Decentralized Autonomous Organization (DAO) treasuries operate on blockchain technology, enabling transparent, community-governed fund management without centralized control, whereas charitable foundation funds rely on traditional legal structures and centralized trusteeship for oversight and disbursal of donations. DAO treasuries utilize smart contracts to automate financial decisions and allocations, enhancing efficiency and reducing administrative costs compared to conventional charitable funds that often face regulatory compliance and reporting challenges. Explore the evolving dynamics between DAO treasuries and charitable foundation funds to understand their impact on finance and philanthropy.

Why it is important

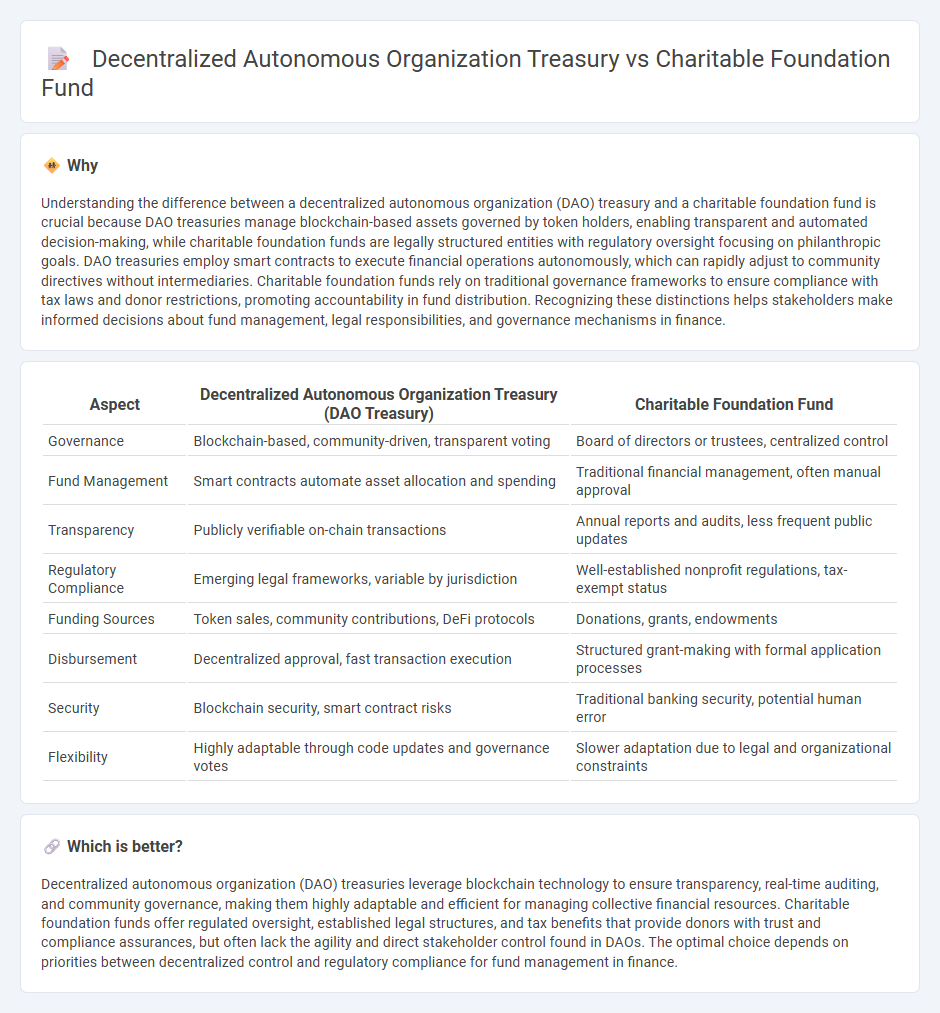

Understanding the difference between a decentralized autonomous organization (DAO) treasury and a charitable foundation fund is crucial because DAO treasuries manage blockchain-based assets governed by token holders, enabling transparent and automated decision-making, while charitable foundation funds are legally structured entities with regulatory oversight focusing on philanthropic goals. DAO treasuries employ smart contracts to execute financial operations autonomously, which can rapidly adjust to community directives without intermediaries. Charitable foundation funds rely on traditional governance frameworks to ensure compliance with tax laws and donor restrictions, promoting accountability in fund distribution. Recognizing these distinctions helps stakeholders make informed decisions about fund management, legal responsibilities, and governance mechanisms in finance.

