Dark pool trading enables institutional investors to execute large orders anonymously, minimizing market impact and price slippage, while high-frequency trading (HFT) uses algorithms to capitalize on millisecond price discrepancies through rapid order placements and cancellations. Both strategies operate within different market niches, influencing liquidity, price discovery, and transparency in financial markets. Explore deeper insights into the mechanics and implications of dark pools and HFT strategies.

Why it is important

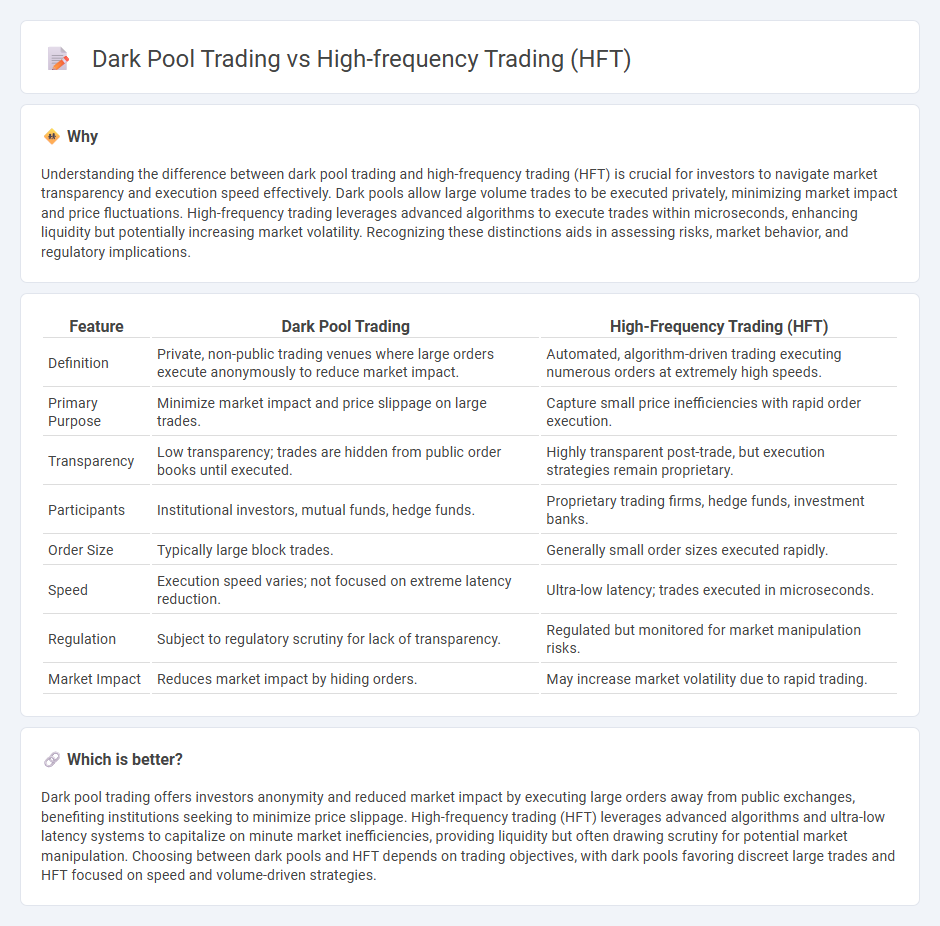

Understanding the difference between dark pool trading and high-frequency trading (HFT) is crucial for investors to navigate market transparency and execution speed effectively. Dark pools allow large volume trades to be executed privately, minimizing market impact and price fluctuations. High-frequency trading leverages advanced algorithms to execute trades within microseconds, enhancing liquidity but potentially increasing market volatility. Recognizing these distinctions aids in assessing risks, market behavior, and regulatory implications.

