Finfluencers leverage social media platforms to provide accessible financial advice, focusing on trends, personal finance tips, and investment strategies tailored for a broad audience. Banking consultants offer personalized, in-depth expertise to optimize banking solutions, regulatory compliance, and corporate financial management for individual clients and businesses. Explore more about how these two financial advisors shape your banking decisions and financial growth.

Why it is important

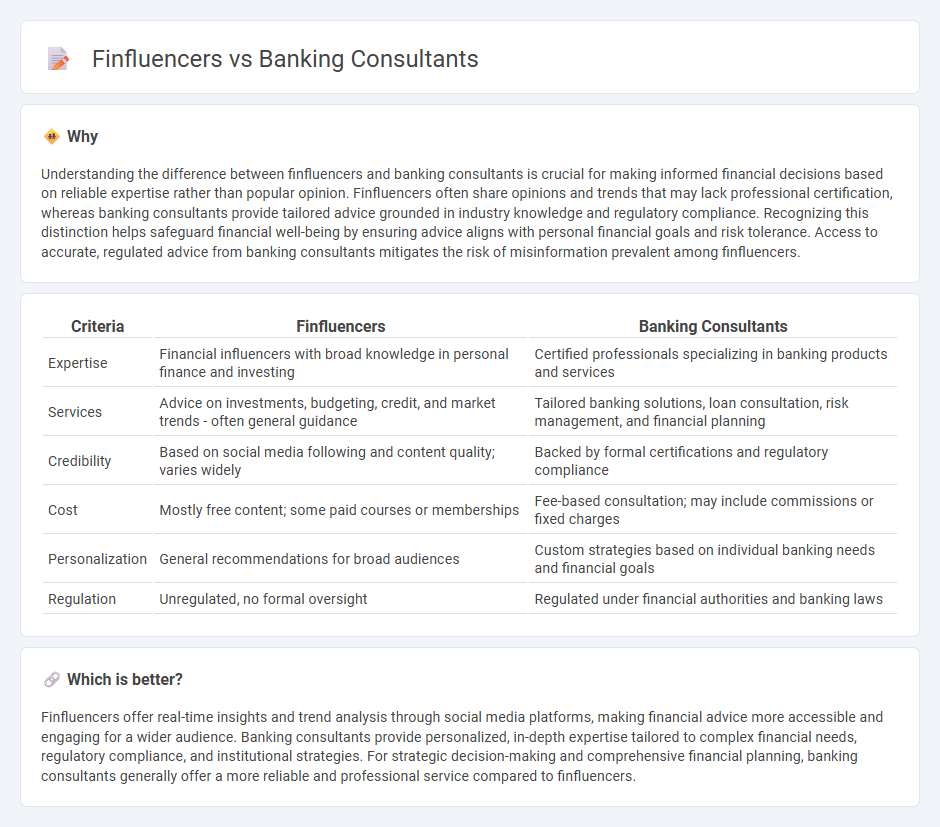

Understanding the difference between finfluencers and banking consultants is crucial for making informed financial decisions based on reliable expertise rather than popular opinion. Finfluencers often share opinions and trends that may lack professional certification, whereas banking consultants provide tailored advice grounded in industry knowledge and regulatory compliance. Recognizing this distinction helps safeguard financial well-being by ensuring advice aligns with personal financial goals and risk tolerance. Access to accurate, regulated advice from banking consultants mitigates the risk of misinformation prevalent among finfluencers.

Comparison Table

| Criteria | Finfluencers | Banking Consultants |

|---|---|---|

| Expertise | Financial influencers with broad knowledge in personal finance and investing | Certified professionals specializing in banking products and services |

| Services | Advice on investments, budgeting, credit, and market trends - often general guidance | Tailored banking solutions, loan consultation, risk management, and financial planning |

| Credibility | Based on social media following and content quality; varies widely | Backed by formal certifications and regulatory compliance |

| Cost | Mostly free content; some paid courses or memberships | Fee-based consultation; may include commissions or fixed charges |

| Personalization | General recommendations for broad audiences | Custom strategies based on individual banking needs and financial goals |

| Regulation | Unregulated, no formal oversight | Regulated under financial authorities and banking laws |

Which is better?

Finfluencers offer real-time insights and trend analysis through social media platforms, making financial advice more accessible and engaging for a wider audience. Banking consultants provide personalized, in-depth expertise tailored to complex financial needs, regulatory compliance, and institutional strategies. For strategic decision-making and comprehensive financial planning, banking consultants generally offer a more reliable and professional service compared to finfluencers.

Connection

Finfluencers and banking consultants both provide expert financial advice, with finfluencers leveraging social media platforms to educate audiences on banking products, investment strategies, and personal finance management. Banking consultants use their industry expertise to offer personalized guidance on banking solutions, often collaborating with finfluencers to reach wider demographics and build trust in financial services. This synergy enhances consumer knowledge and drives more informed decisions in the banking sector.

Key Terms

Banking Consultants:

Banking consultants offer specialized expertise in financial regulations, risk management, and strategic planning tailored to banking institutions, ensuring compliance and operational efficiency. Unlike finfluencers, who primarily provide general financial advice and market trends on social media, banking consultants deliver in-depth, analytical solutions backed by industry experience and data-driven insights. Explore how banking consultants can transform your institution's financial strategy and risk management practices.

Risk Assessment

Banking consultants specialize in comprehensive risk assessment by analyzing credit, market, operational, and compliance risks for financial institutions, ensuring regulatory adherence and mitigating potential losses. Finfluencers provide accessible risk-related insights tailored for retail investors and the general public, focusing on market trends and investment risks but often lack the depth of institutional analysis. Explore how each approach uniquely shapes risk understanding in the financial ecosystem.

Regulatory Compliance

Banking consultants specialize in navigating complex regulatory frameworks such as Basel III, Dodd-Frank, and GDPR to ensure financial institutions maintain compliance and mitigate legal risks. Finfluencers, while influential in financial education and market trends, often lack the formal expertise and certifications required for detailed regulatory interpretation and implementation. Explore how leveraging professional banking consultants can safeguard compliance in an evolving regulatory environment.

Source and External Links

Banking & Financial Services Consulting | FTI Consulting - FTI Consulting provides banking consulting by helping clients manage risk, enhance financial performance, ensure regulatory compliance, and execute business transformation with a team of industry specialists.

Banking consulting services | Crowe - Crowe offers banking consulting with expertise in regulatory actions, business growth, operations, risk, technology, and compliance, serving banks of all sizes with tailored solutions.

Top Banking consulting firms in the USA | Consulting.us - Lists the leading banking consulting firms in the US such as Accenture, Capco, McKinsey & Company, Bain & Company, and Boston Consulting Group, recognized for deep industry expertise and advisory capabilities.

dowidth.com

dowidth.com