Instant payments offer real-time fund transfers with transaction completion in seconds, enhancing liquidity and cash flow management for businesses and individuals. Wire transfers, while secure and reliable, typically involve longer processing times, often taking several hours to a few days to clear, especially for international transactions. Explore how choosing between instant payments and wire transfers can optimize your financial operations and meet your specific banking needs.

Why it is important

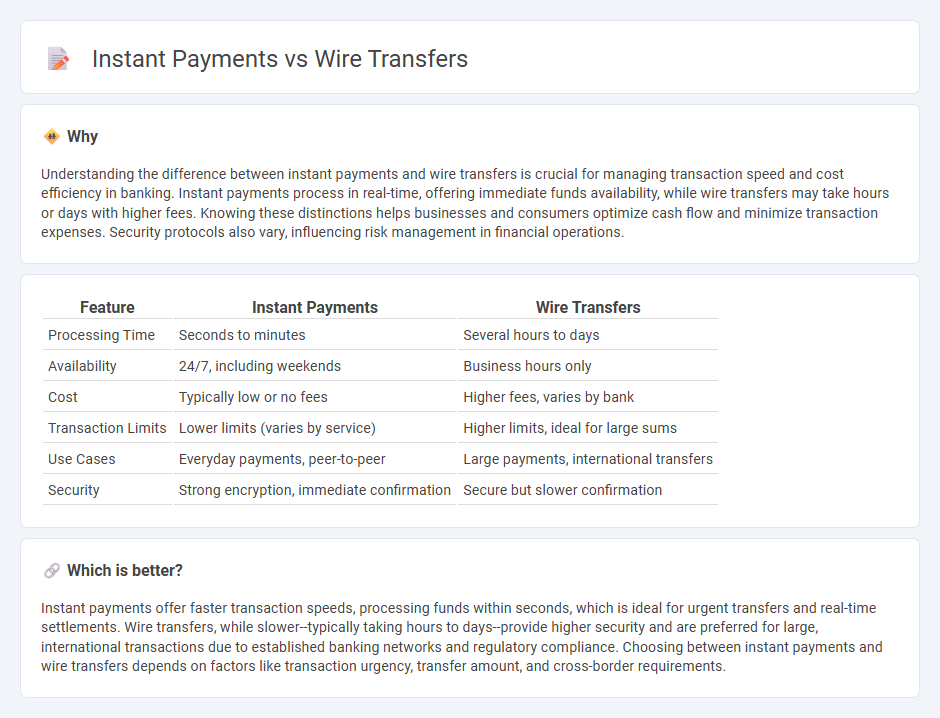

Understanding the difference between instant payments and wire transfers is crucial for managing transaction speed and cost efficiency in banking. Instant payments process in real-time, offering immediate funds availability, while wire transfers may take hours or days with higher fees. Knowing these distinctions helps businesses and consumers optimize cash flow and minimize transaction expenses. Security protocols also vary, influencing risk management in financial operations.

Comparison Table

| Feature | Instant Payments | Wire Transfers |

|---|---|---|

| Processing Time | Seconds to minutes | Several hours to days |

| Availability | 24/7, including weekends | Business hours only |

| Cost | Typically low or no fees | Higher fees, varies by bank |

| Transaction Limits | Lower limits (varies by service) | Higher limits, ideal for large sums |

| Use Cases | Everyday payments, peer-to-peer | Large payments, international transfers |

| Security | Strong encryption, immediate confirmation | Secure but slower confirmation |

Which is better?

Instant payments offer faster transaction speeds, processing funds within seconds, which is ideal for urgent transfers and real-time settlements. Wire transfers, while slower--typically taking hours to days--provide higher security and are preferred for large, international transactions due to established banking networks and regulatory compliance. Choosing between instant payments and wire transfers depends on factors like transaction urgency, transfer amount, and cross-border requirements.

Connection

Instant payments and wire transfers are connected through their core function of facilitating the electronic transfer of funds between bank accounts. Both methods enable real-time or near-real-time movement of money, improving liquidity and efficiency in banking transactions. Advances in payment infrastructure and network integration have increasingly blurred distinctions, allowing seamless use depending on transaction speed and geographic requirements.

Key Terms

Settlement Time

Wire transfers typically require several hours to a few business days for settlement due to interbank processing and compliance checks, making them suitable for larger, less time-sensitive transactions. Instant payments settle within seconds, leveraging real-time payment networks and advanced technology, ideal for urgent transfers and smaller amounts. Explore the nuances of settlement times and their impact on payment choices to optimize your financial transactions.

Intermediary Banks

Intermediary banks play a crucial role in wire transfers by facilitating the movement of funds between the sender's and recipient's banks, especially in cross-border transactions, often leading to higher fees and longer processing times. Instant payments bypass these intermediaries through direct bank-to-bank networks, enabling real-time settlements with reduced transaction costs and enhanced transparency. Explore how intermediary banks impact the efficiency and cost of different payment methods in greater detail.

Real-Time Processing

Wire transfers typically involve batch processing and settle within hours or days, whereas instant payments enable real-time processing and immediate fund availability 24/7. Real-time payment systems leverage advanced technologies like ISO 20022 messaging and APIs to facilitate instant settlement and enhanced transparency. Explore the benefits and applications of real-time processing in modern payment systems to optimize your financial transactions.

Source and External Links

Wire Transfer - SchoolsFirst FCU - Wire transfers are electronic funds transfers between people or institutions, commonly used for emergencies, real estate payments, or debt payoff, requiring specific sender, recipient, and bank details, with fees for domestic ($20) and international ($45) transfers.

The ins and outs of wire transfers - Wells Fargo - Wire transfers electronically send money between people or businesses quickly, often on the same day domestically or within a few days internationally, suitable for urgent transfers or large amounts.

Wire transfer vs electronic transfer | Western Union ES - Wire transfers are faster than ACH payments, typically available the same or next business day domestically, and are one of the few methods that can send money internationally, though with higher fees compared to ACH.

dowidth.com

dowidth.com