Comparison Table

| Feature | Dark Pool Trading | High-Frequency Trading (HFT) |

|---|---|---|

| Definition | Private, non-public trading venues where large orders execute anonymously to reduce market impact. | Automated, algorithm-driven trading executing numerous orders at extremely high speeds. |

| Primary Purpose | Minimize market impact and price slippage on large trades. | Capture small price inefficiencies with rapid order execution. |

| Transparency | Low transparency; trades are hidden from public order books until executed. | Highly transparent post-trade, but execution strategies remain proprietary. |

| Participants | Institutional investors, mutual funds, hedge funds. | Proprietary trading firms, hedge funds, investment banks. |

| Order Size | Typically large block trades. | Generally small order sizes executed rapidly. |

| Speed | Execution speed varies; not focused on extreme latency reduction. | Ultra-low latency; trades executed in microseconds. |

| Regulation | Subject to regulatory scrutiny for lack of transparency. | Regulated but monitored for market manipulation risks. |

| Market Impact | Reduces market impact by hiding orders. | May increase market volatility due to rapid trading. |

Which is better?

Dark pool trading offers investors anonymity and reduced market impact by executing large orders away from public exchanges, benefiting institutions seeking to minimize price slippage. High-frequency trading (HFT) leverages advanced algorithms and ultra-low latency systems to capitalize on minute market inefficiencies, providing liquidity but often drawing scrutiny for potential market manipulation. Choosing between dark pools and HFT depends on trading objectives, with dark pools favoring discreet large trades and HFT focused on speed and volume-driven strategies.

Connection

Dark pool trading and high-frequency trading (HFT) are interconnected through their shared objective of executing large-volume trades with minimal market impact and reduced price slippage. Dark pools provide a private venue where HFT algorithms capitalize on hidden liquidity and rapid trading capabilities to identify and exploit short-lived arbitrage opportunities. This synergy enhances market efficiency but raises concerns about transparency and fairness due to the opaque nature of dark pools combined with the speed advantages of HFT.

Key Terms

Latency

High-frequency trading (HFT) leverages ultra-low latency infrastructure to execute thousands of trades within microseconds, capitalizing on minimal market price fluctuations. Dark pool trading, in contrast, prioritizes anonymity over speed by routing orders through private exchanges to minimize market impact, often accepting slightly higher latency. Explore how latency differentials influence the strategic deployment of HFT and dark pool executions in modern financial markets.

Order Flow

High-frequency trading (HFT) leverages sophisticated algorithms and ultra-low latency connections to execute rapid trades, capitalizing on small price discrepancies within public order flows on lit exchanges. Dark pool trading operates within private, non-transparent venues, where large block orders are executed away from the public eye, reducing market impact but limiting order flow visibility. Explore deeper insights into how order flow dynamics influence trading strategies in both HFT and dark pool environments.

Market Transparency

High-frequency trading (HFT) relies on sophisticated algorithms to execute orders at ultra-fast speeds on transparent public exchanges, enhancing market liquidity but also raising concerns about market fairness. Dark pool trading occurs in private venues where large orders are executed away from public view, reducing market transparency and potentially impacting price discovery. Explore the nuances of market transparency in HFT and dark pool trading by diving deeper into their mechanisms and effects.

Source and External Links

High Frequency Trading (HFT) - Definition, Pros and Cons - High-frequency trading is algorithmic trading that uses special computers for ultra-fast trade execution, handling an extremely large volume of transactions with a very short-term investment horizon to profit from small price fluctuations and improve market liquidity.

High-Frequency Trading Explained: What Is It and How Do You Get ... - HFT employs powerful computers and advanced software to execute trades in microseconds, exploiting tiny price differences across exchanges repeatedly to generate profits through extremely rapid automated trading.

High-frequency trading - Wikipedia - High-frequency trading is a quantitative automated trading system characterized by short holding periods and strategies like market-making, event arbitrage, and latency arbitrage, relying on speed and vast data processing rather than novel algorithms.

dowidth.com

dowidth.com