Central bank digital currency (CBDC) represents a digital form of a nation's fiat currency, issued and regulated by the central bank to enable secure, efficient transactions and enhance monetary policy implementation. Unlike traditional fiat currency, which exists as physical cash or reserves in commercial banks, CBDCs offer programmable features and real-time settlement advantages. Explore the transformative potential and key differences between CBDCs and fiat currency to understand the future of banking.

Why it is important

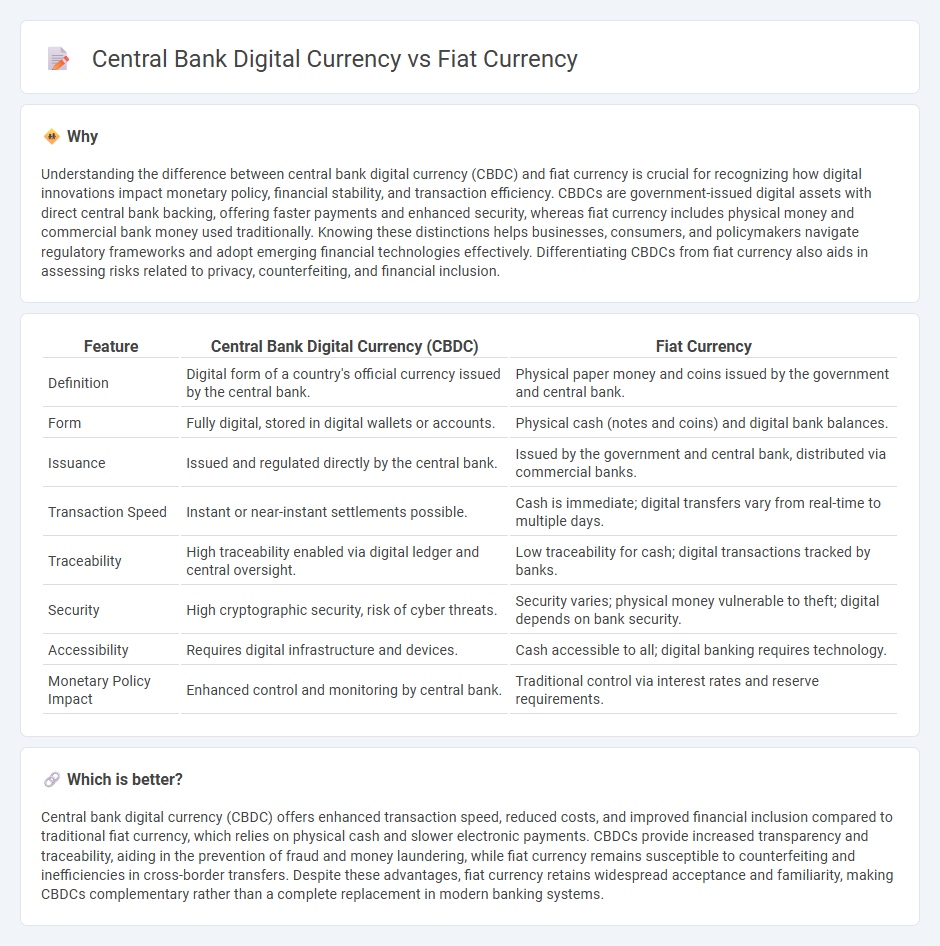

Understanding the difference between central bank digital currency (CBDC) and fiat currency is crucial for recognizing how digital innovations impact monetary policy, financial stability, and transaction efficiency. CBDCs are government-issued digital assets with direct central bank backing, offering faster payments and enhanced security, whereas fiat currency includes physical money and commercial bank money used traditionally. Knowing these distinctions helps businesses, consumers, and policymakers navigate regulatory frameworks and adopt emerging financial technologies effectively. Differentiating CBDCs from fiat currency also aids in assessing risks related to privacy, counterfeiting, and financial inclusion.

