Instant payments provide real-time fund transfers, enabling transactions to be completed within seconds, significantly enhancing liquidity and cash flow management for businesses and consumers. ACH transfers typically take one to three business days to process, offering a cost-effective solution for bulk payments and recurring transactions but lacking immediacy. Explore more about how these payment methods can optimize your financial operations and transaction strategies.

Why it is important

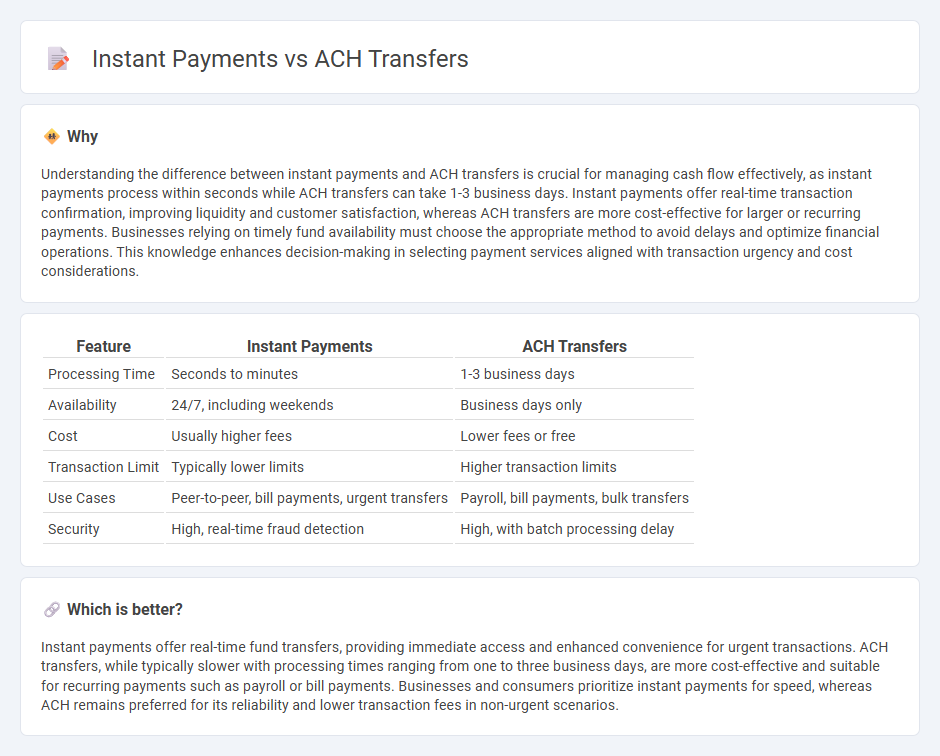

Understanding the difference between instant payments and ACH transfers is crucial for managing cash flow effectively, as instant payments process within seconds while ACH transfers can take 1-3 business days. Instant payments offer real-time transaction confirmation, improving liquidity and customer satisfaction, whereas ACH transfers are more cost-effective for larger or recurring payments. Businesses relying on timely fund availability must choose the appropriate method to avoid delays and optimize financial operations. This knowledge enhances decision-making in selecting payment services aligned with transaction urgency and cost considerations.

Comparison Table

| Feature | Instant Payments | ACH Transfers |

|---|---|---|

| Processing Time | Seconds to minutes | 1-3 business days |

| Availability | 24/7, including weekends | Business days only |

| Cost | Usually higher fees | Lower fees or free |

| Transaction Limit | Typically lower limits | Higher transaction limits |

| Use Cases | Peer-to-peer, bill payments, urgent transfers | Payroll, bill payments, bulk transfers |

| Security | High, real-time fraud detection | High, with batch processing delay |

Which is better?

Instant payments offer real-time fund transfers, providing immediate access and enhanced convenience for urgent transactions. ACH transfers, while typically slower with processing times ranging from one to three business days, are more cost-effective and suitable for recurring payments such as payroll or bill payments. Businesses and consumers prioritize instant payments for speed, whereas ACH remains preferred for its reliability and lower transaction fees in non-urgent scenarios.

Connection

Instant payments and ACH transfers are connected through their roles in electronic funds transfer systems, facilitating fast and secure movement of money between bank accounts. While ACH transfers typically process batches of transactions with settlement times ranging from same-day to several days, instant payments enable real-time clearing and settlement, enhancing liquidity and cash flow management for businesses and individuals. Both methods utilize interoperable banking networks and adhere to regulatory standards, ensuring seamless integration within modern financial infrastructures.

Key Terms

Settlement Time

ACH transfers typically settle within 1-3 business days, making them suitable for non-urgent payments. Instant payments, leveraging real-time payment networks, settle within seconds, providing immediate fund availability. Explore detailed comparisons to understand which payment method best fits your needs.

Clearing Process

ACH transfers rely on batch processing through established clearinghouses, which typically take one to three business days to settle transactions. Instant payments utilize real-time settlement systems, allowing funds to be transferred and cleared within seconds, improving liquidity and reducing payment uncertainty. Explore the detailed mechanisms behind clearing processes to optimize your payment strategy.

Network Infrastructure

ACH transfers rely on batch processing through the Automated Clearing House network, resulting in settlements that typically take one to two business days. Instant payments operate on real-time payment rail infrastructures such as RTP or Faster Payments, enabling immediate fund availability and 24/7 processing. Explore the differences in network infrastructure to understand their impact on transaction speed and reliability.

Source and External Links

ACH Transfer: What Is It and How Long Does It Take? (2025) - Shopify - ACH transfers are electronic fund transfers between banks that generally take between one to three business days to process, involving initiation, batching, sending, receiving, processing, and depositing steps handled via the ACH network operated by institutions like the Federal Reserve and Electronic Payments Network.

What an ACH payment is and how an ACH transfer works - Stripe - ACH payments are bank-to-bank transfers orchestrated by the NACHA network, where the originating bank sends a batch of transfer requests to an ACH operator who forwards them to the receiving bank; funds are validated and settled multiple times a day during business hours.

What is an ACH transaction? - Consumer Financial Protection Bureau - An ACH transaction is an electronic transfer of money between financial institutions that can be used for direct deposits or bill payments, typically taking days but sometimes clearing the same day during business hours, with banks imposing specific limits and fraud protections.

dowidth.com

dowidth.com