Wealthtech leverages advanced algorithms and AI to personalize investment strategies, enhancing portfolio management and client engagement in banking sectors. Digital identity solutions focus on secure, real-time authentication processes to streamline customer onboarding and prevent fraud. Discover more about how these technologies revolutionize financial services.

Why it is important

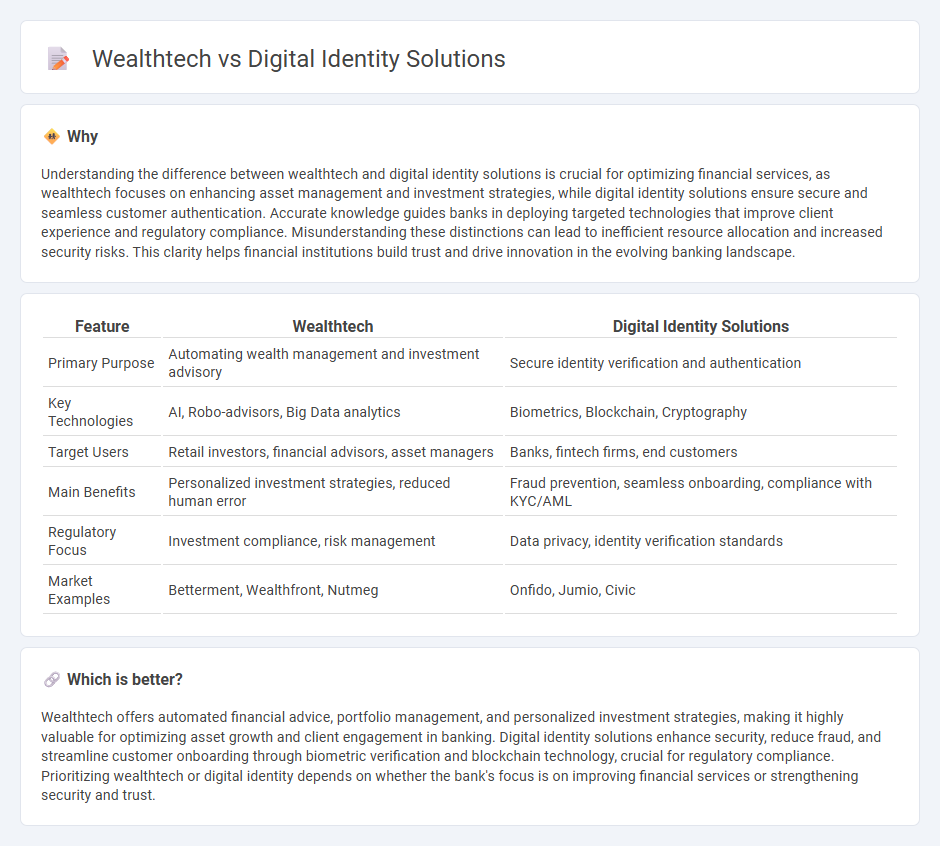

Understanding the difference between wealthtech and digital identity solutions is crucial for optimizing financial services, as wealthtech focuses on enhancing asset management and investment strategies, while digital identity solutions ensure secure and seamless customer authentication. Accurate knowledge guides banks in deploying targeted technologies that improve client experience and regulatory compliance. Misunderstanding these distinctions can lead to inefficient resource allocation and increased security risks. This clarity helps financial institutions build trust and drive innovation in the evolving banking landscape.

Comparison Table

| Feature | Wealthtech | Digital Identity Solutions |

|---|---|---|

| Primary Purpose | Automating wealth management and investment advisory | Secure identity verification and authentication |

| Key Technologies | AI, Robo-advisors, Big Data analytics | Biometrics, Blockchain, Cryptography |

| Target Users | Retail investors, financial advisors, asset managers | Banks, fintech firms, end customers |

| Main Benefits | Personalized investment strategies, reduced human error | Fraud prevention, seamless onboarding, compliance with KYC/AML |

| Regulatory Focus | Investment compliance, risk management | Data privacy, identity verification standards |

| Market Examples | Betterment, Wealthfront, Nutmeg | Onfido, Jumio, Civic |

Which is better?

Wealthtech offers automated financial advice, portfolio management, and personalized investment strategies, making it highly valuable for optimizing asset growth and client engagement in banking. Digital identity solutions enhance security, reduce fraud, and streamline customer onboarding through biometric verification and blockchain technology, crucial for regulatory compliance. Prioritizing wealthtech or digital identity depends on whether the bank's focus is on improving financial services or strengthening security and trust.

Connection

Wealthtech leverages digital identity solutions to enhance secure client onboarding and streamline compliance with Know Your Customer (KYC) regulations. Digital identity technologies enable real-time verification and fraud prevention, improving trust and efficiency in wealth management platforms. Integration of these innovations drives personalized financial advising and seamless digital asset transactions for clients.

Key Terms

Digital Identity Solutions:

Digital identity solutions provide secure authentication, fraud prevention, and streamlined access management for online services, enhancing user trust and regulatory compliance. These systems leverage biometrics, blockchain, and AI-driven verification to protect personal data and ensure seamless digital interactions. Explore how digital identity technologies revolutionize security and user experience in various industries.

Biometric Authentication

Biometric authentication plays a pivotal role in digital identity solutions, enabling secure and seamless user verification through unique biological traits like fingerprints, facial recognition, and iris scans. In wealthtech, biometric authentication enhances client onboarding processes, fraud prevention, and transaction security by integrating these advanced identification methods. Discover how biometric technology transforms security standards across digital identity and wealthtech platforms.

KYC (Know Your Customer)

Digital identity solutions streamline KYC processes by leveraging biometric verification, blockchain, and AI-driven data analytics to enhance customer authentication accuracy and reduce fraud risks. Wealthtech platforms integrate advanced KYC protocols to ensure regulatory compliance while providing seamless onboarding experiences for investors, utilizing automated document verification and risk assessment tools. Explore how cutting-edge digital identity innovations are transforming KYC in wealthtech to improve security and customer experience.

Source and External Links

Signicat: Identity solutions for a trusted digital world - Offers a comprehensive digital identity platform covering onboarding, secure logins, electronic signing, and identity verification with over 240 identity methods for compliant, automated identity and risk workflows trusted by 20,000+ companies worldwide.

Digital Identity | Telesign - Provides digital identity solutions focused on reducing fraud and improving efficiency using extensive global signals, real-time digital attributes, and machine learning-driven risk assessments for secure and frictionless user verification.

Digital Identity by Deloitte - A fully managed identity security solution that consolidates identity governance, access management, and privileged access management into one service to help organizations enhance authentication, reduce risks, and accelerate digital identity maturity.

dowidth.com

dowidth.com