Liquidity staking enhances asset utility by locking tokens to support network security, offering passive rewards with lower risk compared to traditional staking. Liquidity mining involves providing assets to decentralized exchanges or protocols, earning higher yields through trading fees and incentive tokens but carrying increased impermanent loss risk. Explore the detailed mechanics and benefits to optimize your decentralized finance strategies.

Why it is important

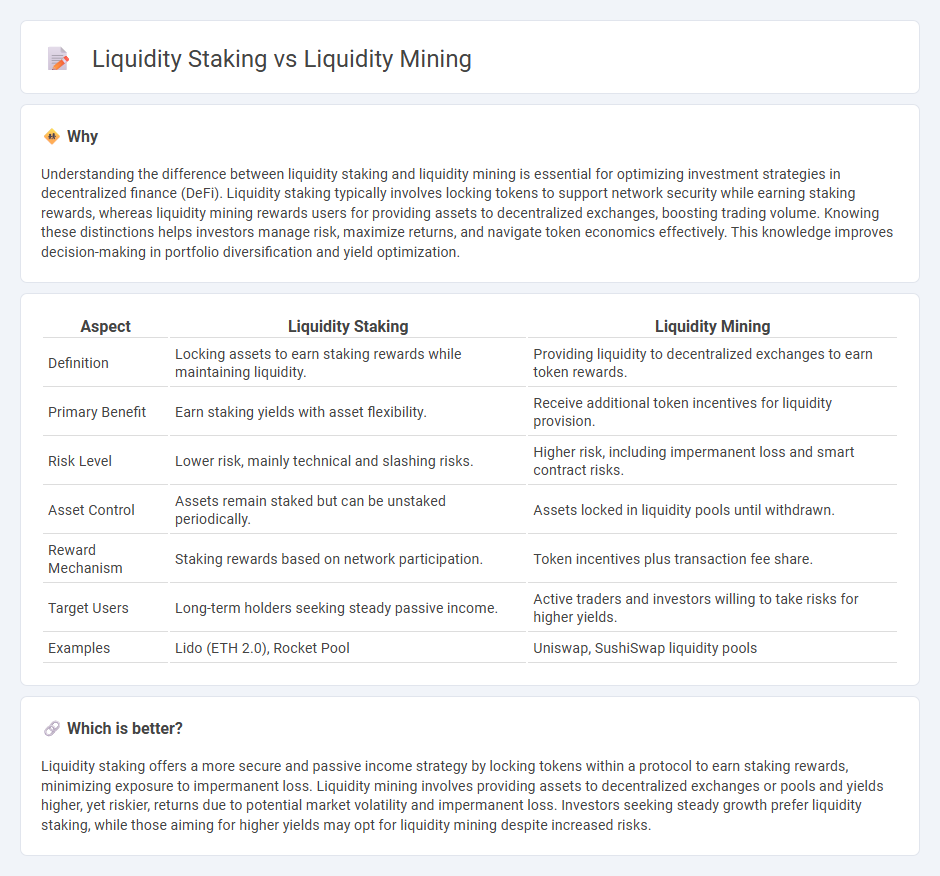

Understanding the difference between liquidity staking and liquidity mining is essential for optimizing investment strategies in decentralized finance (DeFi). Liquidity staking typically involves locking tokens to support network security while earning staking rewards, whereas liquidity mining rewards users for providing assets to decentralized exchanges, boosting trading volume. Knowing these distinctions helps investors manage risk, maximize returns, and navigate token economics effectively. This knowledge improves decision-making in portfolio diversification and yield optimization.

Comparison Table

| Aspect | Liquidity Staking | Liquidity Mining |

|---|---|---|

| Definition | Locking assets to earn staking rewards while maintaining liquidity. | Providing liquidity to decentralized exchanges to earn token rewards. |

| Primary Benefit | Earn staking yields with asset flexibility. | Receive additional token incentives for liquidity provision. |

| Risk Level | Lower risk, mainly technical and slashing risks. | Higher risk, including impermanent loss and smart contract risks. |

| Asset Control | Assets remain staked but can be unstaked periodically. | Assets locked in liquidity pools until withdrawn. |

| Reward Mechanism | Staking rewards based on network participation. | Token incentives plus transaction fee share. |

| Target Users | Long-term holders seeking steady passive income. | Active traders and investors willing to take risks for higher yields. |

| Examples | Lido (ETH 2.0), Rocket Pool | Uniswap, SushiSwap liquidity pools |

Which is better?

Liquidity staking offers a more secure and passive income strategy by locking tokens within a protocol to earn staking rewards, minimizing exposure to impermanent loss. Liquidity mining involves providing assets to decentralized exchanges or pools and yields higher, yet riskier, returns due to potential market volatility and impermanent loss. Investors seeking steady growth prefer liquidity staking, while those aiming for higher yields may opt for liquidity mining despite increased risks.

Connection

Liquidity staking and liquidity mining are interconnected strategies within decentralized finance (DeFi) that enhance market participation and yield generation. Liquidity staking involves locking digital assets in a protocol to support network security while earning rewards, whereas liquidity mining incentivizes providing liquidity to decentralized exchanges through token rewards. Both mechanisms boost asset utilization and contribute to improved liquidity pools, driving efficient capital allocation and higher returns for investors.

Key Terms

Yield

Liquidity mining and liquidity staking both maximize yield by incentivizing users to provide liquidity, but liquidity mining typically offers higher, more variable rewards through native tokens, while liquidity staking emphasizes steady, protocol-based returns. Liquidity mining involves active participation in decentralized exchanges, often yielding governance tokens that can appreciate, whereas liquidity staking locks tokens in a protocol to earn predictable interest or rewards. Explore detailed comparisons to decide which yield strategy aligns best with your investment goals.

Liquidity Pool

Liquidity mining involves providing assets to a liquidity pool and earning rewards, usually in the form of governance tokens, as an incentive for enhancing decentralized finance (DeFi) platform liquidity. Liquidity staking focuses on locking up tokens within a liquidity pool to support network security and consensus mechanisms, earning staking rewards instead of swapping fees or tokens. Explore our detailed comparison to understand how liquidity pools power DeFi ecosystems and maximize your asset growth.

Staking Rewards

Liquidity mining involves providing assets to a decentralized exchange to earn trading fee rewards and native tokens, boosting overall network liquidity and user engagement. Liquidity staking, on the other hand, focuses on locking tokens in a staking protocol to receive rewards often tied to security or governance, with Staking Rewards emphasizing the yield potential and risk profile of different staking opportunities. Explore further to understand how these methods maximize returns and impact decentralized finance ecosystems.

Source and External Links

Staking vs Yield Farming vs Liquidity Mining - Blockchain Council - Liquidity mining is a DeFi process where users provide liquidity to decentralized exchanges (DEXs) and earn rewards in the platform's own tokens plus transaction fees, helping bootstrap liquidity and facilitate trading without centralized intermediaries.

Liquidity Mining - What It Means and How It Works? - Token Metrics - Liquidity mining allows investors to earn cryptocurrency rewards by lending tokens to decentralized platforms or exchanges, generating passive income and boosting token liquidity by facilitating trading activity.

What is Yield Farming and Liquidity Mining in DeFi? - Openware - Liquidity mining specifically involves providing assets to DEX liquidity pools to earn trading fees and incentive tokens, acting as a market maker to ensure smooth trading, and is closely related yet distinctive from broader yield farming strategies.

dowidth.com

dowidth.com