Neobanks operate exclusively online without physical branches, offering seamless digital banking experiences with lower fees and faster onboarding processes compared to traditional mobile banks, which are digital extensions of established brick-and-mortar institutions. These fully digital banks leverage cloud-based infrastructure and advanced fintech integration to provide innovative services such as instant account setup, real-time transaction tracking, and personalized financial management tools. Discover how neobanks transform the future of banking by exploring their unique features and benefits.

Why it is important

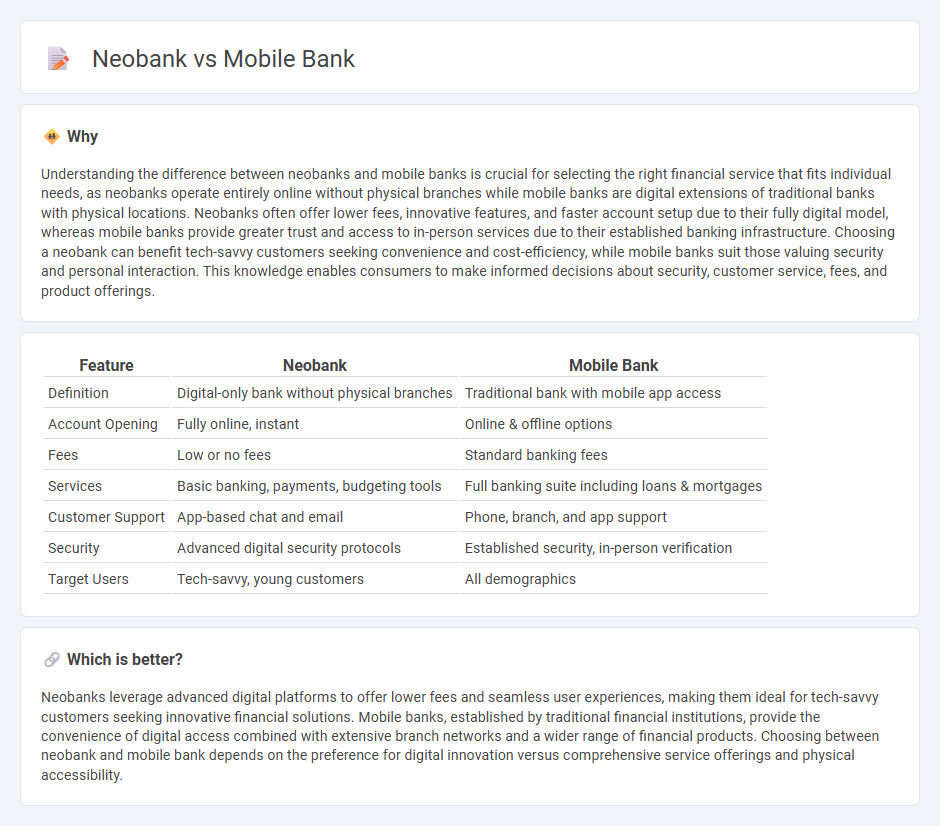

Understanding the difference between neobanks and mobile banks is crucial for selecting the right financial service that fits individual needs, as neobanks operate entirely online without physical branches while mobile banks are digital extensions of traditional banks with physical locations. Neobanks often offer lower fees, innovative features, and faster account setup due to their fully digital model, whereas mobile banks provide greater trust and access to in-person services due to their established banking infrastructure. Choosing a neobank can benefit tech-savvy customers seeking convenience and cost-efficiency, while mobile banks suit those valuing security and personal interaction. This knowledge enables consumers to make informed decisions about security, customer service, fees, and product offerings.

Comparison Table

| Feature | Neobank | Mobile Bank |

|---|---|---|

| Definition | Digital-only bank without physical branches | Traditional bank with mobile app access |

| Account Opening | Fully online, instant | Online & offline options |

| Fees | Low or no fees | Standard banking fees |

| Services | Basic banking, payments, budgeting tools | Full banking suite including loans & mortgages |

| Customer Support | App-based chat and email | Phone, branch, and app support |

| Security | Advanced digital security protocols | Established security, in-person verification |

| Target Users | Tech-savvy, young customers | All demographics |

Which is better?

Neobanks leverage advanced digital platforms to offer lower fees and seamless user experiences, making them ideal for tech-savvy customers seeking innovative financial solutions. Mobile banks, established by traditional financial institutions, provide the convenience of digital access combined with extensive branch networks and a wider range of financial products. Choosing between neobank and mobile bank depends on the preference for digital innovation versus comprehensive service offerings and physical accessibility.

Connection

Neobanks operate exclusively through digital platforms without physical branches, leveraging mobile banking technology to provide seamless financial services. Mobile banking apps developed by neobanks enable real-time transactions, account management, and personalized financial insights. This integration transforms traditional banking by offering enhanced accessibility, lower fees, and user-friendly interfaces tailored for smartphone users.

Key Terms

Digital-Only

Mobile banks operate as digital extensions of traditional financial institutions, providing online access to account management and customer services through mobile apps. Neobanks function exclusively online without physical branches, often offering innovative features, lower fees, and seamless digital experiences tailored for tech-savvy users. Explore the key differences and benefits of digital-only banking solutions to find the best fit for your financial needs.

Regulatory License

Mobile banks operate under traditional banking licenses granted by regulatory authorities, ensuring full compliance with financial regulations and consumer protection laws. Neobanks, often functioning as fintech companies, may partner with licensed banks or obtain specialized e-money licenses to offer streamlined digital services but typically face different regulatory requirements compared to full-fledged banks. Explore the distinctions between mobile banks and neobanks to understand their regulatory frameworks and service offerings better.

Customer Experience

Mobile banks leverage established financial infrastructure to offer seamless integration with existing accounts, providing users with reliable access to traditional banking services via mobile apps. Neobanks operate entirely online with intuitive interfaces and personalized features, emphasizing faster onboarding and tailored financial tools that enhance customer engagement. Discover how these innovative banking models redefine customer experience by exploring their unique advantages and service offerings.

Source and External Links

Mobile Banking | M&T Bank - Offers a comprehensive mobile banking app including features like Zelle payments, mobile check deposit, digital wallet, bill pay, and account management with accessibility focus.

Mobile Banking App Features and Tools from Bank of America - Provides a secure and convenient mobile banking app with tools such as Zelle for quick money transfers, virtual assistant Erica, bill pay, wire transfers, and FICO(r) score monitoring.

Online and Mobile Banking Features and Digital Services - Enables account access 24/7 with mobile deposit, Zelle transfers, bill pay, wire transfers, and a virtual assistant for financial guidance within Bank of America's digital banking ecosystem.

dowidth.com

dowidth.com