Structured credit involves pooling various debt instruments to create tranches with different risk and return profiles, appealing to investors seeking diversified credit exposure. Private equity focuses on direct investments in private companies or buyouts, aiming for value creation and long-term capital appreciation. Explore the distinct strategies and risk-reward dynamics of structured credit versus private equity for informed investment decisions.

Why it is important

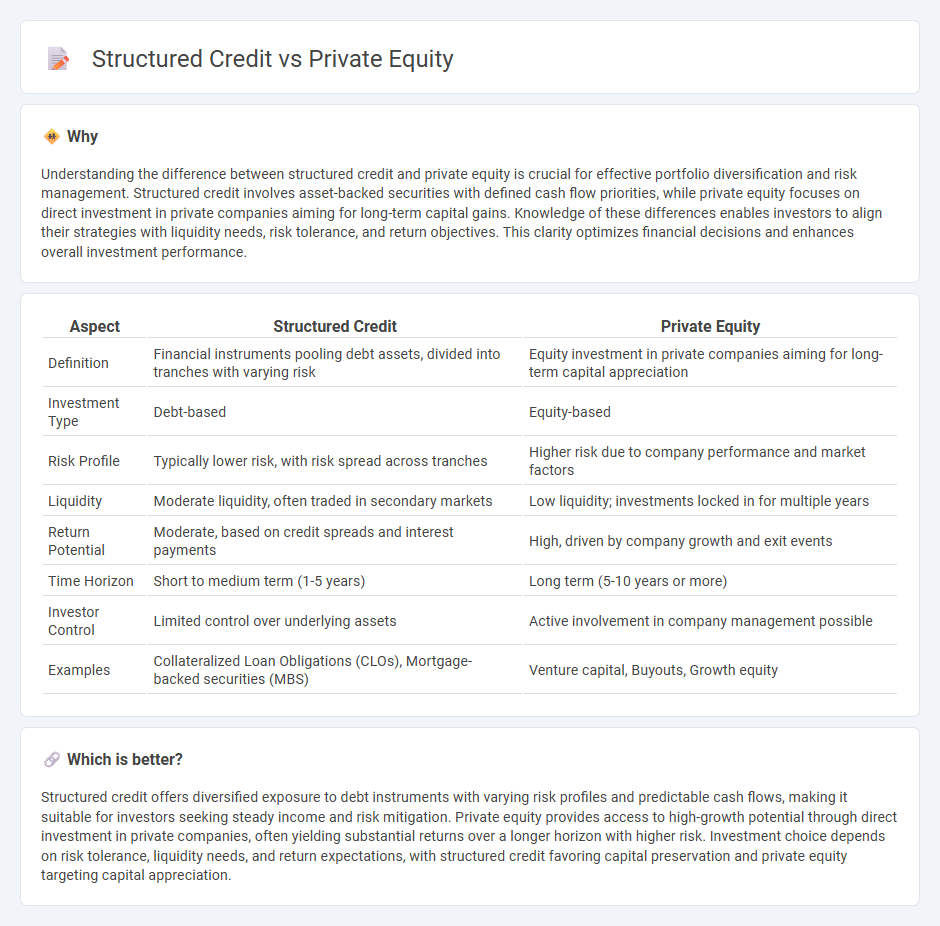

Understanding the difference between structured credit and private equity is crucial for effective portfolio diversification and risk management. Structured credit involves asset-backed securities with defined cash flow priorities, while private equity focuses on direct investment in private companies aiming for long-term capital gains. Knowledge of these differences enables investors to align their strategies with liquidity needs, risk tolerance, and return objectives. This clarity optimizes financial decisions and enhances overall investment performance.

Comparison Table

| Aspect | Structured Credit | Private Equity |

|---|---|---|

| Definition | Financial instruments pooling debt assets, divided into tranches with varying risk | Equity investment in private companies aiming for long-term capital appreciation |

| Investment Type | Debt-based | Equity-based |

| Risk Profile | Typically lower risk, with risk spread across tranches | Higher risk due to company performance and market factors |

| Liquidity | Moderate liquidity, often traded in secondary markets | Low liquidity; investments locked in for multiple years |

| Return Potential | Moderate, based on credit spreads and interest payments | High, driven by company growth and exit events |

| Time Horizon | Short to medium term (1-5 years) | Long term (5-10 years or more) |

| Investor Control | Limited control over underlying assets | Active involvement in company management possible |

| Examples | Collateralized Loan Obligations (CLOs), Mortgage-backed securities (MBS) | Venture capital, Buyouts, Growth equity |

Which is better?

Structured credit offers diversified exposure to debt instruments with varying risk profiles and predictable cash flows, making it suitable for investors seeking steady income and risk mitigation. Private equity provides access to high-growth potential through direct investment in private companies, often yielding substantial returns over a longer horizon with higher risk. Investment choice depends on risk tolerance, liquidity needs, and return expectations, with structured credit favoring capital preservation and private equity targeting capital appreciation.

Connection

Structured credit and private equity intersect through their focus on alternative investment strategies that enhance portfolio diversification and risk-adjusted returns. Structured credit involves securitized debt instruments like collateralized loan obligations (CLOs), whereas private equity entails direct investment in private companies or buyouts. The two asset classes often coexist in diversified alternative investment portfolios, offering complementary exposure to different risk profiles and liquidity horizons.

Key Terms

Equity Ownership

Private equity involves direct equity ownership allowing investors to influence company strategy and operations, often resulting in higher returns linked to the business's growth. Structured credit, while offering income through debt instruments such as collateralized loan obligations, does not provide ownership rights or control over the underlying assets. Explore the distinct advantages of equity ownership versus fixed-income exposure to optimize your investment portfolio.

Securitization

Securitization plays a crucial role in structured credit by transforming illiquid assets into tradable securities, enhancing liquidity and risk distribution for investors. Private equity typically involves direct ownership stakes with active management, whereas structured credit relies on pooling and tranching debt obligations, often including asset-backed securities and collateralized loan obligations. Explore the detailed mechanisms and benefits of securitization to better understand its impact within structured credit compared to private equity.

Leverage

Private equity typically employs moderate leverage, often ranging from 2x to 4x EBITDA, to optimize returns while managing risk, whereas structured credit strategies utilize higher leverage, sometimes exceeding 10x, due to the collateralized nature of debt instruments and tranching mechanisms. Leverage in private equity enhances equity returns through acquisition financing, while in structured credit, it amplifies income streams from securitized debt products like collateralized loan obligations (CLOs). Explore further to understand how leverage impacts risk-adjusted returns in each asset class.

Source and External Links

Private equity - Wikipedia - Private equity (PE) refers to stock in private companies, offered to specialized funds rather than the public, where investment managers raise capital from institutional investors to buy equity stakes using a mix of equity and debt financing aimed at generating returns over a typical 4-7 year horizon, focusing on strategies such as revenue growth, margin expansion, and operational improvements.

What is Private Equity? - BVCA - Private equity is medium-to-long-term finance exchanged for equity stakes in unquoted companies, supporting activities like management buyouts, and emphasizing active ownership to improve operational performance and growth during a typical investment hold of 4 to 7 years before exiting.

Private Equity Funds - Investor.gov - Private equity funds pool capital from investors to take controlling or minority interests in companies, managing these investments actively over long timeframes (often 10+ years) to increase value before eventual exit, and typically are not registered with the SEC, reflecting their long-term and less liquid nature.

dowidth.com

dowidth.com