Direct indexing allows investors to customize portfolios by owning individual securities, optimizing tax efficiency, and aligning investments with personal values. Robo-advisors use algorithms to automate portfolio management, offering low-cost, diversified solutions with minimal human intervention. Explore how these investment strategies can enhance your financial goals and discover which approach suits your needs best.

Why it is important

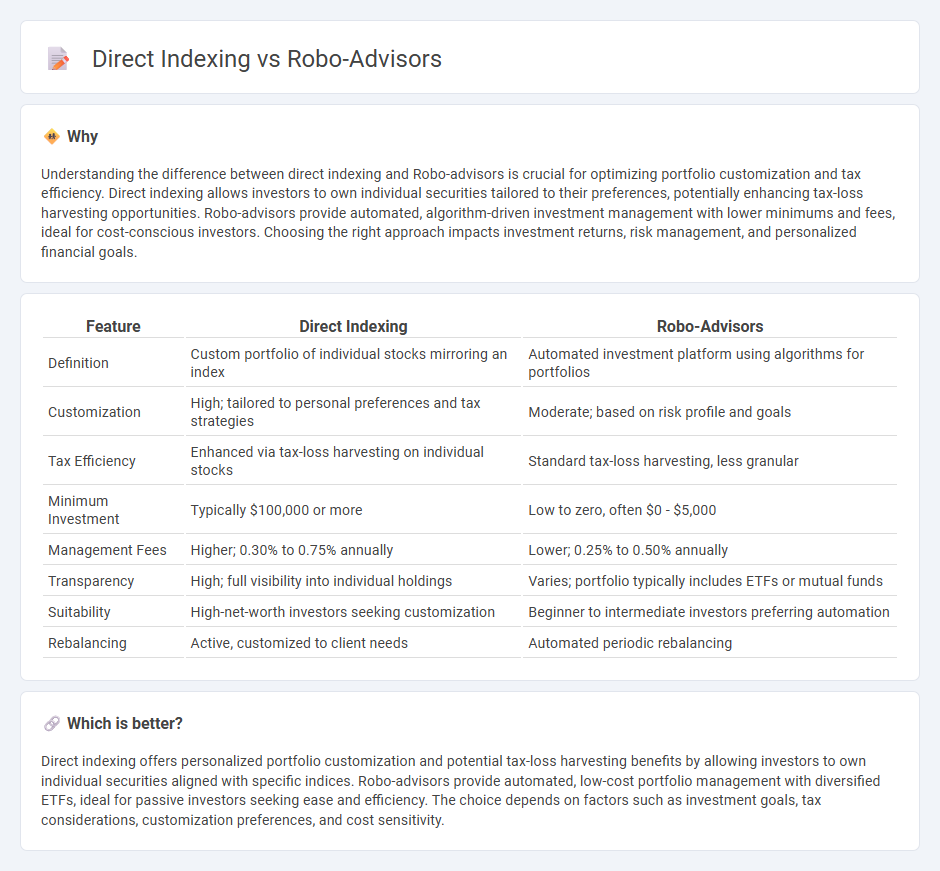

Understanding the difference between direct indexing and Robo-advisors is crucial for optimizing portfolio customization and tax efficiency. Direct indexing allows investors to own individual securities tailored to their preferences, potentially enhancing tax-loss harvesting opportunities. Robo-advisors provide automated, algorithm-driven investment management with lower minimums and fees, ideal for cost-conscious investors. Choosing the right approach impacts investment returns, risk management, and personalized financial goals.

Comparison Table

| Feature | Direct Indexing | Robo-Advisors |

|---|---|---|

| Definition | Custom portfolio of individual stocks mirroring an index | Automated investment platform using algorithms for portfolios |

| Customization | High; tailored to personal preferences and tax strategies | Moderate; based on risk profile and goals |

| Tax Efficiency | Enhanced via tax-loss harvesting on individual stocks | Standard tax-loss harvesting, less granular |

| Minimum Investment | Typically $100,000 or more | Low to zero, often $0 - $5,000 |

| Management Fees | Higher; 0.30% to 0.75% annually | Lower; 0.25% to 0.50% annually |

| Transparency | High; full visibility into individual holdings | Varies; portfolio typically includes ETFs or mutual funds |

| Suitability | High-net-worth investors seeking customization | Beginner to intermediate investors preferring automation |

| Rebalancing | Active, customized to client needs | Automated periodic rebalancing |

Which is better?

Direct indexing offers personalized portfolio customization and potential tax-loss harvesting benefits by allowing investors to own individual securities aligned with specific indices. Robo-advisors provide automated, low-cost portfolio management with diversified ETFs, ideal for passive investors seeking ease and efficiency. The choice depends on factors such as investment goals, tax considerations, customization preferences, and cost sensitivity.

Connection

Direct indexing leverages algorithms similar to those used by robo-advisors to customize portfolios based on individual investor preferences, tax situations, and risk tolerance. Robo-advisors automate the management of these personalized portfolios by continuously rebalancing assets and implementing tax-loss harvesting strategies. This synergy enhances investment efficiency and accessibility, delivering tailored financial solutions at reduced costs compared to traditional fund management.

Key Terms

Algorithmic Portfolio Management

Algorithmic portfolio management in robo-advisors uses automated models to optimize asset allocation based on risk tolerance and investment goals, offering cost-efficient diversification and real-time rebalancing. Direct indexing allows investors to directly own individual securities within an index, enabling personalized tax-loss harvesting and customization beyond traditional index funds. Explore the differences in these advanced investment strategies to determine which method aligns best with your financial objectives.

Customization

Robo-advisors provide automated portfolio management with limited customization, primarily using pre-built models tailored to general risk profiles. Direct indexing offers greater customization by allowing investors to individually select securities, apply tax-loss harvesting, and align portfolios with specific values or goals. Explore how these approaches differ in personalization to determine which suits your investment strategy best.

Tax-Loss Harvesting

Robo-advisors automate tax-loss harvesting by continuously scanning portfolios to offset capital gains with realized losses, enhancing after-tax returns efficiently. Direct indexing allows investors to own individual securities, enabling more precise tax-loss harvesting tailored to specific tax situations and preferences. Discover how each strategy can optimize your investment tax efficiency to maximize portfolio performance.

Source and External Links

Robo-advisor - Wikipedia - Robo-advisors are automated financial advisers that provide personalized investment management online using algorithms with minimal human intervention, offering broad access to wealth management at lower cost by allocating assets based on risk tolerance, typically in diversified ETFs.

What is a robo advisor? | Robo advisory services - Fidelity Investments - Robo-advisors use technology and automated algorithms to build and manage investment portfolios based on user inputs about financial goals and risk tolerance, offering an affordable, simplified alternative to traditional financial advice.

Best Robo-Advisors In July 2025 - Bankrate - Robo-advisors are popular low-cost, automated investment platforms that construct diversified portfolios of ETFs, provide continuous portfolio management including rebalancing, and often include tax-loss harvesting, making professional investment management more affordable.

dowidth.com

dowidth.com