Robo advisors utilize advanced algorithms and artificial intelligence to provide automated, low-cost investment management tailored to individual risk profiles and goals. Financial planners offer personalized, holistic financial advice encompassing retirement planning, tax strategies, and estate planning, often through face-to-face consultations. Explore the key differences and benefits of robo advisors versus financial planners to determine the best fit for your financial needs.

Why it is important

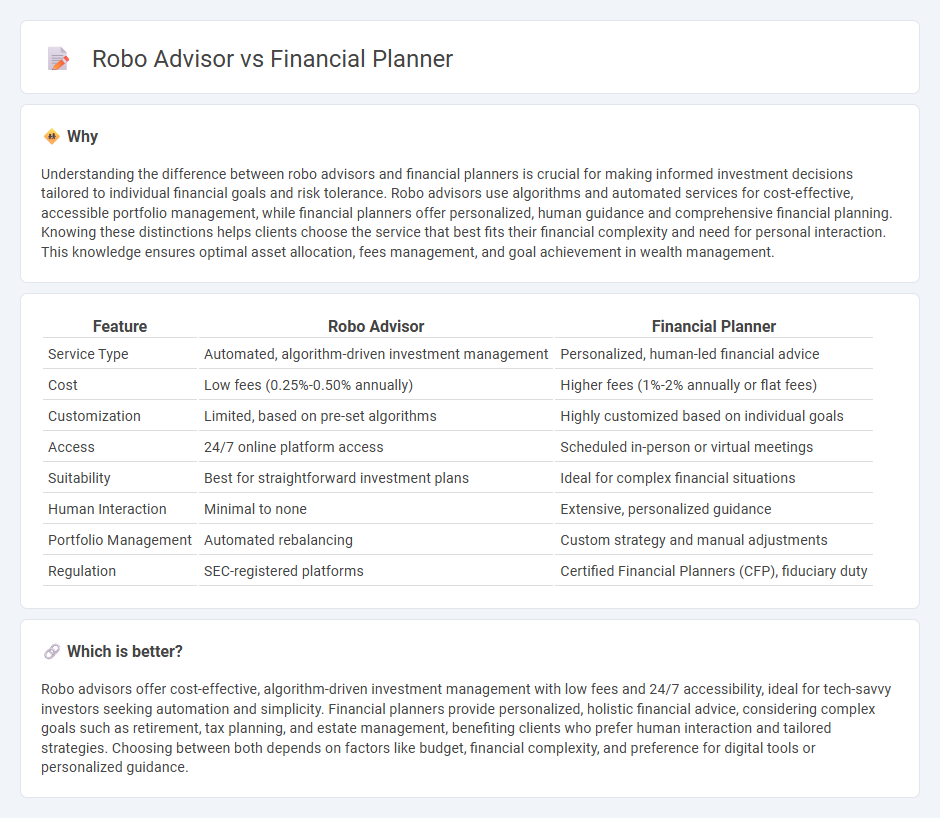

Understanding the difference between robo advisors and financial planners is crucial for making informed investment decisions tailored to individual financial goals and risk tolerance. Robo advisors use algorithms and automated services for cost-effective, accessible portfolio management, while financial planners offer personalized, human guidance and comprehensive financial planning. Knowing these distinctions helps clients choose the service that best fits their financial complexity and need for personal interaction. This knowledge ensures optimal asset allocation, fees management, and goal achievement in wealth management.

Comparison Table

| Feature | Robo Advisor | Financial Planner |

|---|---|---|

| Service Type | Automated, algorithm-driven investment management | Personalized, human-led financial advice |

| Cost | Low fees (0.25%-0.50% annually) | Higher fees (1%-2% annually or flat fees) |

| Customization | Limited, based on pre-set algorithms | Highly customized based on individual goals |

| Access | 24/7 online platform access | Scheduled in-person or virtual meetings |

| Suitability | Best for straightforward investment plans | Ideal for complex financial situations |

| Human Interaction | Minimal to none | Extensive, personalized guidance |

| Portfolio Management | Automated rebalancing | Custom strategy and manual adjustments |

| Regulation | SEC-registered platforms | Certified Financial Planners (CFP), fiduciary duty |

Which is better?

Robo advisors offer cost-effective, algorithm-driven investment management with low fees and 24/7 accessibility, ideal for tech-savvy investors seeking automation and simplicity. Financial planners provide personalized, holistic financial advice, considering complex goals such as retirement, tax planning, and estate management, benefiting clients who prefer human interaction and tailored strategies. Choosing between both depends on factors like budget, financial complexity, and preference for digital tools or personalized guidance.

Connection

Robo advisors and financial planners are connected through their shared goal of providing personalized investment strategies and financial advice, leveraging technology and data analysis. Robo advisors use algorithms to automate portfolio management, offering cost-efficient and accessible solutions aligned with clients' financial goals. Financial planners integrate these digital tools with human expertise to create comprehensive plans addressing complex financial situations and long-term objectives.

Key Terms

Human Advice vs. Automated Algorithms

Financial planners offer personalized human advice tailored to individual financial goals, emotions, and complex situations, providing nuanced strategies and real-time adjustments. Robo advisors utilize automated algorithms and artificial intelligence to deliver low-cost, efficient portfolio management based on risk tolerance and target asset allocation. Discover more about choosing between human expertise and automated investment technology.

Personalized Planning vs. Standardized Portfolios

Financial planners offer personalized financial strategies tailored to individual goals, risk tolerance, and life circumstances, providing in-depth advice and ongoing adjustments. Robo advisors use algorithms and standardized portfolios to automate investment management, typically offering lower fees but less customization. Explore how each option aligns with your financial needs to make an informed choice.

Fee Structure (Commission/Hourly vs. Low Flat/Fee-Based)

Financial planners typically charge commissions or hourly fees based on personalized services, resulting in variable costs tied to the complexity of financial advice. Robo advisors offer a low flat fee or fee-based pricing model, providing automated portfolio management with reduced expenses and predictable charges. Explore the detailed fee structures to determine which option aligns best with your financial goals.

Source and External Links

Choosing a Financial Planner - A financial planner helps develop a personalized financial plan including goals, net worth, budget, risk assessment, and action steps, with key selection criteria being credentials and trustworthiness.

Financial Planner: Definition, How to Find One - Financial planners analyze your finances and create plans to help achieve long-term goals, and while anyone can call themselves a planner, certified financial planners (CFPs) have a fiduciary duty to act in clients' best interest.

Let's Make a Plan: Financial Advisors & Planning - CFP(r) professionals are the gold standard in financial planning, committed to ethics and competency, serving clients' best interests, and offering guidance and accountability like personal trainers for your finances.

dowidth.com

dowidth.com