Dim sum bonds are yuan-denominated bonds issued outside mainland China, primarily in Hong Kong, appealing to investors seeking exposure to Chinese currency risk and growth. Global bonds, on the other hand, are debt securities issued in various currencies across international markets, offering broader diversification and liquidity. Explore the key differences and investment opportunities between dim sum and global bonds to enhance your financial strategy.

Why it is important

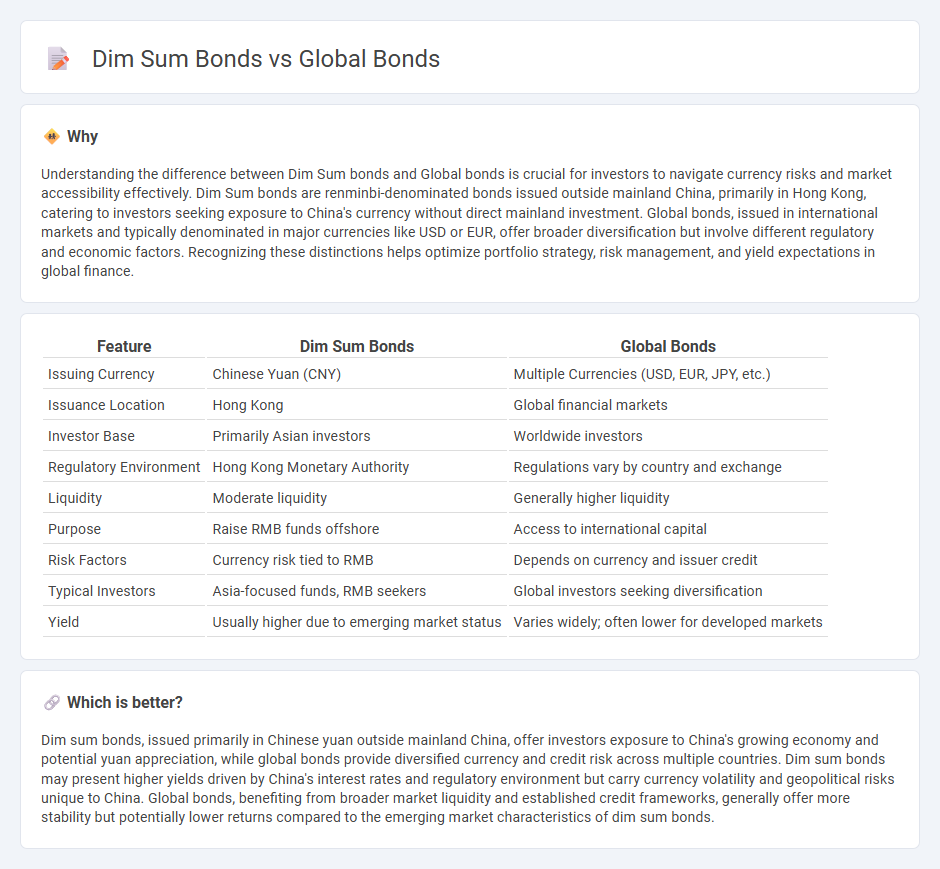

Understanding the difference between Dim Sum bonds and Global bonds is crucial for investors to navigate currency risks and market accessibility effectively. Dim Sum bonds are renminbi-denominated bonds issued outside mainland China, primarily in Hong Kong, catering to investors seeking exposure to China's currency without direct mainland investment. Global bonds, issued in international markets and typically denominated in major currencies like USD or EUR, offer broader diversification but involve different regulatory and economic factors. Recognizing these distinctions helps optimize portfolio strategy, risk management, and yield expectations in global finance.

Comparison Table

| Feature | Dim Sum Bonds | Global Bonds |

|---|---|---|

| Issuing Currency | Chinese Yuan (CNY) | Multiple Currencies (USD, EUR, JPY, etc.) |

| Issuance Location | Hong Kong | Global financial markets |

| Investor Base | Primarily Asian investors | Worldwide investors |

| Regulatory Environment | Hong Kong Monetary Authority | Regulations vary by country and exchange |

| Liquidity | Moderate liquidity | Generally higher liquidity |

| Purpose | Raise RMB funds offshore | Access to international capital |

| Risk Factors | Currency risk tied to RMB | Depends on currency and issuer credit |

| Typical Investors | Asia-focused funds, RMB seekers | Global investors seeking diversification |

| Yield | Usually higher due to emerging market status | Varies widely; often lower for developed markets |

Which is better?

Dim sum bonds, issued primarily in Chinese yuan outside mainland China, offer investors exposure to China's growing economy and potential yuan appreciation, while global bonds provide diversified currency and credit risk across multiple countries. Dim sum bonds may present higher yields driven by China's interest rates and regulatory environment but carry currency volatility and geopolitical risks unique to China. Global bonds, benefiting from broader market liquidity and established credit frameworks, generally offer more stability but potentially lower returns compared to the emerging market characteristics of dim sum bonds.

Connection

Dim sum bonds are a subset of global bonds issued outside the issuer's domestic market, specifically denominated in Chinese yuan and primarily traded in Hong Kong. Both dim sum bonds and global bonds allow investors to diversify currency exposure and access international capital markets. The connection lies in their role as tools for global financing, with dim sum bonds expanding global bond offerings by providing yuan-denominated investment opportunities.

Key Terms

Currency Risk

Global bonds are typically issued in major currencies like the US dollar or euro, exposing investors to foreign exchange fluctuations that can impact returns. Dim sum bonds are RMB-denominated bonds issued outside mainland China, subjecting investors to China's currency policies and potential yuan volatility. Explore the nuances of currency risk management in global and dim sum bonds for strategic investment decisions.

Issuer Location

Global bonds are issued by entities worldwide and typically traded in major financial markets like London, New York, or Tokyo. Dim sum bonds, by contrast, are renminbi-denominated bonds issued outside China, primarily in Hong Kong, allowing foreign investors to access Chinese currency exposure without direct market entry. Explore more to understand the distinct issuer locations and market dynamics influencing these bond types.

Regulatory Environment

Global bonds are governed by international regulatory frameworks such as the U.S. SEC and EU financial authorities, ensuring broad market transparency and investor protection. Dim sum bonds, issued in the Chinese yuan outside mainland China, operate under China's regulatory environment, which includes specific restrictions on currency convertibility and regulatory approvals by the People's Bank of China and State Administration of Foreign Exchange. Explore the key regulatory differences influencing investment strategies and risk management in these bond markets.

Source and External Links

Global bond - Wikipedia - A global bond is issued simultaneously in multiple countries, typically by a large multinational or sovereign entity, denominated in non-native currencies, allowing access to a broad investor base and reducing borrowing costs.

Benchmark & Global Bonds - World Bank Treasury - World Bank global bonds offer high credit quality, liquidity, and are available in large issuances with maturities from 2 to 30 years, mainly in USD or Euro, cleared through major international systems.

Global bonds: Four key drivers of outperformance - Vanguard - Investing in global bonds provides diversification, potential higher yields, access to multiple markets and currencies, and risk premia without necessarily increasing credit or duration risk.

dowidth.com

dowidth.com