Comparison Table

| Aspect | Decentralized Autonomous Organization Treasury (DAO Treasury) | Charitable Foundation Fund |

|---|---|---|

| Governance | Blockchain-based, community-driven, transparent voting | Board of directors or trustees, centralized control |

| Fund Management | Smart contracts automate asset allocation and spending | Traditional financial management, often manual approval |

| Transparency | Publicly verifiable on-chain transactions | Annual reports and audits, less frequent public updates |

| Regulatory Compliance | Emerging legal frameworks, variable by jurisdiction | Well-established nonprofit regulations, tax-exempt status |

| Funding Sources | Token sales, community contributions, DeFi protocols | Donations, grants, endowments |

| Disbursement | Decentralized approval, fast transaction execution | Structured grant-making with formal application processes |

| Security | Blockchain security, smart contract risks | Traditional banking security, potential human error |

| Flexibility | Highly adaptable through code updates and governance votes | Slower adaptation due to legal and organizational constraints |

Which is better?

Decentralized autonomous organization (DAO) treasuries leverage blockchain technology to ensure transparency, real-time auditing, and community governance, making them highly adaptable and efficient for managing collective financial resources. Charitable foundation funds offer regulated oversight, established legal structures, and tax benefits that provide donors with trust and compliance assurances, but often lack the agility and direct stakeholder control found in DAOs. The optimal choice depends on priorities between decentralized control and regulatory compliance for fund management in finance.

Connection

Decentralized Autonomous Organization (DAO) treasuries and charitable foundation funds both utilize blockchain technology to enhance transparency and accountability in managing resources. DAO treasuries often allocate funds through community voting mechanisms, which can be directed towards charitable foundations to support social impact projects. This integration fosters decentralized philanthropy, enabling secure, traceable, and efficient distribution of donations aligned with donor intentions.

Key Terms

Governance Structure

A charitable foundation fund typically operates under a hierarchical governance structure with a board of trustees or directors responsible for decision-making and oversight, ensuring compliance with legal and regulatory requirements while managing donations and grants. In contrast, a decentralized autonomous organization (DAO) treasury is governed by token holders through smart contracts on a blockchain, enabling transparent, democratic control over fund allocations and financial decisions without centralized intermediaries. Explore the differences in governance frameworks and their impact on accountability and transparency within these financial entities.

Transparency

Charitable foundation funds typically operate with centralized oversight, maintaining clear audit trails and regulatory compliance that enhance transparency for donors and stakeholders. In contrast, decentralized autonomous organization (DAO) treasuries leverage blockchain technology, providing immutable transaction records and global accessibility, which can increase trust through decentralized governance. Explore how these distinct transparency models impact trust and efficiency in philanthropic funding.

Fund Allocation

Charitable foundation funds typically allocate resources through centralized decision-making by a board of trustees, ensuring targeted support for specific causes with transparency and legal oversight. In contrast, decentralized autonomous organization (DAO) treasuries distribute funds via community voting mechanisms, enabling broader participation and dynamic allocation based on collective priorities encoded in smart contracts. Explore how these differing fund allocation models impact transparency, efficiency, and stakeholder engagement.

Source and External Links

What is a Private Foundation? - A private foundation is a charitable organization typically established by an individual, family, or corporation to support charitable activities, governed by a board, and subject to specific IRS regulations and tax laws distinct from public charities.

What is a Private Foundation - A private foundation is an independent legal entity set up for charitable purposes, usually funded by one source like an individual or family, allowing control over mission, board, investments, and grantmaking, often designed to perpetuate charitable giving across generations.

What is a Private Family Foundation? - A private family foundation is a type of private foundation funded and run by family members to manage a legacy of giving, offer tax benefits, and conduct charitable grantmaking with a requirement to distribute at least 5% of assets annually.

dowidth.com

dowidth.com