Comparison Table

| Feature | Central Bank Digital Currency (CBDC) | Fiat Currency |

|---|---|---|

| Definition | Digital form of a country's official currency issued by the central bank. | Physical paper money and coins issued by the government and central bank. |

| Form | Fully digital, stored in digital wallets or accounts. | Physical cash (notes and coins) and digital bank balances. |

| Issuance | Issued and regulated directly by the central bank. | Issued by the government and central bank, distributed via commercial banks. |

| Transaction Speed | Instant or near-instant settlements possible. | Cash is immediate; digital transfers vary from real-time to multiple days. |

| Traceability | High traceability enabled via digital ledger and central oversight. | Low traceability for cash; digital transactions tracked by banks. |

| Security | High cryptographic security, risk of cyber threats. | Security varies; physical money vulnerable to theft; digital depends on bank security. |

| Accessibility | Requires digital infrastructure and devices. | Cash accessible to all; digital banking requires technology. |

| Monetary Policy Impact | Enhanced control and monitoring by central bank. | Traditional control via interest rates and reserve requirements. |

Which is better?

Central bank digital currency (CBDC) offers enhanced transaction speed, reduced costs, and improved financial inclusion compared to traditional fiat currency, which relies on physical cash and slower electronic payments. CBDCs provide increased transparency and traceability, aiding in the prevention of fraud and money laundering, while fiat currency remains susceptible to counterfeiting and inefficiencies in cross-border transfers. Despite these advantages, fiat currency retains widespread acceptance and familiarity, making CBDCs complementary rather than a complete replacement in modern banking systems.

Connection

Central bank digital currency (CBDC) represents a digital form of fiat currency issued and regulated by a country's central bank, ensuring legal tender status and monetary policy control. CBDCs facilitate seamless transactions and enhance financial inclusion while maintaining parity with traditional fiat currency in value and backing. The integration of CBDCs with existing financial systems enables efficient currency management and supports monetary stability within the broader banking ecosystem.

Key Terms

Legal Tender

Fiat currency is government-issued money recognized as legal tender, meaning it must be accepted for debts and payments within its jurisdiction. Central bank digital currency (CBDC) is a digital form of fiat currency backed by the central bank, designed to serve as legal tender in electronic transactions, enhancing security and efficiency. Explore the legal frameworks and implications of CBDCs to understand their impact on modern monetary systems.

Digital Ledger

Fiat currency is government-issued money not backed by a physical commodity, while Central Bank Digital Currency (CBDC) leverages a digital ledger technology, such as a blockchain or distributed ledger, to ensure transparency, security, and traceability of transactions. Unlike fiat currency, CBDCs enable real-time settlement and reduce intermediaries, improving efficiency in cross-border payments and monetary policy implementation. Explore more about how digital ledger innovations are transforming the future of money and financial systems.

Monetary Policy

Fiat currency relies on central banks to implement monetary policy through interest rate adjustments and controlling money supply, influencing inflation and economic growth. Central bank digital currencies (CBDCs) offer enhanced precision in policy execution by enabling real-time tracking and direct distribution of funds, potentially reducing transaction costs and improving transparency. Explore how CBDCs could transform traditional monetary policy mechanisms and their impact on the global economy.

Source and External Links

Fiat currency | TRM Glossary - Fiat currency is government-issued money that holds value based on trust and legal backing rather than a physical commodity like gold or silver, with examples including the US Dollar, Euro, and Japanese Yen.

Fiat Money - Corporate Finance Institute - Fiat currency is intrinsically valueless and made legal tender by government decree, originating historically in China around 1000 AD, and widely adopted after commodity-backed systems were abandoned in the 20th century.

Fiat Money - Modern Treasury - Fiat money is backed by the issuing government rather than a commodity and is controlled by central banks to maintain economic stability, with the US dollar officially becoming fiat currency after ending the gold standard in 1971.

dowidth.com

dowidth.com