Neobanking represents a fully digital approach to banking services, leveraging technology to provide seamless online account management, payments, and lending without physical branches. Shadow banking operates outside traditional regulatory frameworks, offering credit and financial services through non-bank institutions that often pose higher risks. Explore more about the distinctions and implications of neobanking versus shadow banking.

Why it is important

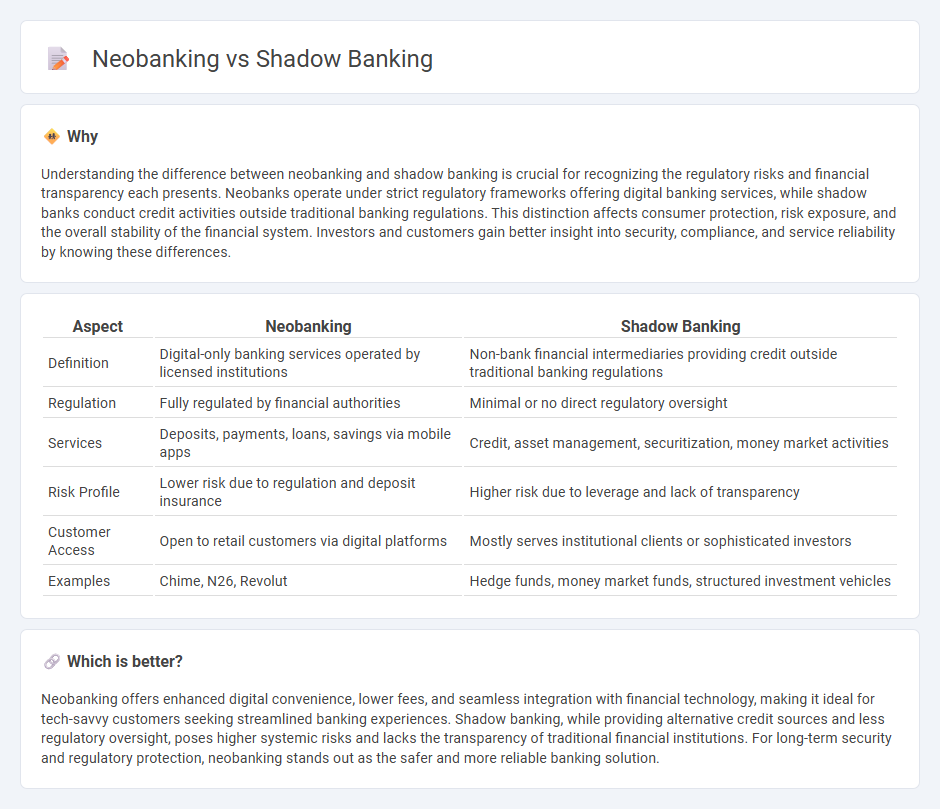

Understanding the difference between neobanking and shadow banking is crucial for recognizing the regulatory risks and financial transparency each presents. Neobanks operate under strict regulatory frameworks offering digital banking services, while shadow banks conduct credit activities outside traditional banking regulations. This distinction affects consumer protection, risk exposure, and the overall stability of the financial system. Investors and customers gain better insight into security, compliance, and service reliability by knowing these differences.

Comparison Table

| Aspect | Neobanking | Shadow Banking |

|---|---|---|

| Definition | Digital-only banking services operated by licensed institutions | Non-bank financial intermediaries providing credit outside traditional banking regulations |

| Regulation | Fully regulated by financial authorities | Minimal or no direct regulatory oversight |

| Services | Deposits, payments, loans, savings via mobile apps | Credit, asset management, securitization, money market activities |

| Risk Profile | Lower risk due to regulation and deposit insurance | Higher risk due to leverage and lack of transparency |

| Customer Access | Open to retail customers via digital platforms | Mostly serves institutional clients or sophisticated investors |

| Examples | Chime, N26, Revolut | Hedge funds, money market funds, structured investment vehicles |

Which is better?

Neobanking offers enhanced digital convenience, lower fees, and seamless integration with financial technology, making it ideal for tech-savvy customers seeking streamlined banking experiences. Shadow banking, while providing alternative credit sources and less regulatory oversight, poses higher systemic risks and lacks the transparency of traditional financial institutions. For long-term security and regulatory protection, neobanking stands out as the safer and more reliable banking solution.

Connection

Neobanking and shadow banking intersect through their reliance on digital platforms to bypass traditional banking regulations, offering streamlined financial services with reduced oversight. Neobanks leverage technology to provide user-friendly, low-cost banking solutions, while shadow banks operate in the non-bank financial sector, often engaging in lending and investment activities without the regulatory constraints faced by conventional banks. This overlap creates both innovative opportunities and regulatory challenges within the financial ecosystem.

Key Terms

Regulation

Shadow banking operates outside traditional regulatory frameworks, often involving non-bank financial intermediaries engaging in credit intermediation without full oversight. Neobanking is subject to regulatory standards similar to traditional banks, including licensing, capital requirements, and consumer protection mandates, ensuring greater transparency and risk management. Explore the nuances of regulatory compliance shaping the growth and stability of shadow banking and neobanking sectors.

Technology

Shadow banking operates through non-traditional financial intermediaries, leveraging alternative credit models and peer-to-peer lending platforms with limited regulatory oversight. Neobanking utilizes advanced digital technologies, including AI-driven analytics and seamless mobile interfaces, to offer fully online banking services with robust cybersecurity measures. Explore the technological innovations that differentiate shadow banking from neobanking for a deeper understanding.

Intermediation

Shadow banking refers to non-bank financial intermediaries that provide credit and liquidity outside traditional banking regulations, often engaging in activities like securitization and repo agreements to facilitate funds flow. Neobanking involves digital-only banks offering streamlined financial services through online platforms, focusing on user experience and streamlined intermediation between depositors and borrowers without physical branches. Explore further to understand how these distinct models impact financial intermediation and regulatory landscapes.

Source and External Links

Shadow banking system - Wikipedia - Shadow banking refers to non-bank financial intermediaries that provide credit and liquidity similar to traditional banks but without access to central bank funding or deposit insurance, operating mostly through short-term funding like commercial paper and repos.

Regulation Shadow Banking FSB - Financial Stability Board - The shadow banking system is a network of financial intermediaries such as money market funds, broker-dealers, and hedge funds that conduct credit, maturity, and liquidity transformation outside of traditional banking regulations, representing about 25% of global financial system assets.

Shadow Banking - New York Fed - Shadow banking provides credit by issuing liquid, short-term liabilities against risky, long-term assets using methods like securitization and repos, but lacks direct access to public liquidity sources, contributing to financial system vulnerabilities before the 2007-09 crisis.

dowidth.com

dowidth.com