Instant settlement enables real-time transfer of funds, enhancing liquidity and reducing counterparty risk in banking transactions. Deferred settlement processes transactions at a later time, often at the end of a business day, which can delay access to funds and increase settlement risk. Explore the key differences and benefits of instant versus deferred settlement to optimize your banking operations.

Why it is important

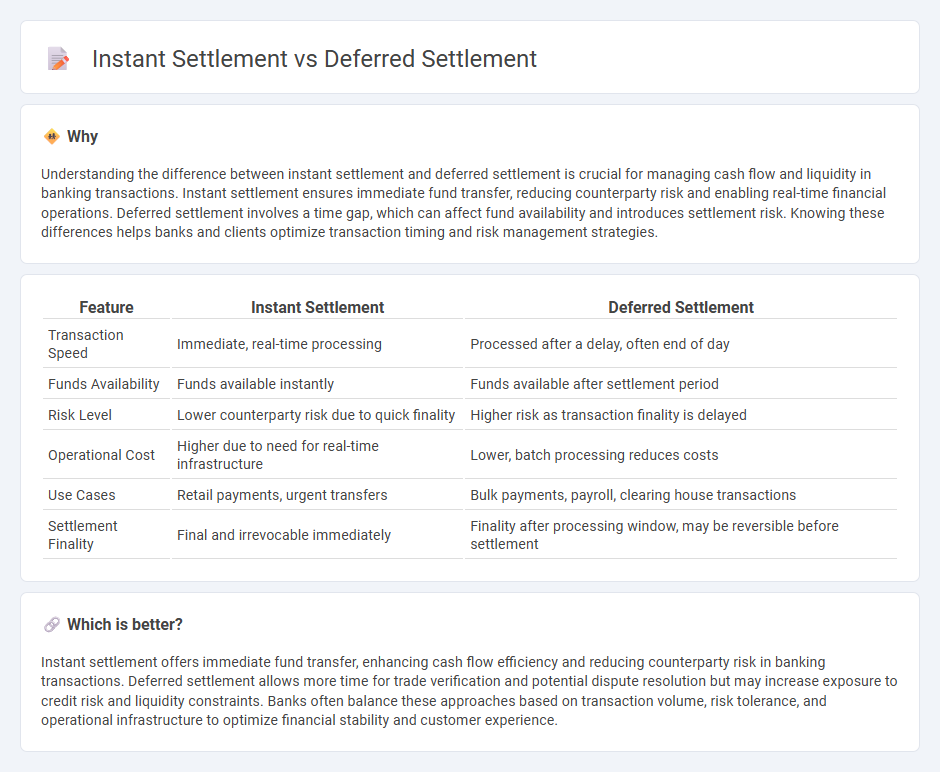

Understanding the difference between instant settlement and deferred settlement is crucial for managing cash flow and liquidity in banking transactions. Instant settlement ensures immediate fund transfer, reducing counterparty risk and enabling real-time financial operations. Deferred settlement involves a time gap, which can affect fund availability and introduces settlement risk. Knowing these differences helps banks and clients optimize transaction timing and risk management strategies.

Comparison Table

| Feature | Instant Settlement | Deferred Settlement |

|---|---|---|

| Transaction Speed | Immediate, real-time processing | Processed after a delay, often end of day |

| Funds Availability | Funds available instantly | Funds available after settlement period |

| Risk Level | Lower counterparty risk due to quick finality | Higher risk as transaction finality is delayed |

| Operational Cost | Higher due to need for real-time infrastructure | Lower, batch processing reduces costs |

| Use Cases | Retail payments, urgent transfers | Bulk payments, payroll, clearing house transactions |

| Settlement Finality | Final and irrevocable immediately | Finality after processing window, may be reversible before settlement |

Which is better?

Instant settlement offers immediate fund transfer, enhancing cash flow efficiency and reducing counterparty risk in banking transactions. Deferred settlement allows more time for trade verification and potential dispute resolution but may increase exposure to credit risk and liquidity constraints. Banks often balance these approaches based on transaction volume, risk tolerance, and operational infrastructure to optimize financial stability and customer experience.

Connection

Instant settlement facilitates immediate transfer of funds and asset ownership upon transaction confirmation, enhancing liquidity and reducing counterparty risk. Deferred settlement postpones the final transfer to a predetermined future date, allowing time for trade verification, regulatory compliance, and risk management. Both methods are interconnected through their impact on financial market efficiency, balancing immediacy with security and operational requirements.

Key Terms

Clearing

Deferred settlement involves postponing the final transfer of funds and securities to a specified date, allowing for batch processing during clearing cycles, which can increase liquidity management flexibility but also counterparty risk. Instant settlement processes transactions immediately upon trade execution, reducing credit risk and operational exposure in clearing but requiring robust real-time infrastructure and liquidity. Explore further the implications of deferred and instant settlement in clearing systems to optimize trade efficiency and risk management.

Settlement finality

Deferred settlement involves a time gap between transaction initiation and final settlement, increasing exposure to counterparty risk and potential price fluctuations. Instant settlement ensures immediate finality, reducing risk by confirming ownership transfer without delay and enhancing market efficiency. Explore more to understand how settlement finality impacts liquidity and risk management strategies.

Real-time processing

Deferred settlement processes transactions in batches, resulting in delayed fund transfers that can take hours or days to complete, whereas instant settlement enables real-time processing with immediate fund availability. Real-time processing reduces counterparty risk and enhances liquidity for businesses and consumers by instantly updating transaction records and balances. Explore the benefits and operational intricacies of both settlement models to determine which best suits your financial needs.

Source and External Links

What Is Deferred Compensation? | Morris Bart Personal Injury Lawyers - Deferred settlement means you don't receive all money due immediately; instead, payments are delayed and paid out over time, often used in personal injury cases as structured settlements.

Deferred settlement | Practical Law - Westlaw - In stock trading, deferred settlement occurs when the obligation to settle a trade two business days after the transaction (T+2) is extended to a later date set by the exchange, such as ASX issuance timelines.

Deferred Settlement Terms Definition - Law Insider - Deferred settlement terms are agreed-upon conditions delaying payment or delivery, where key dates (like Settlement Date or Remittance Date) are postponed for a specified period according to the agreement.

dowidth.com

dowidth.com