Latency arbitrage exploits time delays in market data transmission, allowing traders to capitalize on price differences between geographically dispersed exchanges. Triangular arbitrage involves taking advantage of discrepancies between three currency pairs within the foreign exchange market to generate risk-free profits. Explore more to understand how these sophisticated strategies impact modern trading efficiency.

Why it is important

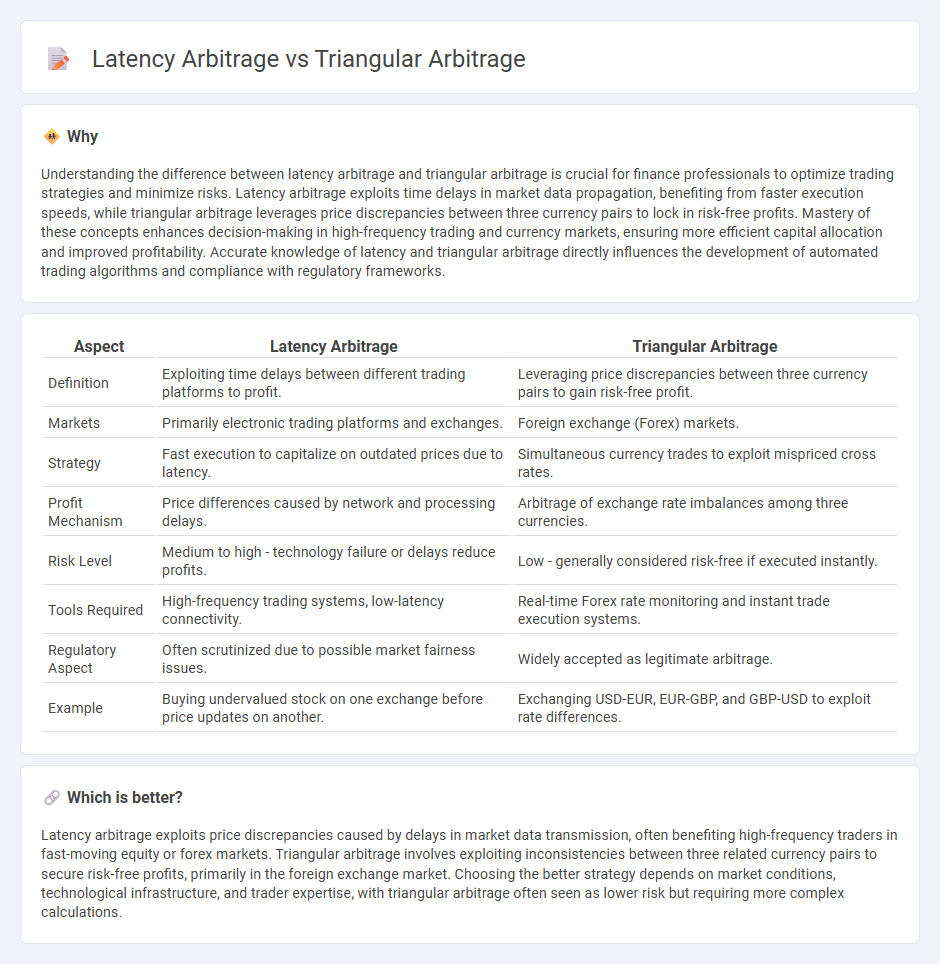

Understanding the difference between latency arbitrage and triangular arbitrage is crucial for finance professionals to optimize trading strategies and minimize risks. Latency arbitrage exploits time delays in market data propagation, benefiting from faster execution speeds, while triangular arbitrage leverages price discrepancies between three currency pairs to lock in risk-free profits. Mastery of these concepts enhances decision-making in high-frequency trading and currency markets, ensuring more efficient capital allocation and improved profitability. Accurate knowledge of latency and triangular arbitrage directly influences the development of automated trading algorithms and compliance with regulatory frameworks.

