Liquidity staking involves locking tokens in a decentralized finance (DeFi) protocol to earn rewards while maintaining liquidity, whereas stablecoin staking focuses on earning interest by locking stablecoins, which are less volatile assets pegged to fiat currencies. Both staking methods provide passive income opportunities with varying risk and reward profiles shaped by market volatility, protocol security, and tokenomics. Explore deeper insights into how liquidity staking and stablecoin staking can fit different investment strategies and risk appetites.

Why it is important

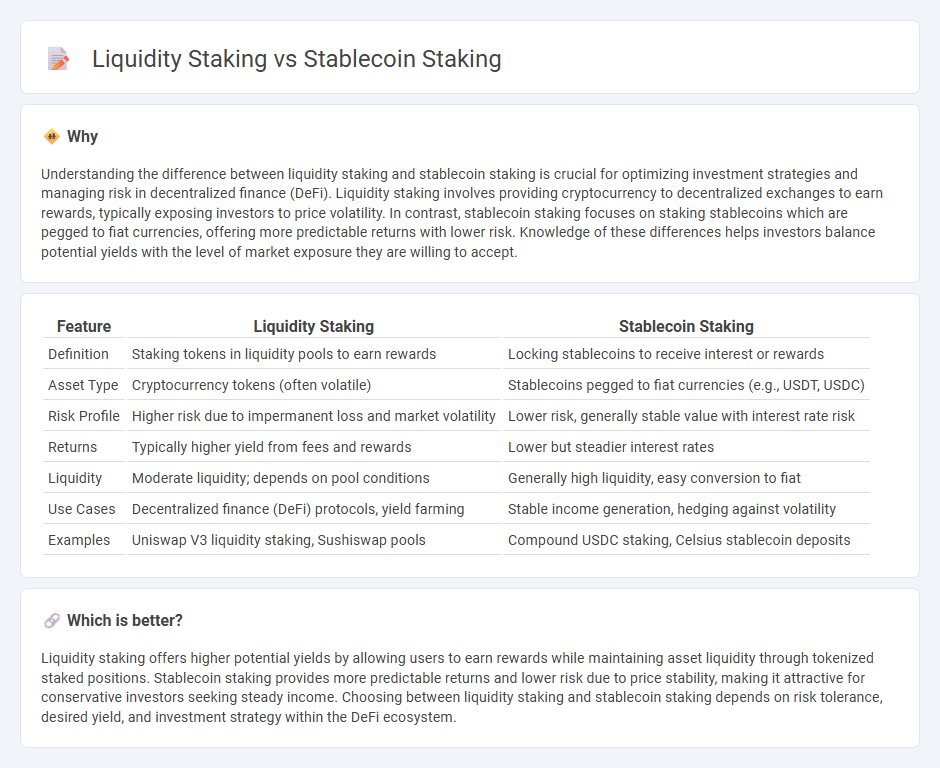

Understanding the difference between liquidity staking and stablecoin staking is crucial for optimizing investment strategies and managing risk in decentralized finance (DeFi). Liquidity staking involves providing cryptocurrency to decentralized exchanges to earn rewards, typically exposing investors to price volatility. In contrast, stablecoin staking focuses on staking stablecoins which are pegged to fiat currencies, offering more predictable returns with lower risk. Knowledge of these differences helps investors balance potential yields with the level of market exposure they are willing to accept.

Comparison Table

| Feature | Liquidity Staking | Stablecoin Staking |

|---|---|---|

| Definition | Staking tokens in liquidity pools to earn rewards | Locking stablecoins to receive interest or rewards |

| Asset Type | Cryptocurrency tokens (often volatile) | Stablecoins pegged to fiat currencies (e.g., USDT, USDC) |

| Risk Profile | Higher risk due to impermanent loss and market volatility | Lower risk, generally stable value with interest rate risk |

| Returns | Typically higher yield from fees and rewards | Lower but steadier interest rates |

| Liquidity | Moderate liquidity; depends on pool conditions | Generally high liquidity, easy conversion to fiat |

| Use Cases | Decentralized finance (DeFi) protocols, yield farming | Stable income generation, hedging against volatility |

| Examples | Uniswap V3 liquidity staking, Sushiswap pools | Compound USDC staking, Celsius stablecoin deposits |

Which is better?

Liquidity staking offers higher potential yields by allowing users to earn rewards while maintaining asset liquidity through tokenized staked positions. Stablecoin staking provides more predictable returns and lower risk due to price stability, making it attractive for conservative investors seeking steady income. Choosing between liquidity staking and stablecoin staking depends on risk tolerance, desired yield, and investment strategy within the DeFi ecosystem.

Connection

Liquidity staking enhances capital efficiency by allowing users to stake assets while maintaining liquidity through derivative tokens, which can be used in DeFi applications. Stablecoin staking offers predictable returns and low volatility, making it attractive for liquidity providers seeking stable yields. Both liquidity staking and stablecoin staking enable maximizing asset utility and generating passive income within decentralized finance ecosystems.

Key Terms

Yield

Stablecoin staking offers predictable and stable yields due to minimal price volatility, making it an attractive option for conservative investors seeking consistent returns. Liquidity staking often provides higher yield potential by capturing trading fees and rewards in decentralized finance (DeFi) protocols, though it carries increased risk from market fluctuations and impermanent loss. Explore comprehensive analyses to determine which staking strategy aligns best with your yield goals and risk tolerance.

Volatility

Stablecoin staking offers lower volatility risk by pegging assets to stable reserves, ensuring steadier returns and reduced exposure to market price swings. Liquidity staking involves providing assets to liquidity pools, exposing investors to impermanent loss due to token price fluctuations within pairings. Explore in-depth comparisons and risk management strategies to optimize your staking portfolio.

Smart Contract

Stablecoin staking involves locking stablecoins in a smart contract to earn rewards, relying on contract stability and security to ensure predictable returns. Liquidity staking requires users to provide tokens to decentralized exchanges or pools, with smart contracts managing both the liquidity and reward distribution, often exposing participants to impermanent loss risks. Explore deeper comparisons on smart contract mechanisms and risk profiles to optimize your staking strategy.

Source and External Links

How to Stake Stablecoins in 2025: A Beginner's Guide - Stablecoin staking involves lending stablecoins to DeFi platforms or centralized exchanges to provide liquidity and earn passive rewards, as stablecoins operate on Proof-of-Reserve rather than Proof-of-Stake systems.

Stablecoin Earn vs. Staking: What's the Right Fit for You? | Trust - Stablecoin staking means locking assets in liquidity pools with potentially higher rewards but risks like impermanent loss, contrasting with lending that offers steadier returns and lower risk.

How to Stake Stablecoins: A Guide to USDC, USDT, and DAI - Staking stablecoins such as USDC, USDT, and DAI provides a way to earn interest passively while maintaining price stability, often by lending them on DeFi platforms to supply liquidity.

dowidth.com

dowidth.com