Thematic ETFs focus on specific industries or trends such as clean energy or artificial intelligence, offering targeted exposure to growth sectors. Smart Beta ETFs use alternative weighting strategies based on factors like value, momentum, or volatility to enhance returns or reduce risk compared to traditional market-cap weighted indices. Explore the differences and benefits of Thematic versus Smart Beta ETFs to optimize your investment portfolio.

Why it is important

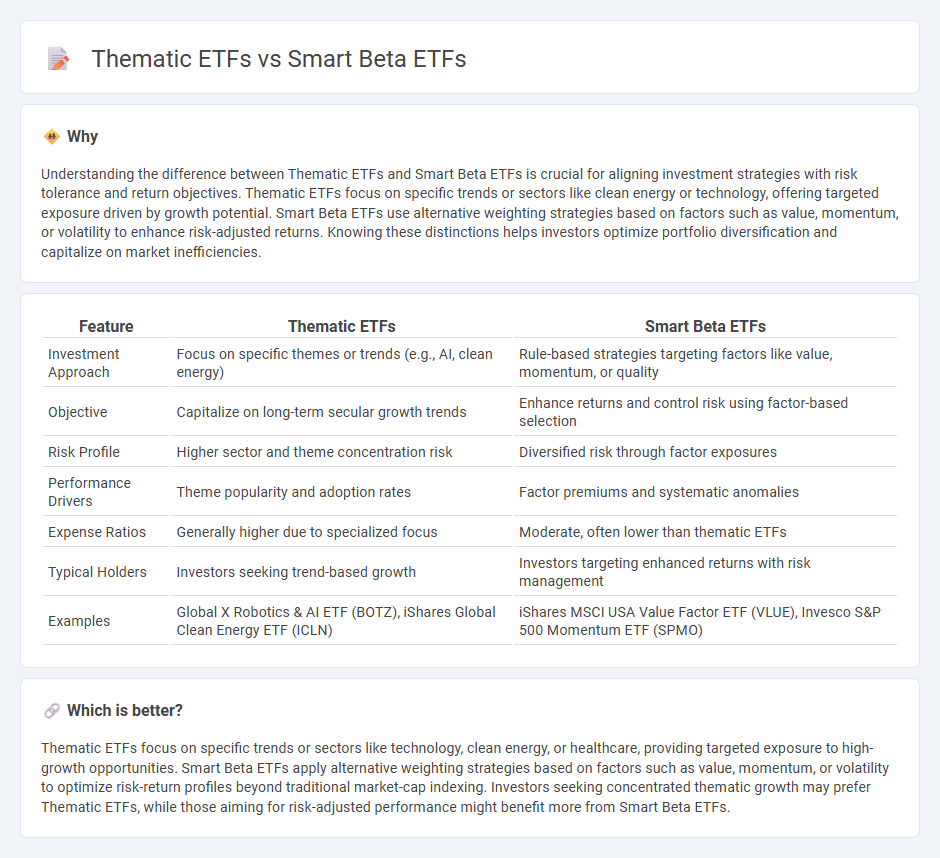

Understanding the difference between Thematic ETFs and Smart Beta ETFs is crucial for aligning investment strategies with risk tolerance and return objectives. Thematic ETFs focus on specific trends or sectors like clean energy or technology, offering targeted exposure driven by growth potential. Smart Beta ETFs use alternative weighting strategies based on factors such as value, momentum, or volatility to enhance risk-adjusted returns. Knowing these distinctions helps investors optimize portfolio diversification and capitalize on market inefficiencies.

Comparison Table

| Feature | Thematic ETFs | Smart Beta ETFs |

|---|---|---|

| Investment Approach | Focus on specific themes or trends (e.g., AI, clean energy) | Rule-based strategies targeting factors like value, momentum, or quality |

| Objective | Capitalize on long-term secular growth trends | Enhance returns and control risk using factor-based selection |

| Risk Profile | Higher sector and theme concentration risk | Diversified risk through factor exposures |

| Performance Drivers | Theme popularity and adoption rates | Factor premiums and systematic anomalies |

| Expense Ratios | Generally higher due to specialized focus | Moderate, often lower than thematic ETFs |

| Typical Holders | Investors seeking trend-based growth | Investors targeting enhanced returns with risk management |

| Examples | Global X Robotics & AI ETF (BOTZ), iShares Global Clean Energy ETF (ICLN) | iShares MSCI USA Value Factor ETF (VLUE), Invesco S&P 500 Momentum ETF (SPMO) |

Which is better?

Thematic ETFs focus on specific trends or sectors like technology, clean energy, or healthcare, providing targeted exposure to high-growth opportunities. Smart Beta ETFs apply alternative weighting strategies based on factors such as value, momentum, or volatility to optimize risk-return profiles beyond traditional market-cap indexing. Investors seeking concentrated thematic growth may prefer Thematic ETFs, while those aiming for risk-adjusted performance might benefit more from Smart Beta ETFs.

Connection

Thematic ETFs focus on specific investment themes, such as clean energy or biotechnology, allowing investors to capitalize on emerging trends. Smart Beta ETFs use alternative weighting strategies based on factors like volatility, value, or momentum to optimize portfolio performance. These two ETF types intersect when thematic ETFs incorporate smart beta methodologies to enhance returns while targeting specific sectors or themes.

Key Terms

Factor Exposure

Smart Beta ETFs focus on systematically targeting specific factor exposures such as value, momentum, or low volatility to enhance risk-adjusted returns compared to traditional indexing. Thematic ETFs concentrate on investment themes like clean energy, artificial intelligence, or cybersecurity, often without explicit factor exposure emphasis. Explore detailed comparisons to understand how factor allocations impact portfolio diversification and performance.

Investment Theme

Smart Beta ETFs employ rules-based strategies that emphasize factors such as value, momentum, or volatility to optimize returns beyond traditional market capitalization weighting. Thematic ETFs concentrate on specific investment themes like clean energy, technology innovation, or healthcare advancements, targeting companies poised to benefit from long-term trends. Explore our detailed guide to understand which ETF aligns best with your investment objectives.

Index Construction

Smart Beta ETFs utilize rules-based strategies to weight securities based on factors like value, momentum, or volatility, aiming to outperform traditional market-cap indices through systematic, factor-driven index construction. Thematic ETFs concentrate on specific trends or sectors such as clean energy, technology innovation, or demographic shifts, selecting companies aligned with these themes rather than relying on traditional factor models. Explore our detailed analysis to understand which ETF type aligns best with your investment strategy.

Source and External Links

Smart Beta ETFs | Charles Schwab - Smart Beta ETFs use rules-based indexes that weight securities based on factors other than market capitalization, such as equal weighting, fundamental weighting, minimum variance, and low volatility, aiming to provide low-cost access to strategic beta strategies including risk-oriented and return-oriented approaches.

Smart Beta ETF List - Smart Beta ETFs follow alternative weighting strategies compared to traditional cap-weighted indexes, blending passive and active investing by adjusting technical and fundamental factors like size, value, momentum, and volatility to enhance returns, reduce risk, and add diversification.

What is a Smart Beta ETF? - justETF.com - Smart Beta ETFs attempt to combine passive and active investing benefits by exploiting known investing anomalies and using factor indices that select and weight stocks based on characteristics like undervaluation, profitability, and momentum to outperform traditional market-cap indexes over the long term.

dowidth.com

dowidth.com