Comparison Table

| Aspect | Latency Arbitrage | Triangular Arbitrage |

|---|---|---|

| Definition | Exploiting time delays between different trading platforms to profit. | Leveraging price discrepancies between three currency pairs to gain risk-free profit. |

| Markets | Primarily electronic trading platforms and exchanges. | Foreign exchange (Forex) markets. |

| Strategy | Fast execution to capitalize on outdated prices due to latency. | Simultaneous currency trades to exploit mispriced cross rates. |

| Profit Mechanism | Price differences caused by network and processing delays. | Arbitrage of exchange rate imbalances among three currencies. |

| Risk Level | Medium to high - technology failure or delays reduce profits. | Low - generally considered risk-free if executed instantly. |

| Tools Required | High-frequency trading systems, low-latency connectivity. | Real-time Forex rate monitoring and instant trade execution systems. |

| Regulatory Aspect | Often scrutinized due to possible market fairness issues. | Widely accepted as legitimate arbitrage. |

| Example | Buying undervalued stock on one exchange before price updates on another. | Exchanging USD-EUR, EUR-GBP, and GBP-USD to exploit rate differences. |

Which is better?

Latency arbitrage exploits price discrepancies caused by delays in market data transmission, often benefiting high-frequency traders in fast-moving equity or forex markets. Triangular arbitrage involves exploiting inconsistencies between three related currency pairs to secure risk-free profits, primarily in the foreign exchange market. Choosing the better strategy depends on market conditions, technological infrastructure, and trader expertise, with triangular arbitrage often seen as lower risk but requiring more complex calculations.

Connection

Latency arbitrage exploits time delays in market data feeds to execute trades faster than competitors, capitalizing on price discrepancies across exchanges. Triangular arbitrage involves simultaneously trading three currencies to profit from varying exchange rates within the forex market. Both strategies rely on detecting and acting upon price inefficiencies caused by latency differences, linking latency arbitrage to the execution of triangular arbitrage opportunities.

Key Terms

**Triangular Arbitrage:**

Triangular arbitrage exploits price discrepancies between three different currency pairs in the foreign exchange market, allowing traders to capitalize on inefficiencies by simultaneously buying and selling currencies to lock in risk-free profits. This strategy relies on real-time calculation of cross-exchange rates and swift execution to benefit from transient price differences. Explore in-depth mechanisms and practical examples of triangular arbitrage to enhance your trading strategies.

Currency Exchange Rates

Triangular arbitrage exploits discrepancies among three currency exchange rates to secure risk-free profits by simultaneously buying and selling currencies across different forex pairs. Latency arbitrage takes advantage of delays in the transmission of currency price quotes between trading platforms, allowing traders to capitalize on outdated prices before they update. Explore these forex arbitrage strategies to enhance your currency trading insights and profitability.

Cross Currency Pairs

Triangular arbitrage exploits price discrepancies among three currency pairs, enabling traders to convert one currency through two intermediaries for risk-free profit, primarily in cross currency pairs like EUR/GBP and GBP/JPY. Latency arbitrage takes advantage of time lags in price updates across trading platforms, profiting from faster execution speeds in cross currency markets often involving USD and major cross pairs. Explore detailed strategies and real-time data analysis to master cross currency arbitrage opportunities.

Source and External Links

Triangular arbitrage - A strategy involving three currency trades to exploit price discrepancies between quoted and implicit cross exchange rates, allowing traders to earn arbitrage profits by quickly exchanging currencies in a cycle.

Triangular Arbitrage Opportunity - Definition and Example - Triangular arbitrage exploits pricing differences among three currencies by converting one currency to another consecutively when cross-exchange rates do not align, often requiring large volumes and consideration of transaction costs.

The Triangular Arbitrage Opportunity - CFA, FRM, and ... - Identifying triangular arbitrage involves calculating market-implied bid and offer rates for currency pairs using formulas to detect price discrepancies in interbank FX markets.

dowidth.com

dowidth.com