Negative interest rates occur when banks charge customers for holding deposits, effectively reducing the principal over time, contrasting sharply with compound interest, which grows savings by reinvesting earned interest. This unconventional monetary policy aims to stimulate borrowing and spending but can erode returns on savings, impacting both consumers and financial institutions. Explore how these opposing interest mechanisms affect your financial strategies and banking choices.

Why it is important

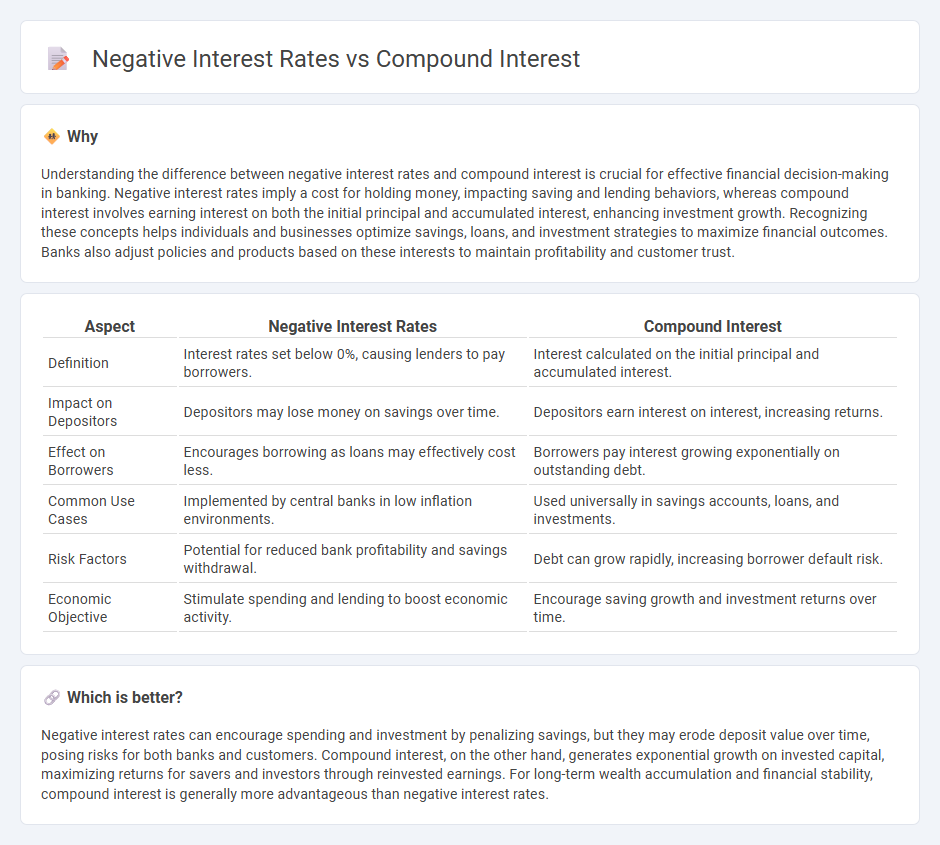

Understanding the difference between negative interest rates and compound interest is crucial for effective financial decision-making in banking. Negative interest rates imply a cost for holding money, impacting saving and lending behaviors, whereas compound interest involves earning interest on both the initial principal and accumulated interest, enhancing investment growth. Recognizing these concepts helps individuals and businesses optimize savings, loans, and investment strategies to maximize financial outcomes. Banks also adjust policies and products based on these interests to maintain profitability and customer trust.

Comparison Table

| Aspect | Negative Interest Rates | Compound Interest |

|---|---|---|

| Definition | Interest rates set below 0%, causing lenders to pay borrowers. | Interest calculated on the initial principal and accumulated interest. |

| Impact on Depositors | Depositors may lose money on savings over time. | Depositors earn interest on interest, increasing returns. |

| Effect on Borrowers | Encourages borrowing as loans may effectively cost less. | Borrowers pay interest growing exponentially on outstanding debt. |

| Common Use Cases | Implemented by central banks in low inflation environments. | Used universally in savings accounts, loans, and investments. |

| Risk Factors | Potential for reduced bank profitability and savings withdrawal. | Debt can grow rapidly, increasing borrower default risk. |

| Economic Objective | Stimulate spending and lending to boost economic activity. | Encourage saving growth and investment returns over time. |

Which is better?

Negative interest rates can encourage spending and investment by penalizing savings, but they may erode deposit value over time, posing risks for both banks and customers. Compound interest, on the other hand, generates exponential growth on invested capital, maximizing returns for savers and investors through reinvested earnings. For long-term wealth accumulation and financial stability, compound interest is generally more advantageous than negative interest rates.

Connection

Negative interest rates directly impact compound interest by altering the growth trajectory of savings and loans, often leading to decreased returns on deposits while increasing the cost of borrowing. In a negative rate environment, compounded interest calculations on savings can result in a gradual reduction of principal over time, contrasting with traditional positive interest growth. This dynamic challenges conventional banking models, influencing consumer behavior and financial product strategies.

Key Terms

Accrual

Compound interest accelerates accrual by reinvesting earned interest, resulting in exponential growth of the principal over time. Negative interest rates, conversely, lead to a decrease in the principal through deductions on deposits or loans, causing the accrued amount to shrink instead of expand. Explore how these opposing mechanisms impact investment strategies and wealth accumulation in detail.

Principal

Compound interest amplifies the principal over time by reinvesting earned interest, leading to exponential growth. Negative interest rates, by contrast, effectively reduce the principal's value as borrowers are paid to take loans, diminishing savings and investments. Explore deeper insights into how these interest rate mechanisms impact capital accumulation and financial planning.

Policy Rate

The policy rate is a critical benchmark influencing both compound interest accumulation and the impact of negative interest rates on the economy. Compound interest, driven by positive policy rates, accelerates investment growth and savings returns, while negative policy rates aim to stimulate borrowing and spending by effectively charging banks for holding excess reserves. Explore the dynamics of policy rate adjustments to understand their profound effects on financial markets and economic stability.

Source and External Links

What is compound interest? - Fidelity Investments - Compound interest is interest that earns interest, making it grow faster than simple interest over time, especially in savings accounts and investments.

What is compound interest? | TD Canada Trust - Compound interest is calculated on both the principal amount and the interest accumulated, leading to significant gains over time, much like a snowball effect.

Compound interest - Wikipedia - Compound interest accumulates from a principal sum and previously accumulated interest, often calculated using the formula \( A=P\left(1+{\frac {r}{n}}\right)^{tn} \).

dowidth.com

dowidth.com