Liability Driven Investing (LDI) focuses on aligning assets to meet specific future liabilities, typically used by pension funds to ensure obligations are met regardless of market conditions. Risk Parity emphasizes balancing portfolio risk equally across asset classes to achieve more stable returns and reduce volatility. Explore the differences in strategy and application to better understand which approach suits your financial goals.

Why it is important

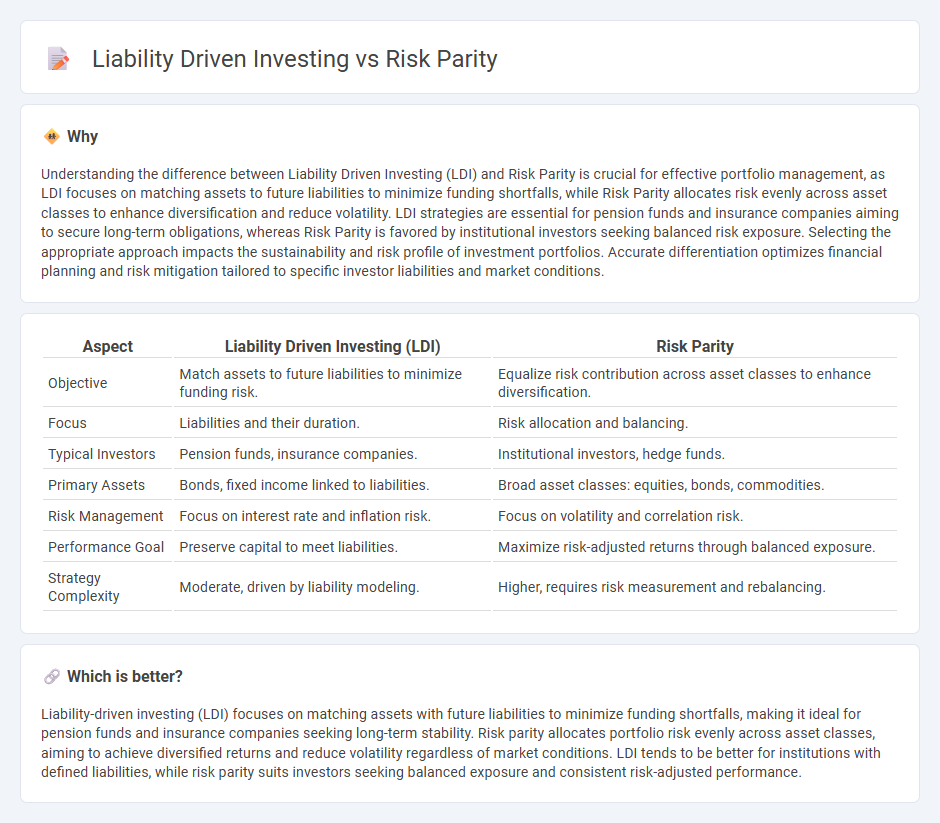

Understanding the difference between Liability Driven Investing (LDI) and Risk Parity is crucial for effective portfolio management, as LDI focuses on matching assets to future liabilities to minimize funding shortfalls, while Risk Parity allocates risk evenly across asset classes to enhance diversification and reduce volatility. LDI strategies are essential for pension funds and insurance companies aiming to secure long-term obligations, whereas Risk Parity is favored by institutional investors seeking balanced risk exposure. Selecting the appropriate approach impacts the sustainability and risk profile of investment portfolios. Accurate differentiation optimizes financial planning and risk mitigation tailored to specific investor liabilities and market conditions.

Comparison Table

| Aspect | Liability Driven Investing (LDI) | Risk Parity |

|---|---|---|

| Objective | Match assets to future liabilities to minimize funding risk. | Equalize risk contribution across asset classes to enhance diversification. |

| Focus | Liabilities and their duration. | Risk allocation and balancing. |

| Typical Investors | Pension funds, insurance companies. | Institutional investors, hedge funds. |

| Primary Assets | Bonds, fixed income linked to liabilities. | Broad asset classes: equities, bonds, commodities. |

| Risk Management | Focus on interest rate and inflation risk. | Focus on volatility and correlation risk. |

| Performance Goal | Preserve capital to meet liabilities. | Maximize risk-adjusted returns through balanced exposure. |

| Strategy Complexity | Moderate, driven by liability modeling. | Higher, requires risk measurement and rebalancing. |

Which is better?

Liability-driven investing (LDI) focuses on matching assets with future liabilities to minimize funding shortfalls, making it ideal for pension funds and insurance companies seeking long-term stability. Risk parity allocates portfolio risk evenly across asset classes, aiming to achieve diversified returns and reduce volatility regardless of market conditions. LDI tends to be better for institutions with defined liabilities, while risk parity suits investors seeking balanced exposure and consistent risk-adjusted performance.

Connection

Liability-driven investing (LDI) and risk parity both focus on balancing risk to optimize portfolio performance against financial obligations. LDI targets matching asset duration and cash flows with liabilities, reducing funding ratio volatility, while risk parity emphasizes equal risk contributions from all asset classes to enhance diversification and stability. Combining these strategies allows investors to efficiently manage interest rate and inflation risks while maintaining a diversified risk profile across equities, bonds, and alternatives.

Key Terms

Asset Allocation

Risk parity allocates assets by balancing risk contributions across asset classes, aiming for diversified portfolio volatility primarily using equities, bonds, and commodities. Liability-driven investing (LDI) focuses on matching assets to future liabilities, prioritizing bonds and interest-rate hedging instruments to minimize funding shortfall risks. Explore how these strategies optimize asset allocation to meet distinct financial goals in detail.

Risk Budgeting

Risk parity optimizes portfolio allocation by balancing risk contributions equally across asset classes to minimize volatility and improve diversification, while liability-driven investing (LDI) centers on aligning assets with future liabilities to ensure funding stability. Risk budgeting in risk parity emphasizes controlling total portfolio risk through systematic risk allocation, whereas LDI prioritizes matching the risk and duration of assets to specific liability profiles to reduce funding ratio volatility. Explore deeper insights on balancing risk budgeting strategies between risk parity and LDI to enhance portfolio resilience and meet financial obligations effectively.

Liability Matching

Risk parity strategies diversify risk equally across asset classes to achieve balanced portfolio exposure, whereas liability driven investing (LDI) concentrates on aligning assets precisely with future liabilities, emphasizing duration and cash flow matching. LDI uses fixed income instruments and derivatives to hedge interest rate and inflation risks, ensuring that portfolio returns systematically cover long-term obligations. Explore how LDI frameworks enhance financial stability and effective liability matching for pension funds and insurers.

Source and External Links

Risk parity - Wikipedia - Risk parity is an investment strategy that allocates portfolio risk equally among asset classes, focusing on balancing volatility rather than capital allocation to achieve higher risk-adjusted returns and better resistance to market downturns compared to traditional portfolios.

An Introduction to Risk Parity - Hossein Kazemi - Risk parity defines a well-diversified portfolio as one where each asset class contributes equally to total portfolio risk, measured typically by volatility, eliminating the need for expected return forecasts and relying instead on stable risk measure estimates.

Understanding Risk Parity | CME Group - Risk parity aims to avoid risk concentration typical in traditional portfolios (like 60% equities, 40% bonds) by balancing the risk contributions from different asset classes, thereby potentially providing superior risk-adjusted returns by leveraging Modern Portfolio Theory principles.

dowidth.com

dowidth.com