee exchanged between longs and shorts to maintain price parity with the underlying asset, often impacting trader profitability. Explore the intricacies of funding rates and leveraged products to optimize your trading strategy.

Source and External Links

What is a Leveraged Token? - Coincall - Leveraged tokens are crypto tokens with built-in leverage that allow users to amplify returns on an underlying asset (e.g., BTC) by a fixed ratio (such as 3x) without the risk of liquidation, as they represent perpetual contract positions and can be traded or redeemed anytime without margin requirements.

Leveraged Tokens Explained: A Comprehensive Guide for Crypto ... - Leveraged tokens provide amplified exposure to cryptocurrency price movements without margin trading complexities or liquidation risks, offering a simpler alternative to traditional leveraged trading by using a basket of perpetual contracts to track the underlying asset.

Leveraged Tokens - Binance Academy - Leveraged tokens are derivatives that allow traders to gain leveraged long or short exposure to cryptocurrencies without managing margin, using algorithms to automatically adjust leverage based on price changes, though they carry high volatility and risk.

dowidth.com

dowidth.com