Thematic ETFs focus on specific sectors, trends, or themes such as technology, clean energy, or healthcare, offering targeted exposure aligned with investors' interests or beliefs. Bond ETFs invest in a diversified portfolio of fixed-income securities, providing income generation and lower volatility compared to equities. Explore the unique benefits and considerations of these ETF types to make informed investment decisions.

Why it is important

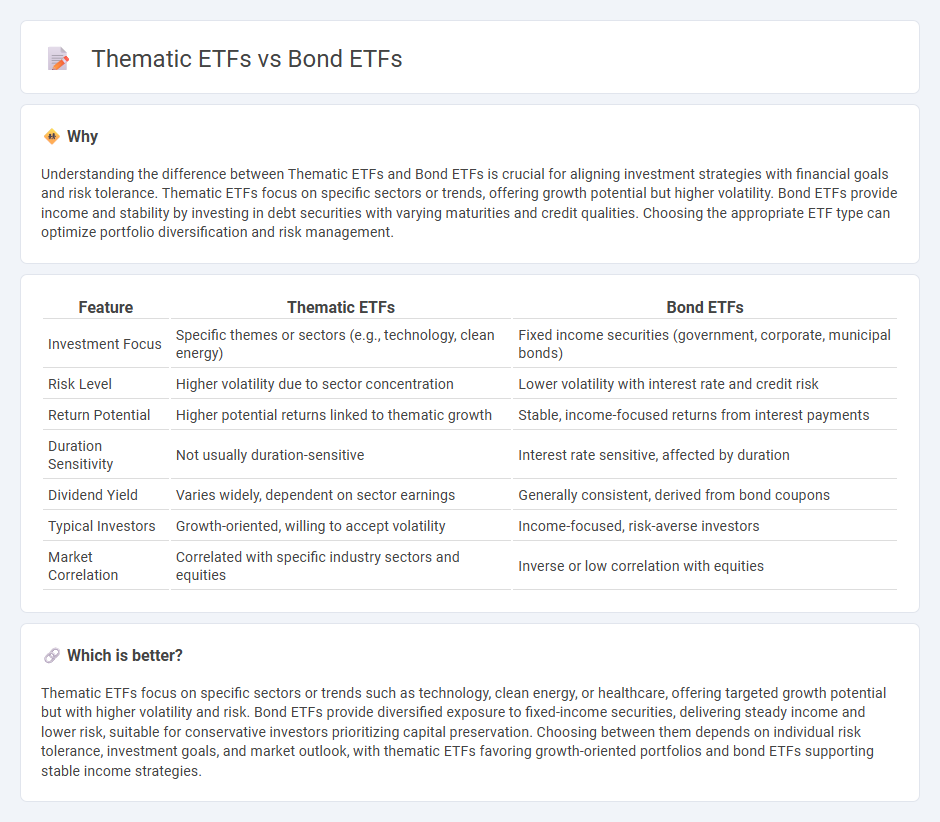

Understanding the difference between Thematic ETFs and Bond ETFs is crucial for aligning investment strategies with financial goals and risk tolerance. Thematic ETFs focus on specific sectors or trends, offering growth potential but higher volatility. Bond ETFs provide income and stability by investing in debt securities with varying maturities and credit qualities. Choosing the appropriate ETF type can optimize portfolio diversification and risk management.

Comparison Table

| Feature | Thematic ETFs | Bond ETFs |

|---|---|---|

| Investment Focus | Specific themes or sectors (e.g., technology, clean energy) | Fixed income securities (government, corporate, municipal bonds) |

| Risk Level | Higher volatility due to sector concentration | Lower volatility with interest rate and credit risk |

| Return Potential | Higher potential returns linked to thematic growth | Stable, income-focused returns from interest payments |

| Duration Sensitivity | Not usually duration-sensitive | Interest rate sensitive, affected by duration |

| Dividend Yield | Varies widely, dependent on sector earnings | Generally consistent, derived from bond coupons |

| Typical Investors | Growth-oriented, willing to accept volatility | Income-focused, risk-averse investors |

| Market Correlation | Correlated with specific industry sectors and equities | Inverse or low correlation with equities |

Which is better?

Thematic ETFs focus on specific sectors or trends such as technology, clean energy, or healthcare, offering targeted growth potential but with higher volatility and risk. Bond ETFs provide diversified exposure to fixed-income securities, delivering steady income and lower risk, suitable for conservative investors prioritizing capital preservation. Choosing between them depends on individual risk tolerance, investment goals, and market outlook, with thematic ETFs favoring growth-oriented portfolios and bond ETFs supporting stable income strategies.

Connection

Thematic ETFs and Bond ETFs both serve as strategic investment tools within diversified portfolios, targeting specific market trends and fixed-income securities, respectively. Thematic ETFs focus on sectors or themes such as technology or clean energy, while Bond ETFs provide exposure to government, corporate, or municipal debt instruments. Combining thematic and bond ETFs allows investors to balance growth opportunities with income stability and risk management.

Key Terms

Yield

Bond ETFs primarily focus on generating consistent income through interest payments from diversified fixed-income securities, providing investors with steady yield and lower volatility. Thematic ETFs target specific trends or sectors, often emphasizing growth potential over income, resulting in varied yield profiles that may be less predictable. Explore how different ETF strategies can align with your yield goals and risk tolerance for optimal portfolio balance.

Diversification

Bond ETFs offer broad diversification across various fixed-income securities, reducing risk through exposure to government, corporate, and municipal bonds. Thematic ETFs concentrate on specific sectors or trends, such as technology or clean energy, which can increase volatility but provide targeted growth opportunities. Explore the key differences and benefits of each ETF type to tailor a diversified investment strategy.

Sector Exposure

Bond ETFs primarily offer exposure to fixed-income securities such as government, corporate, and municipal bonds, providing stability and income generation through interest payments. Thematic ETFs concentrate on specific sectors or trends, like technology, clean energy, or healthcare, allowing investors to capitalize on growth opportunities within targeted industries. Explore detailed comparisons to understand how sector exposure influences risk and return profiles in these ETF categories.

Source and External Links

Bond mutual funds, bond ETFs, and preferred securities - Bond ETFs are diversified, liquid investments that trade like stocks, offer tax efficiency, and provide daily transparency, but they generally do not have a maturity date unlike individual bonds.

Bond ETFs for income - Vanguard - Bond ETFs offer a way to earn income from interest payments and provide broad, diversified exposure to global bond markets, with options ranging from U.S. and international government bonds to inflation-protected securities.

The Best Bond ETFs 2025 - justETF.com - The latest best-performing bond ETFs for 2025 include index-linked products for emerging markets, U.S. Treasuries, and global corporate bonds, with the highest YTD returns above 10%.

dowidth.com

dowidth.com