Negative interest rates occur when banks charge depositors for holding funds, encouraging spending and lending, while the prime rate represents the baseline interest charged to the most creditworthy borrowers. These contrasting rates influence consumer behavior, loan accessibility, and overall economic growth differently. Explore more to understand their impact on banking strategies and financial markets.

Why it is important

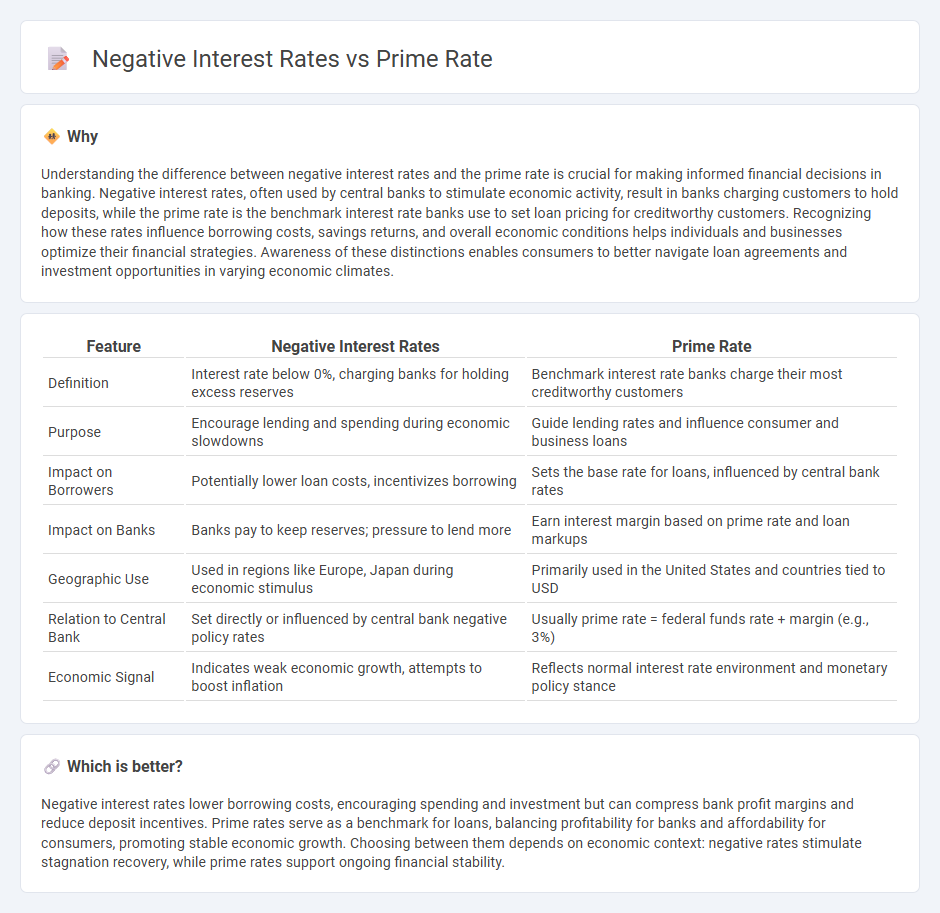

Understanding the difference between negative interest rates and the prime rate is crucial for making informed financial decisions in banking. Negative interest rates, often used by central banks to stimulate economic activity, result in banks charging customers to hold deposits, while the prime rate is the benchmark interest rate banks use to set loan pricing for creditworthy customers. Recognizing how these rates influence borrowing costs, savings returns, and overall economic conditions helps individuals and businesses optimize their financial strategies. Awareness of these distinctions enables consumers to better navigate loan agreements and investment opportunities in varying economic climates.

Comparison Table

| Feature | Negative Interest Rates | Prime Rate |

|---|---|---|

| Definition | Interest rate below 0%, charging banks for holding excess reserves | Benchmark interest rate banks charge their most creditworthy customers |

| Purpose | Encourage lending and spending during economic slowdowns | Guide lending rates and influence consumer and business loans |

| Impact on Borrowers | Potentially lower loan costs, incentivizes borrowing | Sets the base rate for loans, influenced by central bank rates |

| Impact on Banks | Banks pay to keep reserves; pressure to lend more | Earn interest margin based on prime rate and loan markups |

| Geographic Use | Used in regions like Europe, Japan during economic stimulus | Primarily used in the United States and countries tied to USD |

| Relation to Central Bank | Set directly or influenced by central bank negative policy rates | Usually prime rate = federal funds rate + margin (e.g., 3%) |

| Economic Signal | Indicates weak economic growth, attempts to boost inflation | Reflects normal interest rate environment and monetary policy stance |

Which is better?

Negative interest rates lower borrowing costs, encouraging spending and investment but can compress bank profit margins and reduce deposit incentives. Prime rates serve as a benchmark for loans, balancing profitability for banks and affordability for consumers, promoting stable economic growth. Choosing between them depends on economic context: negative rates stimulate stagnation recovery, while prime rates support ongoing financial stability.

Connection

Negative interest rates influence central banks' monetary policy by pushing borrowing costs below zero, encouraging lending and economic activity. The prime rate, typically set based on central bank policy rates, tends to decrease when negative interest rates are implemented to reflect cheaper borrowing costs for consumers and businesses. This connection drives changes in loan interest rates and impacts the overall banking sector profitability and credit availability.

Key Terms

Benchmark Interest Rate

The prime rate serves as a key benchmark interest rate that banks use to set lending rates for customers with strong credit profiles, typically reflecting the central bank's policy rate plus a markup. Negative interest rates, on the other hand, represent a rare monetary policy tool where central banks set nominal interest rates below zero to stimulate economic activity during deflationary periods. Explore the implications of these contrasting benchmark interest rate approaches and their impact on lending and economic growth.

Monetary Policy

The prime rate, typically set by banks as a benchmark for lending, reflects monetary policy aimed at controlling inflation and stimulating economic growth, while negative interest rates represent an unconventional policy tool used by central banks to encourage borrowing and spending during deflationary periods. Negative interest rates effectively charge banks for holding excess reserves, pushing them to increase lending, contrasting with the prime rate's role as a floor for loan pricing. Explore the dynamics of prime rate adjustments and negative interest rate policies to understand their impacts on financial markets and economic stability.

Lending Standards

Prime rate, typically set by banks as a benchmark for lending to prime customers, influences borrowing costs and credit availability, while negative interest rates, used by central banks to stimulate economic activity, encourage banks to lend more aggressively by penalizing excess reserves. Lending standards often tighten with higher prime rates to mitigate default risk, whereas negative interest rates can lead to looser standards as financial institutions seek to maintain profitability through increased loan volume. Explore how shifts in prime rates and negative interest rate policies impact lending behavior and credit markets in depth.

Source and External Links

What is the Prime Rate and How Does it Impact You - This page explains the concept of the prime rate, its impact on interest rates, and how it is influenced by the Federal Reserve.

Current Prime Rate - Provides the current prime rate and explains how it affects loans, credit cards, and lines of credit.

Prime rate - Offers a detailed overview of the prime rate, its uses in banking, and its role in variable interest rates.

dowidth.com

dowidth.com