Insurtech revolutionizes the insurance industry by leveraging digital technologies to enhance underwriting, claims processing, and customer experience. Banktech focuses on modernizing banking operations through innovations like mobile banking, blockchain, and AI-driven financial services. Explore the evolving landscape of finance to understand how insurtech and banktech shape the future of financial services.

Why it is important

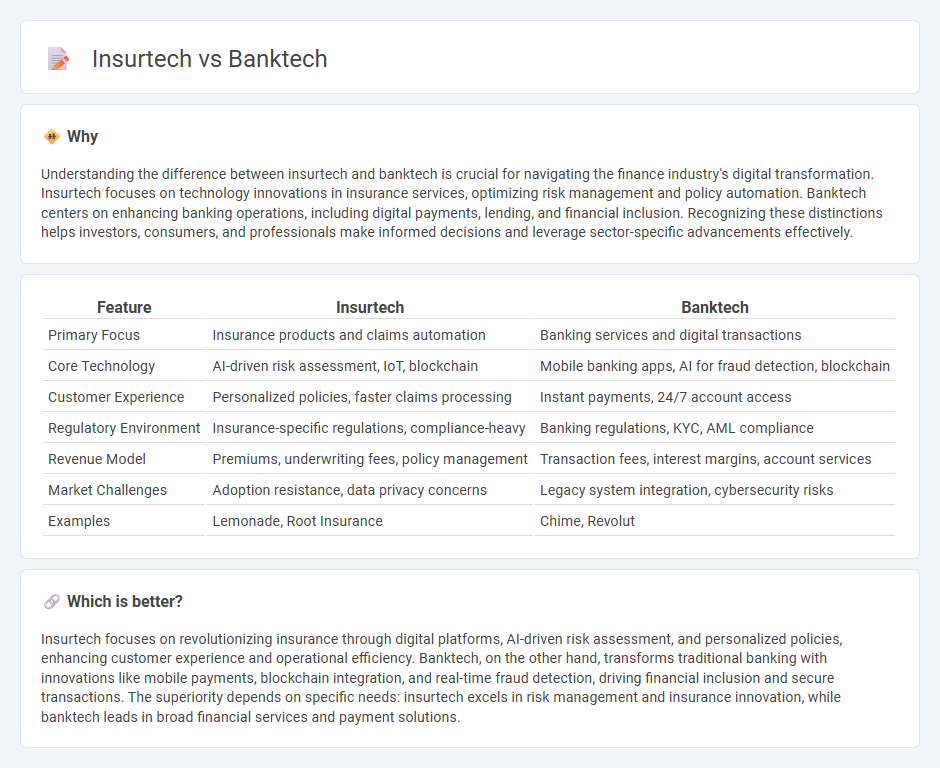

Understanding the difference between insurtech and banktech is crucial for navigating the finance industry's digital transformation. Insurtech focuses on technology innovations in insurance services, optimizing risk management and policy automation. Banktech centers on enhancing banking operations, including digital payments, lending, and financial inclusion. Recognizing these distinctions helps investors, consumers, and professionals make informed decisions and leverage sector-specific advancements effectively.

Comparison Table

| Feature | Insurtech | Banktech |

|---|---|---|

| Primary Focus | Insurance products and claims automation | Banking services and digital transactions |

| Core Technology | AI-driven risk assessment, IoT, blockchain | Mobile banking apps, AI for fraud detection, blockchain |

| Customer Experience | Personalized policies, faster claims processing | Instant payments, 24/7 account access |

| Regulatory Environment | Insurance-specific regulations, compliance-heavy | Banking regulations, KYC, AML compliance |

| Revenue Model | Premiums, underwriting fees, policy management | Transaction fees, interest margins, account services |

| Market Challenges | Adoption resistance, data privacy concerns | Legacy system integration, cybersecurity risks |

| Examples | Lemonade, Root Insurance | Chime, Revolut |

Which is better?

Insurtech focuses on revolutionizing insurance through digital platforms, AI-driven risk assessment, and personalized policies, enhancing customer experience and operational efficiency. Banktech, on the other hand, transforms traditional banking with innovations like mobile payments, blockchain integration, and real-time fraud detection, driving financial inclusion and secure transactions. The superiority depends on specific needs: insurtech excels in risk management and insurance innovation, while banktech leads in broad financial services and payment solutions.

Connection

Insurtech and banktech are connected through their use of digital technologies to enhance financial services, leveraging AI, blockchain, and big data analytics to improve customer experience and operational efficiency. Both sectors integrate mobile platforms and cloud computing to streamline processes like underwriting, claims processing in insurtech, and digital payments, loans, and risk assessment in banktech. Collaborative ecosystems between insurtech startups and banks foster innovation in personalized financial products, fraud detection, and seamless cross-industry financial transactions.

Key Terms

Digital Lending (banktech)

Digital lending within banktech leverages advanced AI algorithms and blockchain technology to streamline loan approval processes and enhance credit risk assessment accuracy. This sector prioritizes regulatory compliance, data security, and user experience, enabling banks to offer personalized lending solutions and faster fund disbursement. Explore how digital lending innovations transform banking efficiency and customer satisfaction.

Policy Automation (insurtech)

Policy automation in insurtech revolutionizes insurance operations by leveraging AI-driven workflows to streamline policy underwriting, claims processing, and customer service, significantly reducing manual errors and operational costs. Unlike banktech, which centers on digital banking solutions such as payment processing and lending automation, insurtech emphasizes automating policy lifecycle management to enhance speed and accuracy. Discover how policy automation is transforming the insurance industry with cutting-edge innovations and improved customer experiences.

Risk Assessment (common to both, but implemented differently)

Banktech leverages advanced algorithms and real-time data analytics to evaluate creditworthiness and fraud risk, emphasizing transaction histories and behavioral patterns. Insurtech applies machine learning models to assess underwriting risks and predict claims by analyzing diverse data sources such as weather patterns, health metrics, and policyholder behavior. Discover how these distinct approaches reshape risk management in financial services.

Source and External Links

Bank Systems & Technology | Connecting The Banking IT Community - BankTech is a source for news and information on banking IT, focusing on issues like channels, payments, security, and compliance.

American Fintech Council Welcomes BankTech Ventures as Strategic Partner to Strengthen Responsible Bank Innovation and Compliance - BankTech Ventures is a strategic investment fund backed by over 100 community banks that supports innovation, risk management, and compliance in banking technology.

Banktech Software Services | Temenos Partner - Banktech provides end-to-end agile implementation and integration services for Temenos banking software products worldwide, accelerating digital transformation for banks.

dowidth.com

dowidth.com