Real-time payments enable instant fund transfers, offering immediate settlement and 24/7 availability, contrasting with wire transfers that typically process within hours to days and operate on business hours. Real-time payment networks enhance liquidity management and improve transaction transparency, benefiting both consumers and businesses. Discover how these payment methods impact efficiency and security in modern banking systems.

Why it is important

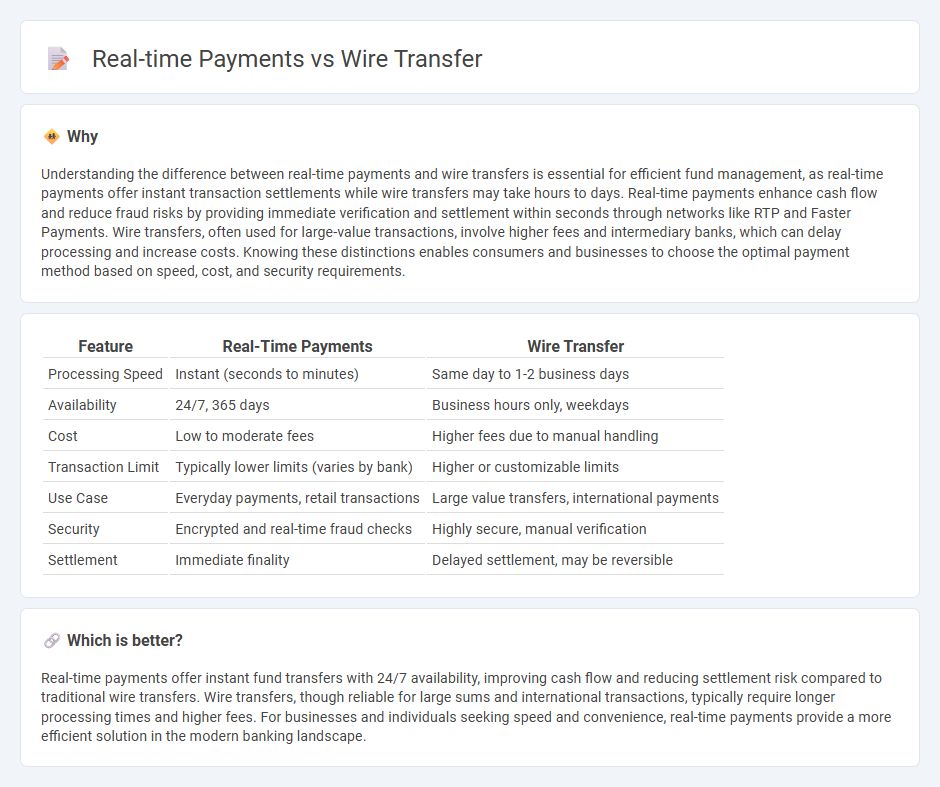

Understanding the difference between real-time payments and wire transfers is essential for efficient fund management, as real-time payments offer instant transaction settlements while wire transfers may take hours to days. Real-time payments enhance cash flow and reduce fraud risks by providing immediate verification and settlement within seconds through networks like RTP and Faster Payments. Wire transfers, often used for large-value transactions, involve higher fees and intermediary banks, which can delay processing and increase costs. Knowing these distinctions enables consumers and businesses to choose the optimal payment method based on speed, cost, and security requirements.

Comparison Table

| Feature | Real-Time Payments | Wire Transfer |

|---|---|---|

| Processing Speed | Instant (seconds to minutes) | Same day to 1-2 business days |

| Availability | 24/7, 365 days | Business hours only, weekdays |

| Cost | Low to moderate fees | Higher fees due to manual handling |

| Transaction Limit | Typically lower limits (varies by bank) | Higher or customizable limits |

| Use Case | Everyday payments, retail transactions | Large value transfers, international payments |

| Security | Encrypted and real-time fraud checks | Highly secure, manual verification |

| Settlement | Immediate finality | Delayed settlement, may be reversible |

Which is better?

Real-time payments offer instant fund transfers with 24/7 availability, improving cash flow and reducing settlement risk compared to traditional wire transfers. Wire transfers, though reliable for large sums and international transactions, typically require longer processing times and higher fees. For businesses and individuals seeking speed and convenience, real-time payments provide a more efficient solution in the modern banking landscape.

Connection

Real-time payments and wire transfers both facilitate the instant or near-instantaneous transfer of funds between banks, enhancing liquidity and cash flow management. Real-time payments use advanced payment rails such as RTP network or Faster Payments, allowing transactions to clear and settle within seconds. Wire transfers, traditionally slower and often reliant on systems like SWIFT, are increasingly adopting real-time capabilities to improve transaction speed and efficiency.

Key Terms

Settlement Speed

Wire transfers typically settle within a few hours to the same business day, depending on the banks involved and geographic locations. Real-time payments process and settle transactions instantly, often within seconds, facilitating faster access to funds and improving cash flow management. Explore the advantages of each payment method to determine which best suits your business needs.

Intermediary Banks

Wire transfers often involve intermediary banks that facilitate international transactions, adding processing time and fees. In contrast, real-time payments typically bypass intermediaries, enabling faster, more cost-effective domestic transfers with immediate fund availability. Explore the evolving role of intermediary banks in cross-border payments for deeper insights.

Irrevocability

Wire transfers offer irrevocable payment confirmation once processed, ensuring the funds cannot be reversed or canceled, which provides a high level of security for large transactions. Real-time payments are typically irrevocable as well, but some systems may allow for recall in exceptional cases, depending on the network's rules and jurisdiction. Explore further to understand the nuances of irrevocability in different payment methods.

Source and External Links

The ins and outs of wire transfers - Discusses the basics of wire transfers, including their use for domestic and international money transfers, particularly for urgent and large transactions.

Wire transfer - Explains wire transfers as a method of electronic funds transfer between bank accounts, detailing different systems like Fedwire and CHIPS.

What is a wire transfer - Provides an overview of wire transfers, including how they work, the fees involved, and the differences between domestic and international transfers.

dowidth.com

dowidth.com