Greenium refers to the premium investors are willing to pay for green bonds compared to conventional bonds, reflecting growing demand for sustainable investments and lower yields due to perceived environmental benefits. Brown bonds, in contrast, finance projects with higher carbon footprints or negative environmental impacts and generally offer higher yields to compensate for increased risks. Explore how these dynamics influence portfolio diversification and sustainable finance strategies.

Why it is important

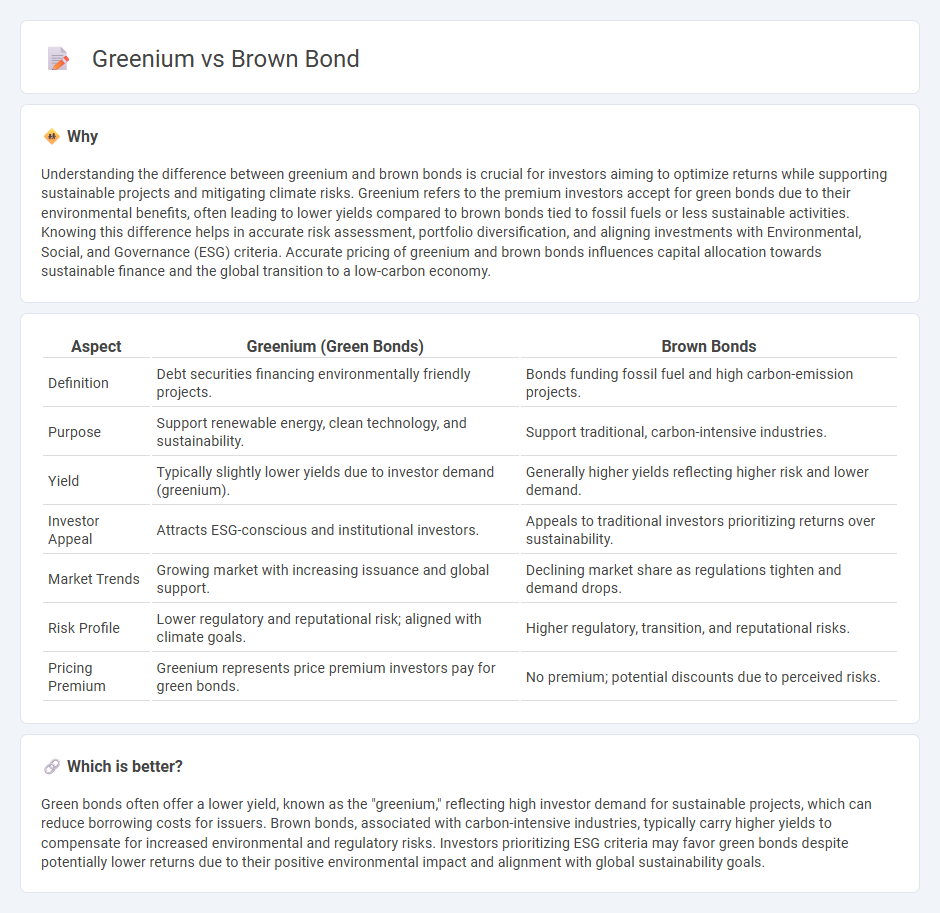

Understanding the difference between greenium and brown bonds is crucial for investors aiming to optimize returns while supporting sustainable projects and mitigating climate risks. Greenium refers to the premium investors accept for green bonds due to their environmental benefits, often leading to lower yields compared to brown bonds tied to fossil fuels or less sustainable activities. Knowing this difference helps in accurate risk assessment, portfolio diversification, and aligning investments with Environmental, Social, and Governance (ESG) criteria. Accurate pricing of greenium and brown bonds influences capital allocation towards sustainable finance and the global transition to a low-carbon economy.

Comparison Table

| Aspect | Greenium (Green Bonds) | Brown Bonds |

|---|---|---|

| Definition | Debt securities financing environmentally friendly projects. | Bonds funding fossil fuel and high carbon-emission projects. |

| Purpose | Support renewable energy, clean technology, and sustainability. | Support traditional, carbon-intensive industries. |

| Yield | Typically slightly lower yields due to investor demand (greenium). | Generally higher yields reflecting higher risk and lower demand. |

| Investor Appeal | Attracts ESG-conscious and institutional investors. | Appeals to traditional investors prioritizing returns over sustainability. |

| Market Trends | Growing market with increasing issuance and global support. | Declining market share as regulations tighten and demand drops. |

| Risk Profile | Lower regulatory and reputational risk; aligned with climate goals. | Higher regulatory, transition, and reputational risks. |

| Pricing Premium | Greenium represents price premium investors pay for green bonds. | No premium; potential discounts due to perceived risks. |

Which is better?

Green bonds often offer a lower yield, known as the "greenium," reflecting high investor demand for sustainable projects, which can reduce borrowing costs for issuers. Brown bonds, associated with carbon-intensive industries, typically carry higher yields to compensate for increased environmental and regulatory risks. Investors prioritizing ESG criteria may favor green bonds despite potentially lower returns due to their positive environmental impact and alignment with global sustainability goals.

Connection

Greenium refers to the premium investors are willing to pay for green bonds, reflecting the growing demand for sustainable investments. Brown bonds, on the other hand, finance projects with higher environmental risks and typically offer higher yields to compensate for this risk. The connection between greenium and brown bonds lies in investor preference, as greenium highlights the financial advantage of green bonds while brown bonds represent the contrasting risk-return profile in the sustainable finance spectrum.

Key Terms

Sustainable finance

Brown bonds refer to debt instruments issued by companies with high carbon footprints or investments in fossil fuels, whereas green bonds finance environmentally-friendly projects promoting renewable energy, energy efficiency, and carbon reduction. Greenium denotes the premium investors are willing to pay for green bonds compared to conventional bonds, reflecting growing demand for sustainable finance and ESG-compliant assets. Explore how these financial instruments are shaping the future of sustainable investing and corporate responsibility.

Environmental impact

Brown bonds typically finance projects with high carbon emissions or limited environmental benefits, negatively impacting sustainability efforts. Greenium refers to the premium investors accept on green bonds due to their positive environmental impact, funding renewable energy, clean tech, and sustainable infrastructure. Discover more about how these bond types influence environmental investing strategies.

Yield differential

The yield differential between brown bonds, which finance carbon-intensive projects, and green bonds, aimed at sustainable and environmentally friendly initiatives, reflects the emerging "greenium" phenomenon where green bonds often command lower yields due to investor preference and perceived lower risk. This yield gap incentivizes issuers to pursue green financing despite potentially higher upfront costs, impacting capital allocation in global bond markets. Explore detailed analytics on yield differentials and market trends to understand the evolving dynamics between brown bonds and greeniums.

Source and External Links

Surety Bonds | Brown & Brown - Brown & Brown offers surety bonds which guarantee third-party financial obligations and help companies use capital efficiently across various bond types like performance, payment, and customs bonds.

The Importance of Brown Sectors in a Green Bond World - Mondrian - Brown sectors involve industries like mining and oil that are essential today and transition financing including "brown bonds" play a role in moving toward greener investments.

Brown & Brown, 4.5% 15mar2029, USD (US115236AB74) - Cbonds - Brown & Brown issues various international bonds denominated in USD with multiple maturities, reflecting their diversified insurance operations backed by bond financing.

dowidth.com

dowidth.com